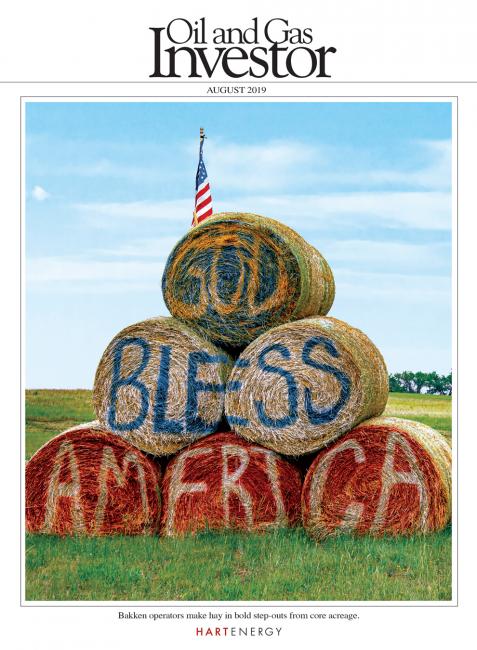

Oil and Gas Investor Magazine - August 2019

Magazine

Ships in 1-2 business days

Download

The Bakken’s operators are seemingly locked into a dwindling geography in North Dakota says OilandGasInvestor's senior editor Darren Barbee, but companies are increasingly returning to their wildcatter roots to see how far they can stretch the Williston Basin’s core. This issue of Oil and Gas Investor examines Bakken operators tactics to tackle the basin.

Also in this issue:

- From wellhead to water, with a trading floor in between, ARM Energy Holdings continues to grow. CEO Zach Lee has inked four big joint ventures so far this year.

- Overshadowed by behemoth unfracked Austin Chalk development in western Louisiana in the past, the formation’s far eastern horizon is being tested for fracked, horizontal development.

- Chesapeake Energy Corp. is cutting costs and shaving nonproductive time by opting to self-source sand instead of using third-party suppliers.

Cover Story

Building A Bigger Bakken

The Bakken’s operators are seemingly locked into a dwindling geography in North Dakota, but companies are increasingly returning to their wildcatter roots to see how far they can stretch the Williston Basin’s core.

Feature

Business Practices: Energy SPAC Challenges

Many private energy companies have started SPAC companies to monetize their investments. However, transacting with a SPAC has presented some unique challenges.

E&P Investment Banking: Aiming At Narrow Targets

With sharply lower activity in equity and debt issuance, bankers look to niche markets and M&A.

Executive Q&A: ARM Energy Holdings Chasing Optionality

From wellhead to water, with a trading floor in between, ARM Energy Holdings continues to grow. CEO Zach Lee has inked four big joint ventures so far this year.

Frack Sand: Chesapeake’s Sand Strategy

Chesapeake Energy Corp. is cutting costs and shaving nonproductive time by opting to self-source sand instead of using third-party suppliers.

Lower 48 Exploration: The Far Eastern Chalk

Overshadowed by behemoth unfracked Austin Chalk development in western Louisiana in the past, the formation’s far eastern horizon is being tested for fracked, horizontal development.

NGVs: Natural Gas Hits The Road

When shale gas first took off, natural gas vehicles became the next big source of demand. How much progress has been made?

Oil, Gas And Decarbonization

Big gains in energy exports fuel commitments to address climate change.

A&D Trends

A&D Trends: Indie Oil And Gas Deal-Making

So far in 2019, oil and gas deals have taken an indie turn in the market with mid-sized deals.

At Closing

OGI At Closing: Needed—Lazy Capex, Some M&A

Will consolidation, scale and slower growth be truly what it takes to attain profitability and free cash flow and grab investor attention?

E&P Momentum

E&P Momentum: Let’s Take A Powder

E&Ps established viable economics for Powder River tight sand plays during the past half-decade. In 2019, they plan to do the same for source-rock Niobrara and Mowry shales.

From the Editor-in-Chief

From OGI Editor-In-Chief: Rice Redux

The recent coup to seize control of EQT Corp. has the Rice brothers back in business.

On the Money

On The Money: E&P Sector Risk-On, Or Risk-Off?

With an ongoing emphasis on capital discipline—and a drive to generate FCF—will the U.S. E&P sector moderate its production growth?