The presidential palace on Independence Square in Paramaribo, Suriname. (Source: Shutterstock)

MEXICO CITY—Suriname’s vertically integrated state-owned company Staatsolie Maatschappij Suriname N.V. expects a final investment decision (FID) regarding offshore Block 58 sometime in 2024, a company executive told Hart Energy during an event in Mexico City.

Block 58 partners Paris-based TotalEnergies (50% working interest, operator) and U.S.-based APA Corp. (50% working interest) have two key appraisal wells now drilling, Staatsolie’s exploration and non-operated ventures asset manager Patrick Brunings told Hart Energy during the AAPG-Energy Opportunities event in Mexico City in March.

“It's more a volumetric objective they're trying to achieve, getting the right volumes,” Brunings said. “So far everything is going accordingly, but in terms of the strategy, we know that they're very close to their objective [and] they want to start big… that’s the strategy of TotalEnergies together with APA.”

The companies look to replicate, to some degree, the development success an Exxon Mobil-led consortium in neighboring Guyana—which includes Hess Corp. and CNOOC—has had in the adjacent Stabroek Block. Currently, Stabroek has two developments online producing over 360,000 barrels per day (bbl/d) from two FPSO units, according to recent comments from Exxon and Hess on their year-end quarterly conference calls.

“So far they like where they are, and hopefully within two to three months we'll have all the data in and they will announce where we stand also in terms of declaring commerciality and then ultimately, of course, FID somewhere, I think next year if everything goes accordingly,” Bruning said. “We're happy with what we're seeing, so we're very enthusiastic.”

RELATED

Suriname to See $23 Billion Deepwater Boom While Venezuela Struggles

Staatsolie has an option to take a 20% interest in Block 58. The company continues to seek financing for its participation in the development. Beyond that, Staatsolie is concentrating on two important opportunities to attract international investors to its Demerara and shallow offshore bid rounds.

Demerara bid round: better basin understanding

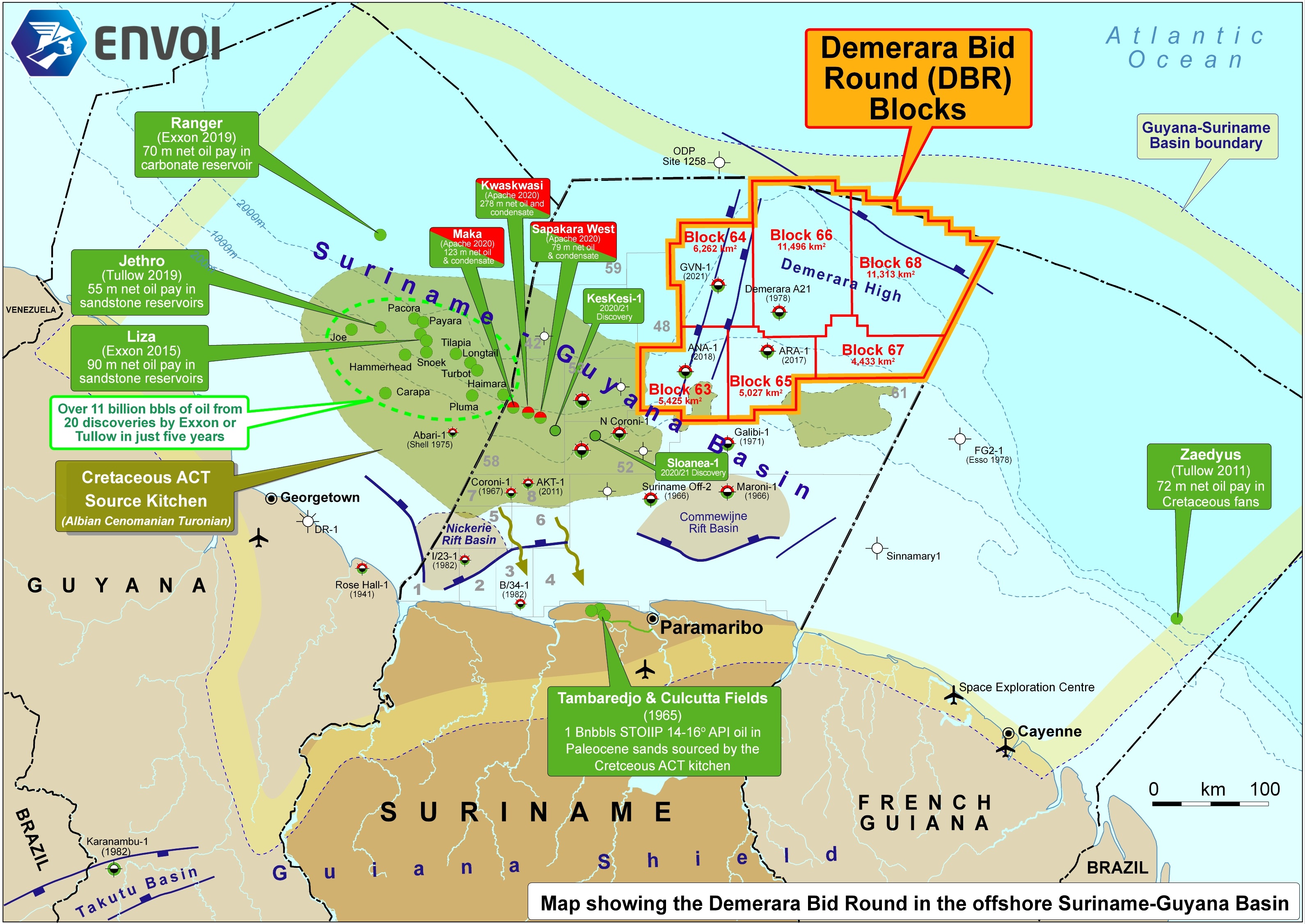

Staatsolie Hydrocarbon Institute (SHI), a wholly owned subsidiary of Staatsolie, launched a competitive bid round on Nov. 28 for six new blocks in the sparsely explored Demerara area offshore Suriname. The blocks offered are located east of current offshore discoveries and located in water depths ranging from 400 m to 3,500 m.

The Demerara round is based on an integrated study conducted by Staatsolie to better understand the basin. Brunings said the state entity used the analysis to set up the bid round.

“We were very confident there are new opportunities in the Demerara area, which is the deeper part of our basin, and it's a new province. So it's not the same province as we have in the West, but we see it has new insights and we're making use of those new insights. There's a lot of enthusiasm,” Brunings said.

The data room containing data and information on the open Demerara acreage will close to new bidders on April 28, 2023, with bids to be submitted by May 31, 2023, according to Staatsolie.

“All the major IOCs [international oil companies] are basically registering, so it's going the way we want,” Brunings said. “They’re visiting the data rooms and the only thing that we're now waiting for are the actual bids.”

Central shallow offshore and great new 3D seismic

Staatsolie is equally excited about Suriname’s shallow offshore, as was evidenced by a successful bidding round for blocks in this area, which generated strong interest from IOCs, including Chevron Corp.

The shallow offshore has seen discoveries in the west of the basin. Staatsolie currently gets all its oil production from onshore fields and says oil has migrated toward and through the shallow area, Brunings said.

In efforts to incentivize investors, Staatsolie generated its own new data, as well as enter into multi-client agreements.

“The first investors were in the west where four blocks were contracted, and now we're concentrating on more of the central part of the shallow offshore also with this great new 3D seismic coverage,” Brunings said.

Armed with better knowledge of the basin and new data, Staatsolie is now targeting its shallow offshore bid round by the end of the year, likely by November, according to Brunings.

Recommended Reading

CSW Increases Common Stock Offering to Repay Debt

2024-09-05 - CSW Industries increased its offering of common stock from 1 million shares to 1.1 million shares at $285 per share.

Five Point Closes Infrastructure Fund with $1.4B in Commitments

2024-09-09 - Five Point Energy, which created newly public Permian Basin company LandBridge, said its Five Point Energy Fund IV was oversubscribed from a target of $1.25 billion.

Dividends Declared in the Week of Sept. 2

2024-09-06 - Here is a compilation of dividends declared by select E&Ps for third-quarter 2024.

CrownRock Offloads Oxy Shares Two Weeks After Closing $12B Deal

2024-08-15 - Underwriters of the offering agreed to purchase CrownRock’s Occidental stock at $58.15 per share, which will result in approximately $1.719 billion in proceeds before expenses.

Viper Energy Offers 10MM Shares to Help Pay for Permian Basin Acquisition

2024-09-12 - Viper Energy Inc., a Diamondback Energy subsidiary, will use anticipated proceeds of up to $476 million to help fund a $1.1 billion Midland Basin deal.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.