Oil and Gas Investor Magazine - September 2020

Magazine

Ships in 1-2 business days

Download

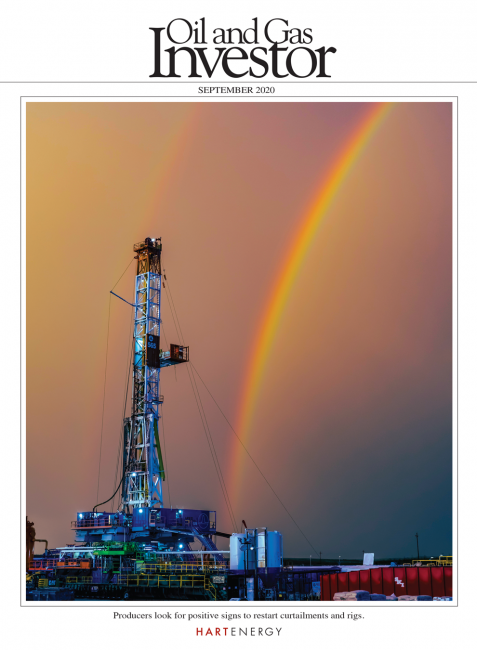

Shale operators have plans to restart production, but with OPEC seemingly satisfied with $40 oil prices, U.S. producers are facing the prospect of becoming ‘zombie companies,’ all dressed up but with nowhere to drill. Oil and Gas Investor's cover story explores company strategies for restarting production and navigating the new environment.

Also in this issue:

-

Geologist Dr. Scott Tinker is on a mission to educate the world on the critical intersection of energy, environment and economics. Can he save the world’s energy future by drawing players into the radical middle?

-

As commercial banks cautiously retrench—if not retreat—from energy, others have a growing appetite to provide debt solutions. Some call it rescue capital.

-

A conventional, stratigraphic trap in Scurry County on the Permian Basin’s Eastern Shelf doesn’t cover hundreds of thousands of acres like shale plays. But the wells are just as good. And, for private wildcatters, they’re particularly great.

-

Water midstream companies are navigating the market downturn alongside E&Ps, eyeing possible opportunities ahead.

Cover Story

US Shale: Meditations on the Revolution

Shale operators have plans to restart production. But with OPEC seemingly satisfied with $40 oil prices, U.S. producers are facing the prospect of becoming ‘zombie companies’—all dressed up but with nowhere to drill.

Feature

Energy Credit Alternatives: The ‘Shadow’ Banks

As commercial banks cautiously retrench—if not retreat—from energy, others have a growing appetite to provide debt solutions. Some call it rescue capital.

Executive Q&A: Defining a Smart Energy Future

Geologist Dr. Scott Tinker is on a mission to educate the world on the critical intersection of energy, environment and economics. Can he save the world’s energy future by drawing players into the radical middle?

Oil and Gas Personnel Issues: Legal Minefields

The nature of oil and gas businesses can pose tricky personnel issues, but sound human resources practices can prevent litigation.

Right-sizing G&A for the New E&P Reality

With limited exit and financing alternatives, oil and gas companies must take steps to address G&A and overhead costs to ensure the financial health of their organizations and their stakeholders.

Small Play, Big Wells: Permian Basin’s Horizontal Eastern Shelf

A conventional, stratigraphic trap in Scurry County on the Permian Basin’s Eastern Shelf doesn’t cover hundreds of thousands of acres like shale plays. But the wells are just as good. And, for private wildcatters, they’re particularly great.

Water Solutions: Going with the Flow

Water midstream companies are navigating the market downturn alongside E&Ps, eyeing possible opportunities ahead.

A&D Trends

Oil and Gas Industry A&D Trends: At the Brink

As 2020 crawls through the third quarter, the strains on M&A and the oil and gas industry are beginning to take on albatross-ian levels.

At Closing

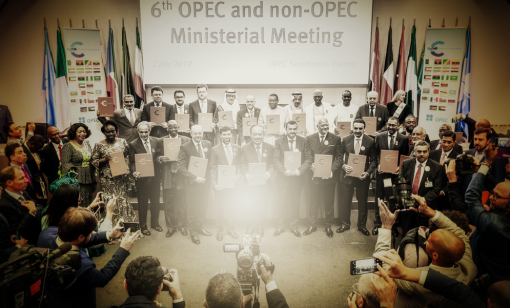

Oil and Gas Investor At Closing: September 1960

Let’s face it—although we can debate the importance of OPEC, it’s clear that we all hang on the organization’s every word, perhaps never more so than this year, a year that will go down in infamy.

From the Editor-in-Chief

From Oil and Gas Investor Editor-in-Chief: Major Stiff Arm

With American giant Exxon Mobil exiting the Dow Jones Industrial Average, it’s hard to imagine a silver lining in a bad year for the industry, but good news—very good news—might be just around the corner.