Inventory scarcity is fueling a historic wave of consolidation across the Permian Basin as U.S. shale enters a new phase of maturation.

Activity across the Permian Basin, America’s hottest oil play, took a major hit during the COVID-19 pandemic. Operators slashed rigs and frac crews, and shut in production; the industry worked through a wave of restructurings as oil prices collapsed.

But today, the Permian is back. E&Ps have ramped up their drilling cadence over the past three years—working hard to spend within their means and return as much cash to shareholders as possible.

The strategic importance of the Permian cannot be understated: The basin was expected to account for more than 5.98 MMbbl/d of crude oil production in December—or roughly 62% of total Lower 48 oil output, according to the Energy Information Administration.

The Permian’s prolific resource output continues to attract investment from among the world’s largest oil and gas companies, like supermajors Exxon Mobil and Chevron.

And with the Permian anticipated to drive U.S. oil production growth for the foreseeable future, E&Ps are spending big bucks to give themselves a bigger piece of the pie.

The problem is there isn’t that much more of the Permian pie to go around.

Hunting for inventory

The highest quality acreage inventory in the Permian with the lowest drilling costs—often referred to as core or Tier 1 inventory—is scarce.

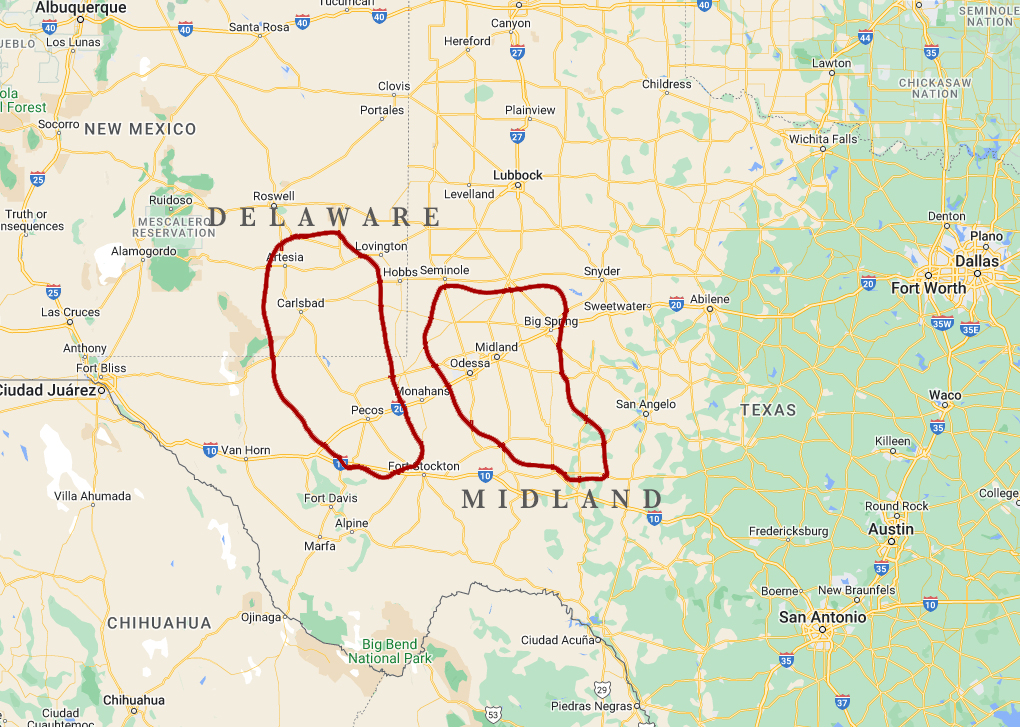

About 80% of the remaining Tier 1 drilling locations throughout the entire basin, including all benches of the Midland and Delaware basins, are held by a small number of companies with a market cap of over $30 billion, according to data from Wood Mackenzie.

That inventory scarcity is driving up prices for acreage and production in the Permian. Acquiring between 500 and 1,000 Tier 1 drilling locations in the Permian could fetch a price tag anywhere between $3 billion and $10 billion.

With acquisition targets dwindling and investors demanding greater scale and inventory runway, E&Ps are pumping historic amounts of cash into Permian Basin deals.

Total transaction value in Permian assets eclipsed $100 billion during 2023, said Wood Mac. The previous record was $65 billion in 2019.

The $60 billion mega-merger between Exxon Mobil and Pioneer Natural Resources, announced in October, will reshape the future of the Permian Basin.

Exxon expects its Permian production to grow to approximately 1.3 MMboe/d after closing the Pioneer deal, positioning it atop the Permian producer leaderboard.

By 2027, Exxon aims to boost its total Permian output to 2 MMboe/d—up from its previous goal of 1 MMboe/d before acquiring Pioneer.

Roughly 45% of Exxon’s global upstream volumes will come from U.S. production after closing the Pioneer acquisition.

Occidental Petroleum is also digging deeper into the Permian: The company inked a $12 billion deal to acquire CrownRock, one of the most attractive remaining private E&Ps in the basin.

The acquisition of CrownRock, a joint venture between CrownQuest Operating and private equity firm Lime Rock Partners, includes more than 94,000 net acres of 1,700 undeveloped drilling locations in the core of the Midland Basin.

“This most recent deal will create the sixth soon-to-be 1 MMboe/d U.S. [Lower 48] producer, with others including Chevron, EOG, Exxon Mobil, EQT and ConocoPhillips,” said Robert Clarke, vice president of upstream research at Wood Mac.

“And in the Permian specifically, Oxy will become a top three producer behind the majors, pumping more oil and gas pro forma than Pioneer did at the time of its sale announcement,” he said.

The Permian has also seen a deluge of smaller transactions as public E&Ps work to shore up their balance sheets and inventory portfolios.

Civitas Resources allocated nearly $7 billion to jump into the Permian with scale during 2023. The company entered both the Midland and Delaware basins with a pair of deals with private E&Ps NGP-backed Tap Rock Resources and Hibernia Energy III.

Citivas followed on with a $2.1 billion acquisition of Vitol-backed Midland Basin E&P Vencer Energy in October.

“Given what has happened with commodity prices—we’ve seen a significant run-up last year and now some softness as the market’s digesting global macro issues—it underscores again the importance of having high-quality, low-breakeven inventory,” Chris Doyle, president and CEO of Civitas, told Hart Energy.

In a rarer public-public transaction, Permian Resources spent $4.5 billion to acquire Earthstone Energy, adding core Delaware inventory and production in the Midland.

Ovintiv spent $4.275 billion acquiring three private Midland E&Ps backed by EnCap Investments.

“If you’re a company with a more limited scale in the basin, there’s less both long-term opportunity and current valuation upside that comes as a result of that,” said Matthew Bernstein, senior shale analyst at Rystad Energy.

Companies unable to afford premium Tier 1 inventory are moving out into fringier areas of the Permian or targeting less developed zones deeper underground. But these Tier 2 or Tier 3 opportunities require more money to drill and exploit than core Tier 1 locations.

“We have a way to get more oil out of the ground,” said Fernando Valle, senior oil and gas equity analyst at Bloomberg Intelligence. “It’s a matter of whether it’s worthwhile and how that cost can come down over the next five to 10 years.”

Buying bonanza

E&Ps in the Permian still need inventory, so experts think the trend of consolidation will continue in 2024. But the number of attractive and somewhat affordable acquisition targets is shrinking as options are plucked off the market.

Endeavor Energy Partners holds a coveted position in the core of the Midland Basin. A Fitch Ratings report from November disclosed that the privately held E&P is producing 331,000 boe/d, up 25% from 2022 levels.

But Endeavor wouldn’t be cheap to acquire: Analysts suggest that its current market valuation could be in the neighborhood of $30 billion. That’s a whopping asking price that few oil companies, outside of the majors, could afford.

There’s also Tyler, Texas-based E&P Mewbourne Oil, one of the Permian’s top private producers and among the most active drillers in the Delaware.

In an exclusive interview with Hart Energy last summer, Mewbourne President and CEO Ken Waits insisted that the company wasn’t for sale.

“[Endeavor’s and Mewbourne’s] strategies may be a bit more different in terms of willingness and timing of wanting to sell,” Bernstein said.

Fort Worth-based Double Eagle has been one of the largest independent purchasers of oil and gas leasehold interests in the Permian.

Double Eagle IV, formed in 2022, is growing a position mainly in the Midland Basin but has also scooped up interests on the Delaware side.

There are several other private equity-backed E&Ps developing footprints in the Permian, but many of the most attractive options were bought up last year. The runway for public-private deals might be shorter in 2024 than it was in 2023.

“As opposed to X private equity firm bundled together three operating companies and sold them for $1 billion to X midsize E&P, I think it’s going to be a bit more of those public names to watch, for sure,” Bernstein said.

The gas glut

E&Ps buy Permian acreage to drill for crude oil volumes, but Permian wells are producing more natural gas over time as the oily basin develops and matures.

Associated gas volumes—the natural gas output associated with drilling new oil wells—continue to rise across the Permian.

Permian associated gas output was expected to hit a record 24.85 Bcf/d during December, according to the EIA’s most recent forecast.

Energy intelligence firm East Daley Analytics reported that natural gas flow out of the Permian Basin hit record volumes during November 2023.

Companies are pouring a lot of money into getting more associated gas and NGL out of the Permian and into demand centers.

East Daley found that 60% of the midstream capex budgets across the Lower 48 are being spent in the Permian Basin; 49% of that total is being spent on Permian NGL takeaway capacity, excluding gathering and processing investment.

Recommended Reading

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Will TG Natural Resources Be the Next Haynesville M&A Buyer?

2025-03-23 - TG Natural Resources, majority owned by Tokyo Gas, is looking to add Haynesville locations as inventory grows scarce, CEO Craig Jarchow said.

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

Voyager Midstream Closes on Panola Pipeline Interest Deal

2025-03-19 - Pearl Energy Investments portfolio company Voyager Midstream Holdings has closed on its deal with Phillips 66 for its non-op interest in the Panola Pipeline.

Sources: Citadel Buys Haynesville E&P Paloma Natural Gas for $1.2B

2025-03-13 - Hedge fund giant Citadel’s acquisition includes approximately 60 undeveloped Haynesville locations, sources told Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.