APA Corp.’s confidence is growing offshore Suriname, where the company sees the potential to develop the South American country’s first offshore oil hub while it continues to run five rigs in the Permian Basin. (Source: Shutterstock)

APA Corp. is gaining confidence in technical results offshore Suriname’s Block 58 that could lead to development of the South American country’s first offshore oil hub.

“While there is more technical work to do, the results to date have provided more confidence,” APA CEO and president John J. Christmann IV said in the company’s second-quarter 2023 earnings report. APA also reported continued success in the Permian Basin, which made up about 65% of APA’s adjusted production in the quarter. However, APA’s income fell as the company weathered the same commodity price volatility that has roiled most public E&Ps’ earnings in the quarter.

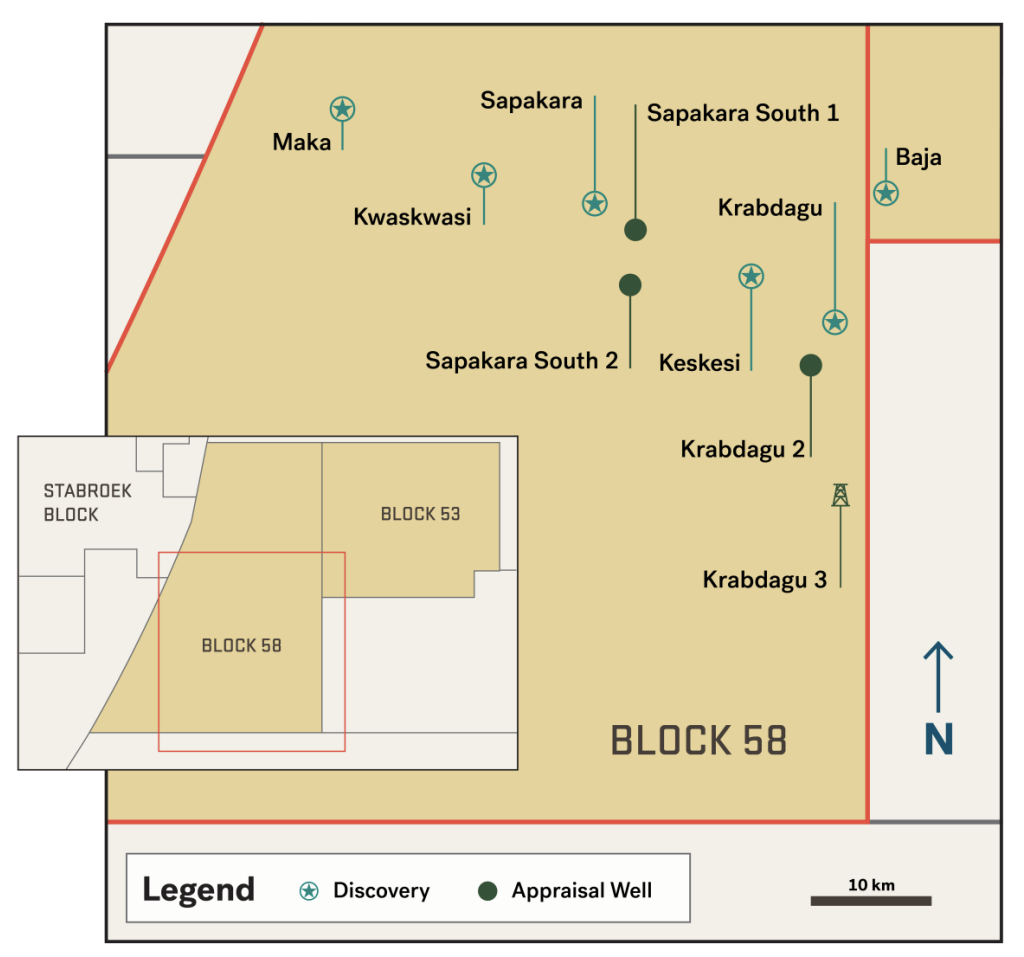

APA, with a 50% interest in Block 58, is working alongside partner and operator TotalEnergies to continue scoping a potential oil hub project that combines the Sapakara and Krabdagu discoveries, the executive said.

“Results have been promising in Suriname and we await further announcements as APA indicates appraisal success and scoping around a future hub project,” TD Cowen said in an Aug. 2 research report.

RELATED

TotalEnergies Eager to Dip into Suriname Oil Pool

Suriname’s Staatsolie Hopeful of APA, TotalEnergies Offshore 2024 FID

APA and TotalEnergies will continue with an oil resource assessment at Krabdagu having successfully tested three oil reservoirs on Block 58, confirming high quality and deliverability.

The Krabdagu-3 discovery confirmed and extended the oil resource 14 km (approximately nine miles) from the discovery well, APA said in its earnings presentation. Technical analysis is underway to quantify the resource in the Krabdagu fairway, which is greater than 25 km.

“We are currently focused on appraising last year's Krabdagu discovery. … We have completed testing at Krabdagu-2 and results were consistent with our pre-drill expectations. At Krabdagu-3, we are in the pressure buildup phase and data collected thus far is very encouraging,” Christmann said during APA’s earning call with analysts. “The semi-submersible rig is still on location and will be released upon completion of operations. We believe that no additional appraisal or exploratory drilling is necessary in the Sapakara and Krabdagu area at this time.”

In the adjacent Block 53 where APA has a 45% interest, the company is accessing next activities at its Baja discovery.

“I can't say a lot at this point other than … we've got a lot of work to do in terms of, ‘does Baja potentially flow into, you know, an oil hub and Block 58’, or ‘does it make up its own project in Block 53?’” Christmann said.

U.S. Permian anchors production growth

Houston-based APA also reported quarterly financial and operational results. Reported net income attributable to common stock was $381 million in second-quarter 2023 compared to $926 million in the second quarter 2022, down mainly on lower commodity price realizations, despite a rise in overall production.

APA’s reported production was 398,930 boe/d in the second quarter compared to 384,627 boe/d in second-quarter 2022. Adjusted production, excluding Egypt non-controlling interest and tax barrels, was 325,338 boe/d in second-quarter 2023 compared to 304,621 boe/d for the same period last year.

U.S. production led the way, rising 6% to an average 212,786 boe/d in the second quarter compared to the second quarter last year. The company averaged two rigs in the southern Midland Basin and three in the Delaware Basin.

APA connected 21 new wells in the second quarter with more than 67% coming online in June. In the southern Midland Basin, 10 wells were placed in production, and 11 in the Delaware Basin. APA said new drilling and completion activity in Alpine High has been deferred pending improved natural gas and NGL pricing.

In Egypt, production averaged 144,026 boe/d in the quarter, flat compared to the second quarter 2022. APA said that was due to the declining production from the mature Qasr gas field. APA had an average of 17 rigs running in Egypt during the second quarter 2023.

In the North Sea, production averaged 42,118 boe/d in the second quarter 2023, up 3% compared to the second quarter 2022. APA expects commencement of production from the Storr North to push production higher in the third quarter. APA released the Ocean Patriot semi-submersible rig and deferred 2023 platform drilling in June. The company said that while its portfolio had technically attractive drilling prospects, they weren’t “economically justified at this time.”

APA expects drilling activity in the U.S. and Egypt “to remain at current levels, as this activity pace optimizes operational efficiencies,” the company said in its release. APA also said it would reduce its upstream capital investment guidance to $1.9 billion and lowered its full-year LOE outlook by $100 million to $1.4 billion.

“We expect a positive equity response on lower capex and opex, as well as maintained fiscal year 2023 production guidance given concerns on the ability to deliver on the second half 2023 oil ramp coming into the print,” Piper Sandler Co. senior research analyst Mark A. Lear said in an Aug. 3 research report.

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.

Quantum Capital’s View on AI: Lots of Benefits, Pain Points

2024-05-16 - The energy industry is lagging in the race to implement AI, but Sebastian Gass, CTO of Quantum Capital Group, offered a few solutions during Hart Energy’s 2024 SUPER DUG Conference & Expo.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.