(Source: Shutterstock)

Midcontinent oil and gas producer Mach Resources is planning to go public, regulatory filings show.

Oklahoma City-based Mach Natural Resources LP registered for an IPO with the U.S. Securities and Exchange Commission, according to a Sept. 22 filing.

The preliminary regulatory filing does not list a price per share nor indicate how many shares Mach Resources plans to sell. The company plans to use proceeds from the offering to repay debt from its credit facilities.

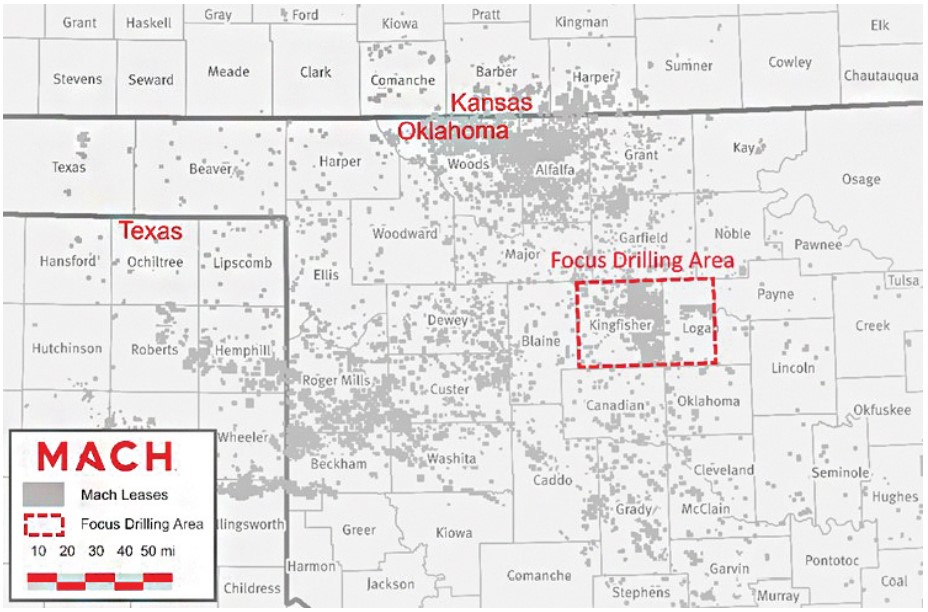

Mach is an upstream E&P acquiring oil, gas and NGL reserves in the Anadarko Basin. Through a series of acquisitions, Mach has grown its position to around 936,000 net acres and more than 2,000 undeveloped horizontal drilling locations since launching.

The company operates about 4,500 producing wells across its footprint in western Oklahoma, southern Kansas and the Texas Panhandle. Mach’s average net daily production for the year ended June 30 was approximately 65,000 boe/d.

Mach is currently focused on new drilling projects in Kingfisher and Logan counties, Oklahoma.

Through the first six months of 2023, Mach spent around $182 million to drill 50.4 net wells and on equipment, per the filing. The company deployed about $270 million to drill 87.9 net wells in 2022.

But around 57% of the company’s production comes from its low-decline legacy assets in the Anadarko Basin.

In addition to upstream assets, Mach also owns midstream assets, including gas gathering lines, gas processing facilities and saltwater disposal infrastructure.

RELATED

Mach Resources: Midcontinent Aggregator

Veteran leadership

Mach is led by oil and gas industry veteran Tom Ward as CEO; Ward previously co-founded Chesapeake Energy Corp., SandRidge Energy and Tapstone Energy.

Both Chesapeake and SandRidge are publicly traded E&Ps; Tapstone was acquired by Diversified Energy for $419 million in 2021.

The E&P is backed by Houston-based private equity firm Bayou City Energy as financial sponsor.

Mach and Bayou City Energy partnered together in the Anadarko with a shared business philosophy: Scoop up assets shunned by the sector, operate them through the downturn and wait for a recovery.

In April 2020, BCE-Mach—as they refer to their partnership—closed a $220 million acquisition of bankrupt Oklahoma shale company Alta Mesa Resources and its Kingfisher Midstream affiliate.

Mach has closed on around a dozen acquisitions of oil, gas and midstream assets; last summer, the company spent around $88 million bolting on properties in Oklahoma and Texas in deals with Camino Natural Resources and Scout Energy.

Mach spent nearly $143 million on acquisitions last year. The company said it intends to continue pursuing growth through Anadarko M&A after the IPO.

Mach did not respond to Hart Energy’s request for comment on its IPO process at the time of publication.

Several energy and services companies have launched IPOs this year: Permian Basin E&P startup Rise Oil & Gas; the Africa-focused Elephant Oil Corp.; TXO Energy Partners, led by Bob Simpson; Atlas Energy Solutions, formerly Atlas Sand of Austin, Texas; and Montgomery, Texas-based Kodiak Gas Services.

RELATED

Recommended Reading

Sunoco Completes $7.3B NuStar Energy Merger

2024-05-03 - The completion of its acquisition of NuStar Energy allows Sunoco to realize at least $150 million of expense and commercial synergies and at least $50 million per year of additional cash flow from refinancing activity.

Marketed: Delta Minerals Non-producing Sale in Colorado

2024-05-02 - Delta Minerals LLC has retained EnergyNet for the sale of non-producing minerals in Bent, Cheyenne and Kiowa counties, Colorado.

NuStar Energy Unitholders Approve Merger with Sunoco

2024-05-02 - The transaction is expected to close on or about May 3, in which NuStar Energy LP will merge with and into a merger subsidiary of Sunoco LP.

FTC OKs Exxon-Pioneer Merger, but Bars Sheffield from Exxon’s Board

2024-05-02 - A megamerger between Exxon Mobil and Pioneer Natural Resources can proceed, but Pioneer Chairman Scott Sheffield is out, the Federal Trade Commission says.

Ecopetrol, Occidental Permian JV Generating Positive Results

2024-03-07 - Ecopetrol SA's joint venture with Occidental Petroleum in the Permian continues to generate outstanding operational and financial results for the Colombian state-owned energy giant.