(Source: Alta Mesa Resources Inc.; Shutterstock.com)

The sale of bankrupt Oklahoma shale firm Alta Mesa Resources LLC closed despite a collapse in oil prices that nearly derailed the deal, buyers said in an April 16 release.

A U.S. bankruptcy court last week approved the sale of Alta Mesa and its midstream subsidiary to a partnership involving Tom L. Ward-led Mach Resources LLC for $220 million—a price nearly a third less than what creditors had negotiated earlier this year before the oil price crash.

In a statement on April 16, Ward said his goal has been to be a patient, buyer of choice for both undercapitalized, distressed sellers in the Midcontinent region.

“We believe this strategy will reap large rewards in the future as this market corrects itself through a lack of capital invested in future drilling,” he said.

An industry veteran, Ward has formed and led several oil and gas companies throughout his career including shale pioneer Chesapeake Energy Corp., which he co-founded in 1989 alongside Aubrey K. McClendon. He also went on to start SandRidge Energy Inc. in 2006 and Tapstone Energy LLC in 2013.

Through his latest venture, Ward has partnered with Bayou City Energy Management LLC, a Houston-based private-equity-firm founded by Will McMullen who said in a statement that he views the partnership with Mach Resources as being a consolidator in the Midcontinent.

Since forming the partnership in 2018, the pair have made seven acquisitions, which includes the purchases of Alta Mesa and its Kingfisher Midstream LLC affiliate.

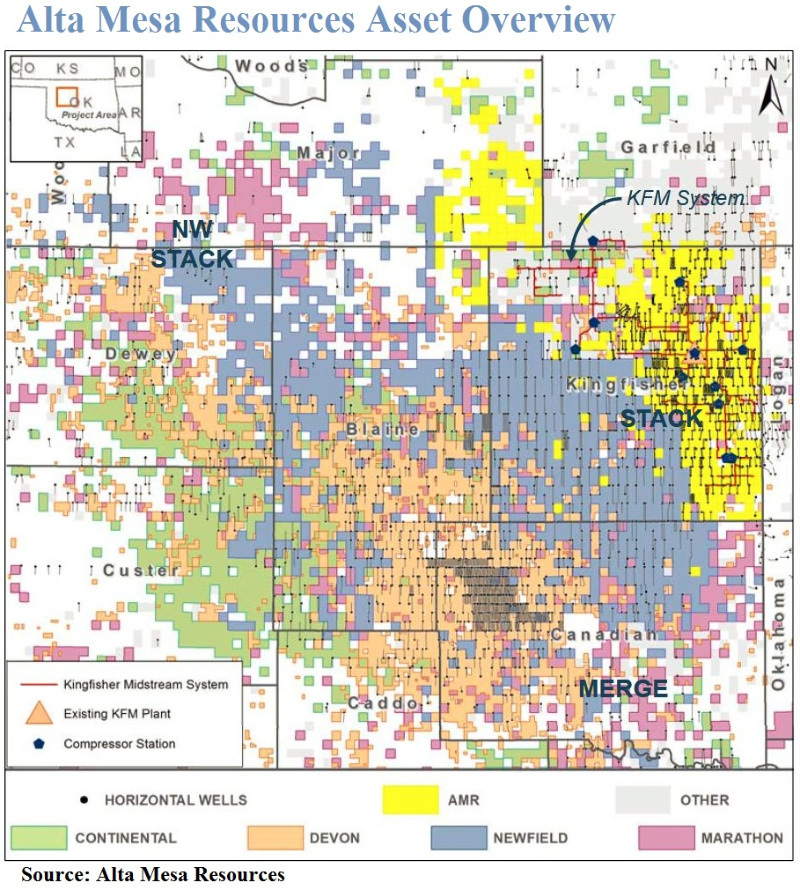

Alta Mesa Resources is a Houston-based independent that despite betting big on the Oklahoma’s STACK shale play through a three-way combination involving a special purpose acquisition company led by industry veteran Jim Hackett, succumbed to bankruptcy last year after struggling with debt.

In May 2019, Alta Mesa reported debt of about $1.1 billion and $144 million of total liquidity. Roughly $868 million of the reported debt was allocated toward Alta Mesa’s upstream operations.

Map of Alta Mesa assets from February 2018.

In his statement, Ward noted that he has seen the need for caution with regard to further investment in the upstream space for several years, adding that: “Stretched reserve valuations and cash being spent in excess were creating a situation that was untenable for the industry.”

“Although we did not know at the time we developed the thesis that a global pandemic would further exacerbate the already dire situation, we did understand that the situation was unsustainable,” he continued.

The renegotiated price for the Alta Mesa transaction adjusts by $1.75 million for every $1/bbl change from a $23/bbl baseline price. The reference price is set two days before closing, which occurred on April 9.

With the addition of the Alta Mesa assets, the Bayou City-Mach partnerships will now have net daily production of about 58,000 boe/d, interests in over 5,700 wells and roughly 500,000 net acres across the Midcontinent.

The strategy for the Alta Mesa position primarily located in Oklahoma’s Kingfisher County, according to McMullen, is to “conservatively develop the assets with an unwavering focus on maximizing free cash flow.”

“By applying to these assets, the same prudent operatorship that the BCE-Mach partnerships have employed with assets previously acquired in the Mississippi Lime and Western Anadarko Basin, we believe the additional scale of these assets will bolster strong returns for our investors,” he said.

Recommended Reading

Lake Charles LNG Selects Technip Energies, KBR for Export Terminal

2024-09-20 - Lake Charles LNG has selected KTJV, the joint venture between Technip Energies and KBR, for the engineering, procurement, fabrication and construction of an LNG export terminal project on the Gulf Coast.

Entergy Picks Cresent Midstream to Develop $1B CCS for Gas-fired Power Plant

2024-09-20 - Crescent will work with SAMSUNG E&A and Honeywell on the project.

FERC Chair: DC Court ‘Erred’ by Vacating LNG Permits

2024-09-20 - Throwing out the permit for Williams’ operational REA project in the mid-Atlantic region was a mistake that could cost people “desperately” reliant on it, Chairman Willie Phillips said.

Diamondback to Sell $2.2B in Shares Held by Endeavor Stockholders

2024-09-20 - Diamondback Energy, which closed its $26 billion merger with Endeavor Energy Resources on Sept. 13, said the gross proceeds from the share’s sale will be approximately $2.2 billion.

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.