Dubbed this summer the Midland Basin’s “belle of the M&A ball” by J.P. Morgan Securities, new data suggest Endeavor Energy Resources could fetch in the neighborhood of $30 billion.

The privately held Midland pureplay is now producing 331,000 boe/d, up 25% from 2022, according to a Nov. 8 Fitch Ratings report.

Fitch’s new inside look at Endeavor and a Hart Energy comparison with Exxon Mobil’s valuation of Pioneer Natural Resources, also a Midland pureplay, suggest Endeavor’s current market valuation could be some $30 billion. That's based purely on the numbers and not the name-brand recognition a company like Pioneer brings to the table.

Exxon Mobil is paying $89,500 per Pioneer’s flowing boe/d, currently averaging 721,000 boe/d. Pioneer has 900,000 net acres. Exxon’s all-stock deal values the company at $64.5 billion, including the assumption of about $5 billion of debt.

Endeavor averages 331,000 boe/d and holds 350,000 net acres. Its current gross debt is $907 million.

The company’s leasehold includes 9,800 gross future horizontal locations economical at $60/bbl, according to Fitch. J.P. Morgan Securities estimated in June that Pioneer holds some 11,000 future-well locations at more than $55 oil; Endeavor, about 4,500 at that price.

Both operators are leveraged below 0.5x EBITDA, according to the new Fitch report and an October update on Pioneer.

Endeavor’s output is 57% oil, Fitch reported. Pioneer’s is 53% oil, according to its 10-Q filing for third-quarter 2023.

Fitch stated Endeavor’s total liquids—including NGLs—output is 80%. Pioneer’s NGL output was 25% of total production in the third quarter, bringing its total liquids production to 78%.

81% margin

Additional data Fitch provided includes Endeavor’s operating costs, which have improved to $9 per boe/d, down from $15.40 per boe/d in 2017 —a year after it began going after tight rock with horizontals and mega-fracs.

The $9/boe cost is “among the lowest of Fitch’s aggregate E&P peer group,” wrote analysts Daniel Michalik and Mark Sadeghian. They affirmed Endeavor’s BBB- rating.

Endeavor’s unhedged netback, $38.30 per boe, is an 81% margin that is “the highest of the peer group and benefits from a high liquids content of approximately 80%, strong realized prices and competitive cost structure.”

In comparison, Pioneer’s unhedged cash netback is $34.10 per boe/d, Fitch reported in October.

Marathon Oil’s netback is $25.10/boe; Continental Resources, $30.90/boe; APA Corp., $27.80/boe; and Diamondback Energy, $34/boe.

“Management has demonstrated the ability to grow while managing drilling, completion and exploration costs and enhancing overall returns, despite inflationary cost pressures,” Michalik and Sadeghian said.

Cash flush

Fitch expects Endeavor’s free cash flow to be $1 billion in 2024 and 2025 at a base-case oil price assumption of $70 next year and $65 oil in 2025. About 10% of 2024 oil production is hedged at $70; associated gas — about 20% — at $3.25.

Debt-to-EBITDA is expected to remain below 0.5x, which is similar to that of Devon Energy, through 2027. Endeavor’s $907 million in senior unsecured notes mature in 2028.

The company also has an unused bank credit facility of $1.5 billion, plus $1.9 billion of cash on hand.

In 2021, Endeavor paid off $500 million of senior notes that were due 2026. In 2022, the company retired another $600 million of senior notes due 2025 using free cash flow, according to a 2022 Fitch report.

Endeavor’s free cash flow could be used “for potential M&A activity,” Michalik and Sadeghian said. But Fitch’s BBB- credit rating is based on no M&A, they wrote.

Factors that could lead to a higher rating include “steps to further moderate corporate governance-related risks,” they added. Endeavor does not have independent board members. Endeavor’s ownership is fully held by Autry Stephens, who founded the company in 1979.

But, the analyst said, “Endeavor has moved towards professional management, including making outside hires for key management positions.”

That includes enlisting Marathon Oil’s vice president of unconventional resources, Lance Robertson, in 2017 as CEO. Robertson had previously worked at Pioneer.

The property

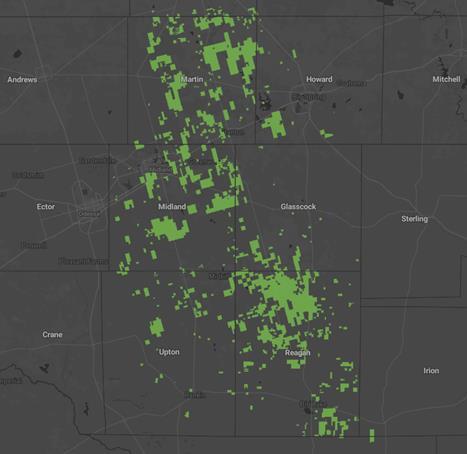

Endeavor operates more than 1,000 horizontal wells on its mostly contiguous footprint concentrated in Martin, Midland and Reagan counties, Texas. The company had 13 rigs drilling as of mid-October.

Recent completions, according to J.P. Morgan Securities reports, include 11 wells on the Kronos lease in Martin County that averaged IPs of 1,040 boe/d, 84% liquids; 12 in its “Interstate” unit in Midland County, averaging 1,654 boe/d, 87% liquids; and 22 on Fasken property in Midland County, averaging 1,317 boe/d, 89% liquids.

In 2022, Endeavor’s results were 11.24 bbl of oil per lateral foot, according to J.P. Morgan, in fourth place ahead of Ovintiv (11.02) and behind Chevron (12.50), SM Energy (12.24) and APA Corp. (11.43).

Its minerals unit, 1979 Royalties, added about 5,000 net royalty acres in Martin and Dawson counties recently from EnCap Investments-backed Peacemaker Royalties for $61 million, according to Enverus. The surface acreage is primarily operated by Endeavor and Ovintiv.

Recommended Reading

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.

73-year Wildcatter Herbert Hunt, 95, Passes Away

2024-04-12 - Industry leader Herbert Hunt was instrumental in dual-lateral development, opening the North Sea to oil and gas development and discovering Libya’s Sarir Field.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”