Formerly known as MorningStar Partners LP, TXO Energy is an MLP with operations and assets in the Permian Basin, New Mexico’s San Juan Basin and Colorado led by industry veteran Bob Simpson. (Source: VideoFlow/ Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

TXO Energy Partners LP’s IPO got off to a strong start Jan. 30, with early morning trading up 10% over its initial public pricing of $20 per common unit.

As of 11 a.m. CST, TXO was trading at roughly $22/ unit on the NYSE. The IPO could serve as a test case for other oil and gas companies that are contemplating or have already filed preliminary IPO intentions, such as the Barnett Shale’s BKV Corp.

Formerly known as MorningStar Partners LP, TXO Energy is an MLP based in Fort Worth, Texas. The E&P’s operations are in conventional-formation producing assets in the Permian and San Juan basins, plus CO2 property in Colorado, according to its S-1 filing. In unconventional, it has upside potential in the Mancos Shale in the San Juan.

If the name sounds similar to Exxon Mobil subsidiary XTO Energy, it’s not exactly a coincidence. The new MLP is led by CEO Bob Simpson, an industry veteran with more than 45 year leading companies. Previously, Simpson founded Cross Timbers Oil, later named XTO Energy Inc., which in 2010 sold to Exxon Mobil Corp. for $41 billion.

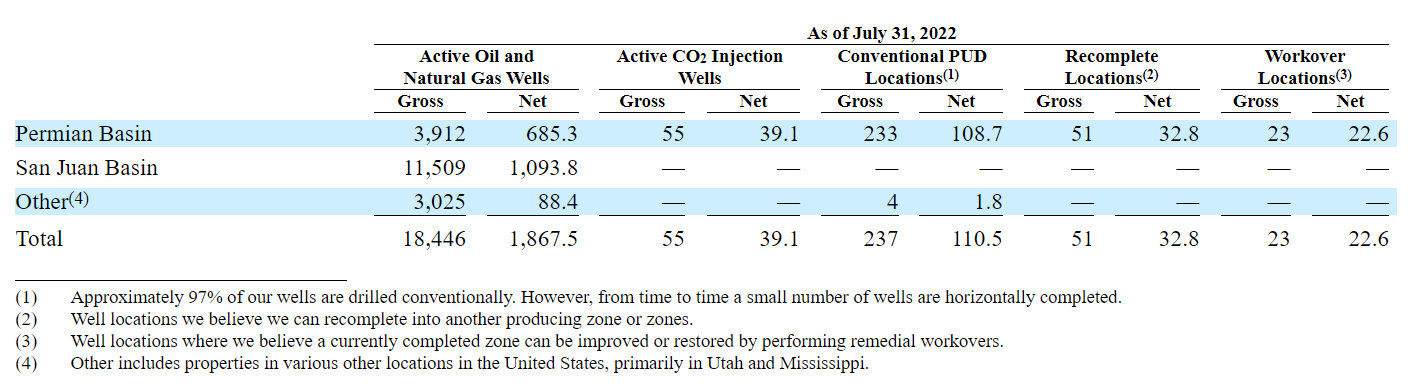

As of Dec. 31, 2021, TXO Energy Partners’ assets consisted of approximately 370,000 net leasehold and mineral acres, primarily in the Permian and San Juan basins, according to Jan. 26 regulatory filings. At the time, the company’s total estimated proved reserves were approximately 130 MMboe, of which approximately 37% were oil and approximately 82% were proved developed, both on a boe basis.

In the first nine months of 2022, XTO produced an average of approximately 23,265 boe/d, approximately 70% of which came from assets operated by the company.

XTO made its preliminary disclosure to file an offering in mid-January. On Jan. 26, TXO Energy said priced its IPO of 5 million common units to the public at $20 each.

TXO also granted its underwriters an option to purchase up to 750,000 additional common units at the same price, less underwriting discounts ad commission. The offering is expected to close on Jan. 31, subject to customary closing conditions.

In its prospectus, TXO plans to maintain a flat-to-low growth production profile. The company’s strategy includes replacing depleted reservoirs through acquisitions and drilling. The company’s funding sources for our acquisitions have included proceeds from bank borrowings, cash from partners and cash flow from operating activities. The company’s development budget in 2022 was $30 million. For 2023, XTO plans to spend $30.

TXO initially expected net proceeds of approximately $88 million from the IPO, after deducting underwriting discounts and commissions and excluding any exercise of the underwriters’ option to purchase additional common units.

TXO intends to use the net proceeds to repay a portion of the amounts outstanding under its revolving credit facility.

Upon the closing of the offering, the public will own an approximate 17% limited partner interest in TXO, or an approximate 83% limited partner interest if the underwriters exercise, in full, their option to purchase additional common units.

Raymond James, Stifel, Janney Montgomery Scott and Capital One Securities are acting as joint book-running managers for the offering.

Baker Botts LLP represented the underwriters in the offering.

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.