Production at BP’s U.K. North Sea Clair Ridge development started up in November 2018. (Source: BP)

The fixed platform and floating production systems markets are continuing to recover slowly after several years in the doldrums, following the oil price crash in 2014.

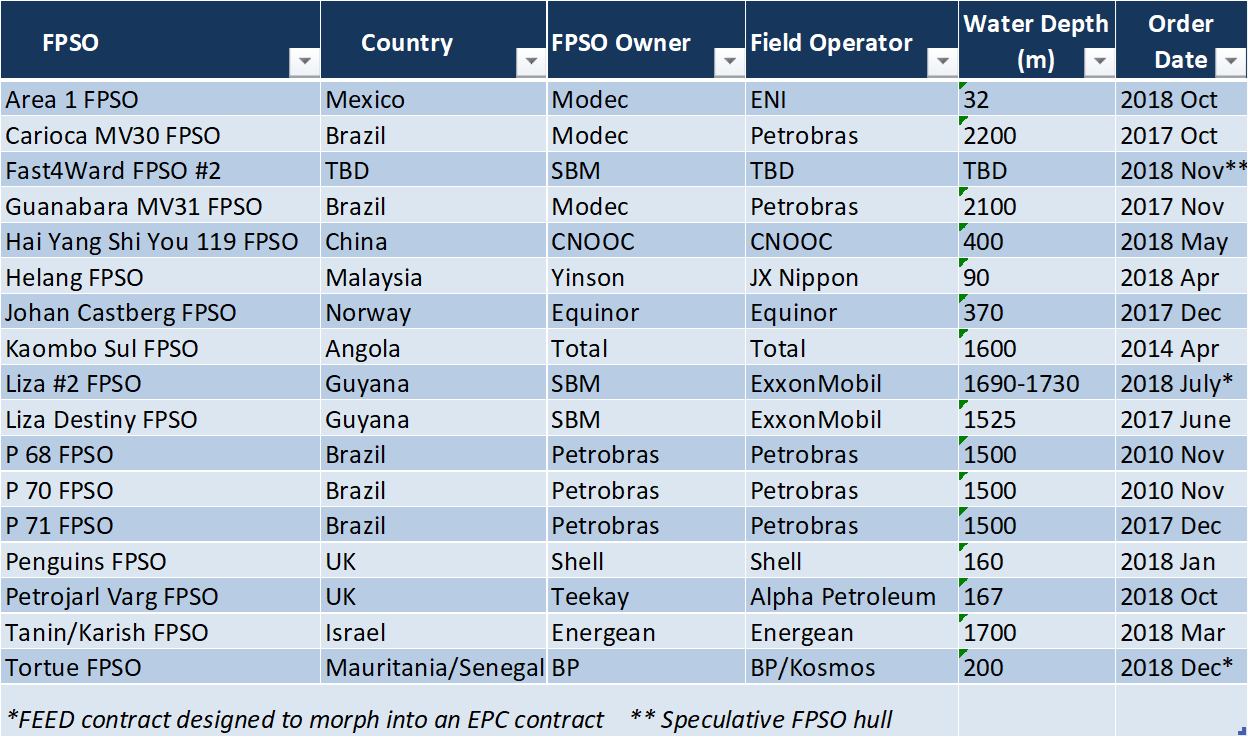

These signs of a renaissance are highlighted by the FPSO sector where there were nine awards in 2018, on par with the nine ordered in 2017, indicating a continued pickup from the dark days of 2016 when not a single order was placed.

The upturn comes as operators and contractors have teamed up to drive down prices with a focus on cost efficiencies and a move to more standardization of equipment.

The cost savings achieved have put the offshore sector in a good position for growth if the lower price base can be maintained to keep the industry in line with competitor producing sectors such as onshore.

Floater solutions remain key to accessing new reserves in areas such as offshore Brazil and Mexico as well as in the Lower Tertiary play in the Gulf of Mexico (GoM). Southeast Asia/China and East and West Africa are also major growth areas for floating production systems.

Fixed platforms remain the weapon of choice for closer-to-shore, easier-to-reach reserves, which can be tapped with more conventional methods.

FPSO market upturn

Floater analysts International Maritime Associates said in a February report that the nine FPSOs ordered in 2018 are to be deployed in water depths ranging from 32 m (105 ft) with the Area 1 FPSO offshore Mexico to 1,700 m (5,578 ft) with the Tanin/Karish FPSO offshore Israel.

Six of the orders utilize new purpose-built hulls. Three are conversions or modifications of existing FPSOs.

Two of the 2018 contracts—an FPSO for use by Exxon Mobil offshore Guyana and an FPSO to be deployed by BP on an LNG project offshore Mauritania/Senegal—are FEED contracts structured to morph into engineering, procurement and construction (EPC) contracts, according to International Maritime Associates.

In its fourth-quarter 2018 Floating Production Systems Report (released in September 2018), Energy Maritime Associates reviewed the market for floating production systems, including FPSOs, floating LNGs (FLNG), floating storage regasification units, tension-leg platforms, spars, semisubmersibles, floating storage offloading units and mobile offshore production units. Energy Maritime Associates identified 31 projects most likely to be sanctioned in the next 12 months.

“Oil prices have rebounded over 100% from their lowest levels, while offshore costs have hardly moved. As a result, many offshore developments are now very competitive, if not more attractive than onshore shale fields, with breakevens as low as $30/bbl,” said David Boggs, Energy Maritime Associates’ managing director, in the report. “We see this as the start of a new cycle for the industry with reset pricing and a growing oil price similar to the period from 2004 to 2005. If oil prices remain stable, there is a tremendous opportunity for new floating production projects over at least the next two years. While there have been substantial industry reductions and consolidation, there is still sufficient industry capacity, particularly in the subsea and drilling sectors through 2020.”

Cost efficiencies

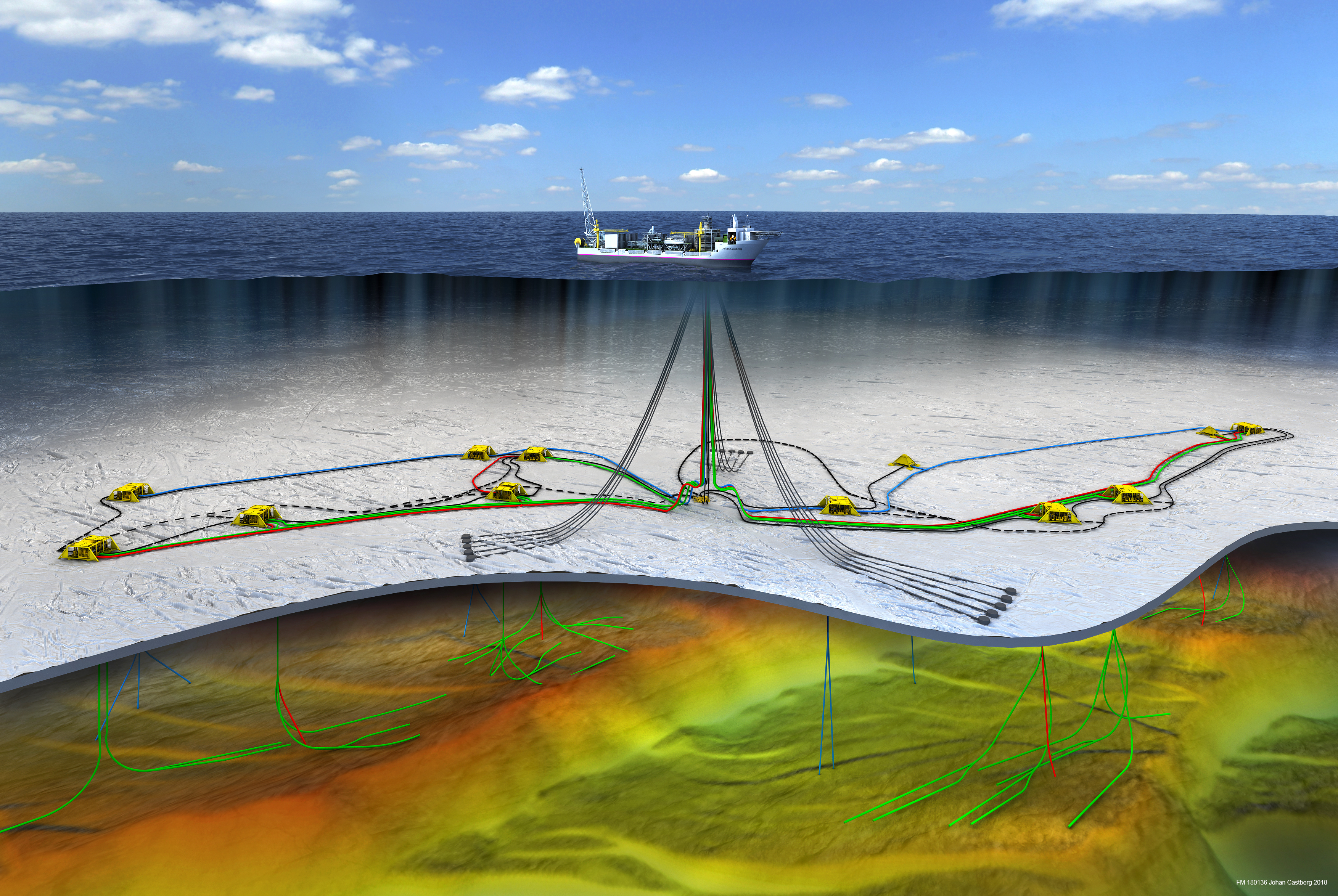

A prime example of cost-cutting initiatives having a positive effect on development plans can be seen with the approval by the Norwegian Parliament of the plan for development and operation of Equinor’s Johan Castberg Field in the Barents Sea.

The field will be developed with an FPSO+ production vessel with additional subsea solutions. Compared with the original solution, Equinor said costs were halved from about $11.7 billion to $5.85 billion.

With first oil scheduled for 2022, the field has a production horizon of 30 years. Recoverable resources are estimated at 450 MMboe to 650 MMboe.

The field development consists of a production vessel and a comprehensive subsea system, including 30 wells distributed on 10 templates and two satellite structures. Globally, this is the largest subsea field under development.

“The project is on schedule, and gradually, we will see the results of the construction work. Many yards and companies across the country will be busy with Johan Castberg deliveries in the years to come,” said Knut Gjertsen, project director for Johan Castberg.

Equinor said the project, which initially had a breakeven price above $80/bbl, was not sustainable when the oil price collapsed in 2014. A new concept and new solutions were found by working with suppliers and partners to ensure the development is profitable at an oil price below $35/bbl.

Project awards

Other project awards in 2018 included Shell’s U.K. North Sea Penguins Field where an FPSO will take the place of the decommissioned Brent Charlie platform in the nearby Brent Field. As part of the redevelopment process, a further eight wells will be drilled and tied back to the FPSO vessel. Oil will be transported via tanker to refineries, and gas will be transported via the Far North Liquids and Associated Gas System pipeline to the St. Fergus gas terminal in northeast Scotland, according to the company.

Highlighting cost efficiencies, Shell said the redevelopment is an attractive opportunity with a competitive forward-looking breakeven price below $40/bbl. Once fully functional, average peak production is expected to be about 45,000 boe/d.

Another FPSO project in the North Sea to reach a final investment decision (FID) in 2018 is Alpha Petroleum’s Cheviot development. The Petrojarl Varg FPSO will be deployed to the field. First oil production is targeted for the second quarter of 2021 at an expected rate of at least 30,000 bbl/d.

Offshore Israel, Energean’s Karish and Tanin development project remains on track to deliver first gas into the Israeli domestic market in the first quarter of 2021.

Senegal first

Meanwhile, MODEC was awarded a contract by Woodside Energy, operator of the SNE Field development, for an FPSO on Senegalese waters offshore West Africa. MODEC will perform FEED for the FPSO and, subject to an FID on the project this year, will be responsible for the supply, charter and operations of the FPSO. The SNE deepwater oil field is expected to be Senegal’s first offshore oil development. The field is located within the Sangomar Deep Offshore permit area, approximately 100 km (62 miles) south of Dakar. The FPSO will be designed to produce about 100,000 bbl/d of crude oil, with the first oil production targeted in 2022 and will be moored in a water depth of about 800 m (2,625 ft).

Brazil FPSO orders

International Maritime Associates said Brazil is expected to account for 30% to 35% of the projected FPSO orders over the next five years as Petrobras ramps up activities.

This figure reflects a large number of deepwater projects in the planning queue in Brazil, the expected rebound of Petrobras over the next few years and the future role of international oil companies in Brazil deepwater exploration and development, according to the International Maritime Associates.

The FPSOs ordered for Brazil will generally be large capacity units based on purpose-built or converted very large crude carrier hulls.

In November 2018 Petrobras started production of oil and natural gas in the Búzios 2 area in the presalt of the Santos Basin with the P-75 FPSO, the second unit installed in the Búzios Field. With a daily capacity to process up to 150,000 bbl of oil and compress up to 6 MMcm (212 MMcf) of natural gas, P-75 will produce through 10 producing wells, also using seven injection wells.

P-75 was one of six FPSOs to start production in 2018 offshore Brazil. Others included the FPSO Cidade Campos dos Goytacazes in the Tartaruga Verde Field, the P-67 and P-69 in the Lula Field and the P-74 and P-76 in the Búzios Field.

Farther out, first oil is expected from the ultradeepwater Mero Field in 2021 and will involve the use of the Guanabara MV31 FPSO, which is capable of processing 180,000 bbl/d of crude oil.

In addition, the Libra oil field is one of the most significant oil and gas discoveries in recent years. Situated about 177 km (110 miles) off the coast of Rio de Janiero, the field could hold as many as 12 Bbbl of oil. The FPSO Pionero de Libra is operating the field as an early production system.

Standardized solutions

Standardization of equipment also is helping play a key role in the bounce back of the offshore sector. SBM Offshore is at the forefront of this revolution with its homogenized Fast4Ward FPSO. The design consists of a newbuild with a generic double hull capable of accommodating an internal or external turret mooring system or spread mooring and standardized modules. The vessel will have a production capacity of 100,000 bbl/d to 250,000 bbl/d of oil and up to 2 MMbbl of storage.

In July 2018, SBM Offshore announced that it had been awarded contracts for Exxon Mobil’s second Liza FPSO, based on its Fast4Ward program, for the Liza development located in the Stabroek Block offshore Guyana.

Following FEED and subject to requisite government approvals, project sanction and an authorization to proceed with the next phase, SBM Offshore will construct, install and then lease and operate the FPSO for a period of up to two years, after which the FPSO ownership and operation will transfer to Esso Exploration and Production Guyana Ltd. The FPSO will be spread moored in a water depth of about 1,600 m (5,250 ft).

In a March 2018 press release, SBM said, “Fast4Ward optimizes an FPSO design, creating standard specifications and enhancing reliability, bringing costs down further. It accelerates delivery by up to 12 months and improves quality and productivity on a de-risked, more reliable plan with a higher degree of safety.”

Aasta Hansteen onstream

The floater market is not the preserve of FPSOs, however, and there also have been some bright spots for other parts of the sector as well.

Equinor and its partners kicked off production from the Aasta Hansteen gas field in the Norwegian Sea in December 2018 with the largest spar platform in the world.

Aasta Hansteen is located 299 km (186 miles) west of Sandnessjøen, far from other fields and in an area with harsh weather conditions. The field development concept consists of a floating platform with a vertical cylindrical substructure moored to the seabed. Some 339 m (1,112 ft) tall, the platform weighs 70,000 tonnes. When the platform was towed to the field in April, it was the biggest tow on the Norwegian Continental Shelf (NCS) since Troll A in 1995.

Gas is produced from seven wells in three subsea templates. At water depths of 1,300 m (4,265 ft), this is the deepest ever installation of subsea equipment on the NCS.

Both Aasta Hansteen and the 483-km (300-mile) long pipeline from the field to Nyhamna can accommodate discoveries. The first one, Snefrid North, is already under development and will come onstream toward the end of the year. The recoverable resources at Aasta Hansteen, including Snefrid North, are estimated at 54 Bcm (1.9 Tcf) of gas and 353 MMboe of condensate.

FLNG resurgence

As the demand for reliable gas supplies grows, the FLNG market also is moving into a new wave of developments. Westwood Global Energy Group’s analysis of sanctioned and upcoming projects sees global FLNG capex projected to total $52.8 billion over the 2019-2024 period.

As LNG exports take a foothold in the U.S., investment in floating liquefaction facilities in North America will play a pivotal role in global FLNG expenditure over the forecast, accounting for 45% of expenditure, the analyst said.

Golar LNG’s Hilli Episeyo project offshore Cameroon came onstream in 2018. Built by Keppel in Singapore, the Hilli Episeyo is the world’s first converted FLNG vessel. Launched in July 2017, the Hilli Episeyo was converted from an LNG carrier built in the mid-1970s and moved from Singapore to Cameroon in October 2017.

Golar also will be supplying its Gimi vessel to BP for Phase 1 of the Greater Tortue Ahmeyim project located at a nearshore hub on the Mauritania and Senegal maritime border. The Greater Tortue Ahmeyim project will produce gas from an ultradeepwater subsea system and mid-water FPSO vessel, which will process the gas, removing heavier hydrocarbon components. Expected to commence production in 2022, Gimi is designed to produce an average of about 2.5 million tonnes per annum of LNG. Total gas resources in the field are estimated to be about 424 Bcm (15 Tcf) of gas.

Fixed platforms

For offshore projects that are closer to shore and perhaps less complex, traditional fixed platforms are still a cost-effective solution for operators.

BP’s Clair Ridge project in the U.K. North Sea shows that there are exciting opportunities to develop resources with fixed platforms, even in harsh conditions. The multibillion-pound investment by BP and partners started up in November 2018 and is designed to continue producing until 2050.

Clair Ridge is the second phase of development of the Clair Field, 76 km (47 miles) west of Shetland. The field, which was discovered in 1977, holds an estimated 7 Bboe of hydrocarbons.

Two new, bridge-linked platforms and oil and gas export pipelines have been constructed as part of the Clair Ridge project. The project has been designed to recover an estimated 640 MMbbl with production expected to ramp up to a peak plateau level of 120,000 bbl/d of oil.

Clair Ridge is the first offshore deployment of BP’s EOR technology, LoSal, which has the potential to increase oil recovery from reservoirs by using reduced salinity water in water injection. This is expected to result in up to an additional 40 MMbbl being cost-effectively recovered over the lifetime of the development.

In addition to the platforms, the Clair Ridge project also included new pipeline infrastructure with the installation of a 5.5-km (3.4-mile), 22-in. oil export pipeline tying into the Clair Phase 1 export pipeline. Oil from Clair is exported to the Sullom Voe Terminal on Shetland. A new 14.5-km (9-mile) long, 6-in. gas export pipeline tying Clair Ridge into the West of Shetland Pipeline (WOSP) also was installed as part of the project. The WOSP transports gas from west of Shetland to the Sullom Voe Terminal.

Clair Ridge also features an advanced drill rig that will deliver a drilling program over several years. There are 36 well slots, two of which are being used for the tieback of predrilled wells. The drilling program, which is likely to last more than 10 years, includes drilling and completing development wells from the remaining 34 well slots.

Leviathan thinks big

In milder climes offshore Israel, Noble Energy’s Leviathan project is now about 75% complete. The company has completed the installation of all infield gathering lines, subsea trees and fabrication of the jacket structure. The jacket has been installed. All four production wells have been completed, and flow tests have confirmed the deliverability of more than 8.4 MMcm/d (300 MMcfe/d) per well. Construction of the platform continues, and the project remains on schedule for startup by the end of the year. The Leviathan platform will have an initial deck weight of 22,000 tons. Processed gas will connect to the Israel Natural Gas Lines Ltd. onshore transportation grid in the northern part of the country and to regional markets via onshore export pipelines.

Minimal design

Unmanned, remotely operated platforms are another route operators are taking to cut costs.

The Oseberg Vestflanken 2 Field came onstream via a stripped down, unmanned platform. Remotely operated from the Oseberg Field center, the new Oseberg H platform is the first unmanned platform on the NCS. Recoverable resources are 110 MMbbl, and the project was delivered far below budget. The project was delivered at $760 million, more than 20% lower than the cost estimate of the plan for development and operation, according to the company. The breakeven price was reduced from $34/bbl to below $20/bbl, further strengthening a development that is already highly profitable.

Maintenance campaigns are to be carried out once or twice per year on the platform. The alternative to an unmanned wellhead platform would have been subsea wells. According to news reports, the new concept provides a competitive alternative in developing smaller discoveries.

The 11 wells on Oseberg Vestflanken 2 will be drilled by the Askepott jackup rig owned by the Oseberg license. Nine wells will be drilled through the Oseberg H platform and two through an existing subsea template. Pipelines and subsea equipment also have been installed.

For questions or comments on this story, contact Executive Editor Jennifer Presley at jpresley@hartenergy.com.

This story first appeared in E&P magazine's "2019 Offshore Technology Yearbook" issue, which published in May. Read the other "2019 Offshore Technology Yearbook" articles:

OVERVIEWS:

Back to Deep Water

Mexico Finding Its Place in Offshore Landscape

Middle East Offshore Market Treads Recovery Path

KEY PLAYERS:

Operators Foresee Vast Potential

TECHNOLOGY:

New Generation of Offshore Drilling Tools Targets Safety, Wellbore Conditions

Platforms Enter a New Cycle (story above)

Subsea Sector Recovery Underway

Evolving ROVs

CASE STUDIES:

Advanced Flowmetering

Composites Gain Ground

PRODUCTION FORECAST:

Americas and Middle East Put Offshore Back on the Map

Recommended Reading

Berkshire Hathaway Boosts stake in Occidental Petroleum to Nearly 29%

2024-06-19 - Warren Buffett's Berkshire Hathaway Inc. acquired another 2.95 million shares in Occidental Petroleum.

Producers Trim 2024 Hedges Amid Bullish Oil Prices, M&A

2024-06-14 - Meanwhile, gas-weighted players are benefitting from solid hedge books planned ahead of price uncertainty.

Liberty Energy Warns of ‘Softer’ E&P Activity to Finish 2024

2024-07-18 - Service company Liberty Energy Inc. upped its EBITDA 12% quarter over quarter but sees signs of slowing drilling activity and completions in the second half of the year.