Analysts anticipate the $26 billion merger between Diamondback Energy and Endeavor Energy will elevate it into a class of massive, public independent E&Ps in the Permian Basin.

The tie-up between Diamondback and Endeavor Energy Resources LP, two of the top oil producers in the prolific Permian Basin, is expected to create an oil and gas company with a market value of more than $50 billion. The deal also further reduces an already tight market for E&Ps scouring the Permian for inventory.

Diamondback’s cash-and-stock bid to acquire Endeavor Energy is also the largest buyout of a private upstream company ever tracked by Enverus Intelligence Research, Senior Vice President Andrew Dittmar said.

The merger, announced before markets opened Feb. 12, “creates an entity that will compete on day one for [Pioneer Natural Resources] market cap (~$54 billion),” analysts at Stifel reported.

The combination could place Diamondback into an elite group of super-independent E&Ps, a nebulously defined group that often includes the likes of EOG Resources ( with a market cap of about $65 billion), Pioneer Natural Resources ($54 billion) and Occidental Petroleum ($52 billion).

It’s already a small group, and it’s getting smaller: Texas-based supermajor Exxon Mobil Corp. inked an eye-popping $65 billion acquisition of Pioneer last fall.

“With Pioneer Natural Resources set to be folded into Exxon Mobil, Diamondback will be the standard bearer for Permian pure plays and will have an enviable combination of scale, remaining inventory quality and operational execution,” Dittmar said.

Once closed, the Endeavor acquisition would vault Diamondback’s market value ahead of the other large majors in its peer group, including Hess Corp. (with a market cap of $44 billion), Devon Energy ($30 billion), Coterra Energy ($20 billion) and Marathon Oil ($13.3 billion).

California-based major Chevron Corp. signed its own $60 billion deal to acquire Hess last year.

RELATED: Diamondback Energy to Acquire Permian’s Endeavor for $26B

Permian prowl

Travis Stice, Diamondback chairman and CEO, called Endeavor “the highest quality private oil company in the United States” during a Feb. 12 conference call with analysts.

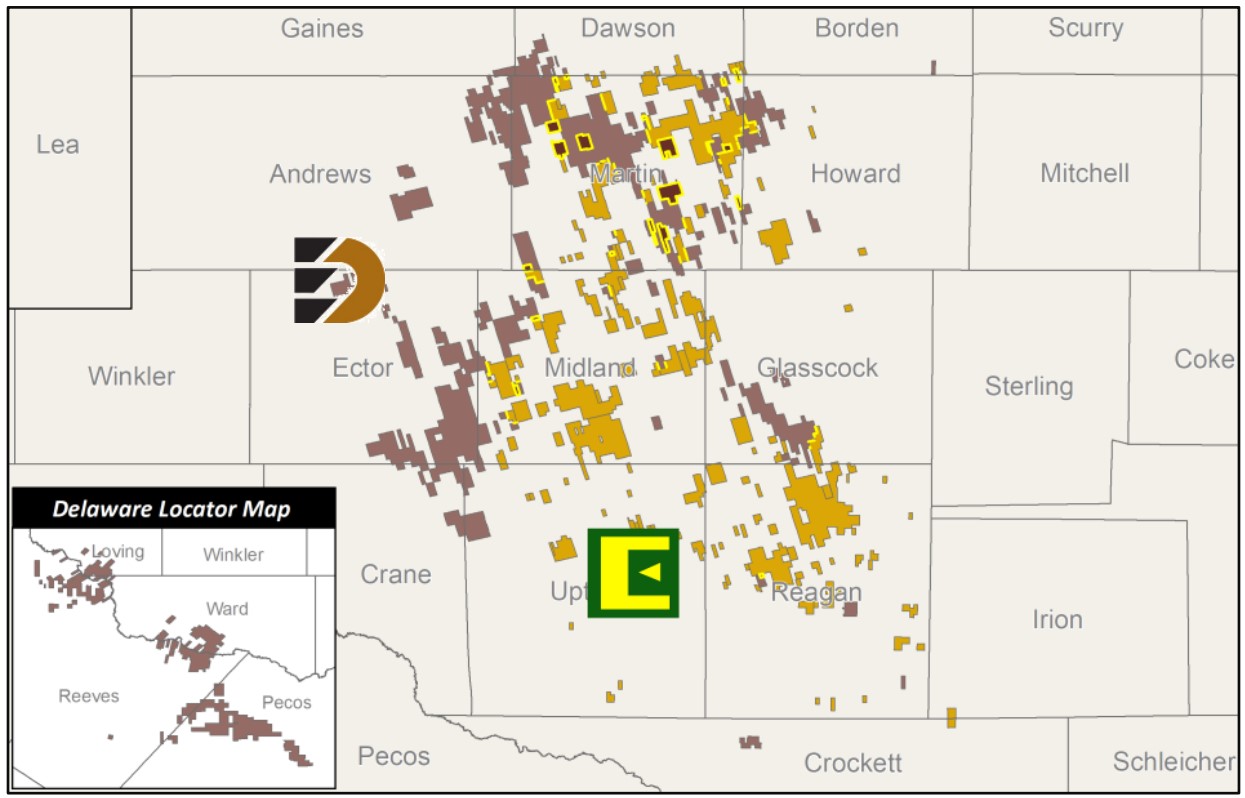

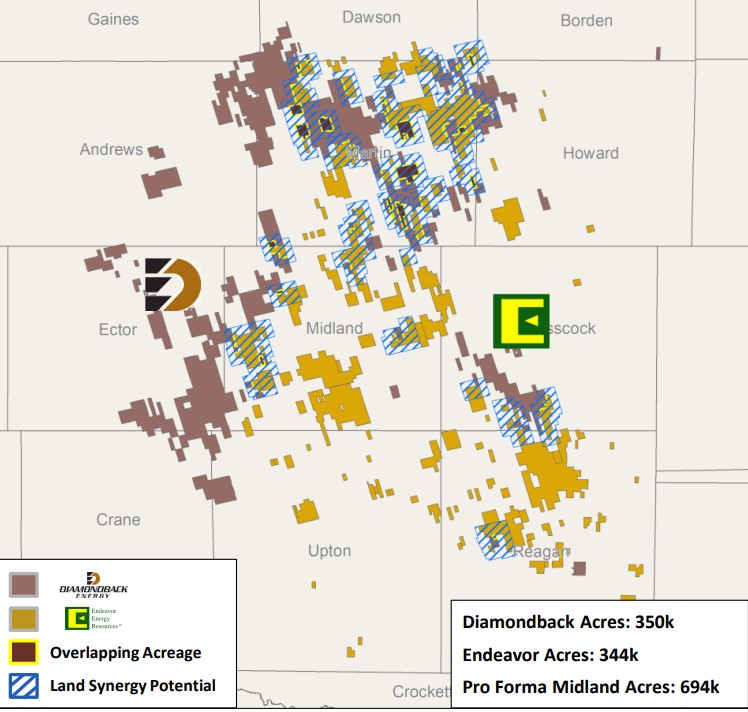

Diamondback portfolio includes about 494,000 acres spread across the Permian, the nation’s top oil-producing basin. Around 70% of the company’s acreage is held within the Permian’s Midland Basin.

Founded by wildcatter Autry Stephens in 1979, Endeavor developed one of the most coveted acreage positions in the core of the Midland.

Endeavor’s long history is part of what makes the private E&P such an attractive target for M&A, Dittmar said.

“Endeavor was able to secure what is now among the most valuable acreage in the Permian well before the shale boom came around and is one of the few acquisition targets that improves the quality of Diamondback’s portfolio,” he said.

After merging with Endeavor, Diamondback’s pro forma oil production will grow to 468,000 bbl/d (816,000 boe/d) from 273,000 bbl/d (463,000 boe/d).

The company’s total Permian acreage will grow to around 838,000 net acres.

Based on Endeavor’s 344,000 net Midland acres and roughly 2,300 core drilling locations, Diamondback’s purchase price shakes out to around $31,200 per acre and $4.7 million per location, TD Cowen managing director David Deckelbaum reported.

Diamondback’s Endeavor deal “screens attractive relative to implied valuations” of other recent deals inked in the Permian—including Exxon’s acquisition of Pioneer ($38,000/acre; $4.4 million/location) and Occidental’s $12 billion acquisition of CrownRock ($56,000/acre; $4.8 million/location), per TD Cowen analysis.

RELATED: After Record Year, Permian Basin Set for Even More M&A in 2024

Chopping block watch

The Permian Basin has seen a wave of consolidation as E&Ps big and small search for drilling inventory depth and high-quality rock.

A scarcity-fueled M&A deluge culminated in $192 billion of upstream transactions in 2023, according to Enverus analysis.

Because of the record amount of upstream consolidation, the list of potential M&A targets in the Permian is getting leaner.

“While there are a handful of potential public company tie-ups, the next wave of Permian dealmaking will likely need to be driven by non-core asset sales from the big buyers,” Dittmar said.

Speaking during the company’s call with analysts, Diamondback CFO Kaes Van’t Hof said the E&P doesn’t feel forced to sell off any of its portfolio. But Diamondback envisions eventually making some non-core asset sales to reduce debt more quickly.

“We still have some significant JV [joint venture] interests,” he said. “Clearly, the Delaware Basin is going to get less capital as a percentage of total than it did previously. But again, we’re not a forced seller.”

Diamondback’s Delaware Basin acreage is one part of its portfolio that could hit the chopping block for a sale, Dittmar said. Analysts had similar thoughts about the new Midland Basin acreage that Delaware-focused Permian Resources gained through the $4.5 billion acquisition of Earthstone Energy last year.

Recommended Reading

Verdagy Awarded $39.6MM DOE Grant for Electrolyzer Production

2024-03-14 - Verdagy will use the Department of Energy grant to accelerate the manufacture of e-dynamic electrolyzers for green hydrogen solutions.

Energy Transition in Motion (Week of March 1, 2024)

2024-03-01 - Here is a look at some of this week’s renewable energy news, including Chevron’s plans for a solar-to-hydrogen facility in California.

Shell Taps Bloom Energy’s SOEC Technology for Clean Hydrogen Projects

2024-03-07 - Shell and Bloom Energy’s partnership will investigate decarbonization solutions with the goal of developing large-scale, solid oxide electrolyzer systems for use at Shell’s assets.

No Silver Bullet: Chevron, Shell on Lower-carbon Risks, Collaboration

2024-04-26 - Helping to scale lower-carbon technologies, while meeting today’s energy needs and bringing profits, comes with risks. Policy and collaboration can help, Chevron and Shell executives say.

Energy Transition in Motion (Week of Feb. 9, 2024)

2024-02-09 - Here is a look at some of this week’s renewable energy news, including the latest on a direct lithium extraction technology test involving one of the world’s biggest lithium producers and the company behind the technology.