Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado. (Source: Shutterstock.com)

Sitio Royalties is adding scale in Colorado with the mineral and royalty specialist’s first deal of 2024.

Denver-based Sitio Royalties Corp. announced a $150 million acquisition in the Denver-Julesburg (D-J) Basin in its Feb. 28 fourth-quarter earnings report.

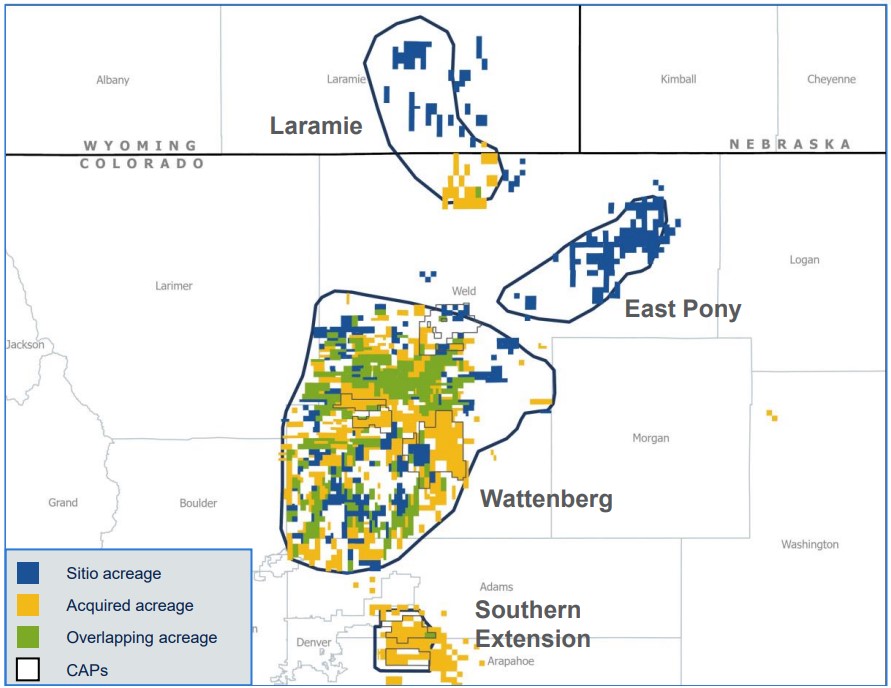

The acquisition from an undisclosed seller included more than 13,000 net royalty acres in the D-J Basin; around 77% of the interests are located within the Wattenberg Field in Weld County, Colorado.

It’s a productive part of the D-J—around 75% of the total rigs deployed in the D-J Basin were active on acreage that Sitio scooped up, the company reported. Production on the acquired D-J assets averaged 2,609 boe/d (41%) oil during the fourth quarter.

“As with most of our acquisitions, this deal originated through a relationship with a seller we've known for a while,” Sitio CEO Chris Conoscenti said on a Feb. 29 earnings call. “The seller did an outstanding job of piecing together a differentiated asset base concentrated in the best parts of the D-J Basin.”

Top operators by production volumes on the acquired assets are Chevron Corp., Civitas Resources and Occidental Petroleum.

Sitio anticipates closing the acquisition in the second quarter. The deal is expected to be financed with existing cash, cash flow from operations and revolving credit facility borrowings.

Dax McDavid, executive vice president of corporate development for Sitio, said the company was able to underwrite future D-J Basin development activity with greater certainty compared to other geographies because of Colorado’s comprehensive area plans (CAPs) and oil and gas development plans (OGDPs).

Colorado state regulators require oil and gas drillers to submit to more stringent development standards than other states. Operators have to obtain approvals to drill under new standards adopted in 2021.

RELATED: Civitas, Prioritizing Permian, Jettisons Non-core Colorado Assets

Major footprints

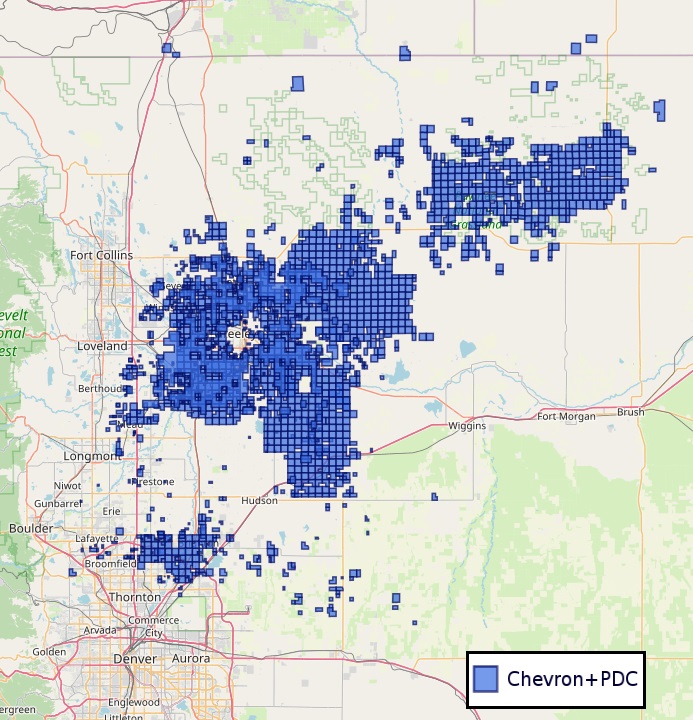

Sitio is working with a who’s-who of top operators in the D-J Basin. California-based major Chevron already had a large footprint in Colorado last year—and it grew larger with the $6.3 billion acquisition of PDC Energy last year.

“Chevron has underscored their dedication to the DJ Basin, commenting that their acreage has high cash flow margin, low breakeven barrels and has permits that extend through late 2029,” McDavid commented on Sitio’s earnings call.

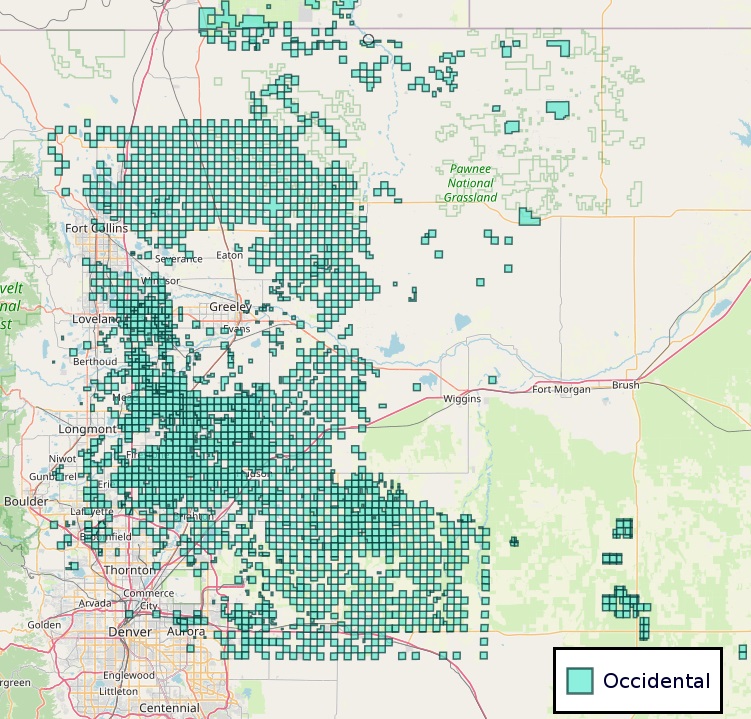

Occidental has a large footprint in the Rockies, both in Colorado and in Wyoming’s Powder River Basin.

Despite a massive $12 billion investment in West Texas to take out private Permian Basin E&P CrownRock, the D-J Basin remains a core part of Occidental’s U.S. portfolio.

“Oxy (Occidental) recently highlighted several positive aspects about the D-J Basin assets as well, including a 32% improvement in well productivity from 2022 to 2023 and an 11% implied annual production growth for the Rockies and other segment based on the midpoint of their 2024 guidance,” McDavid said.

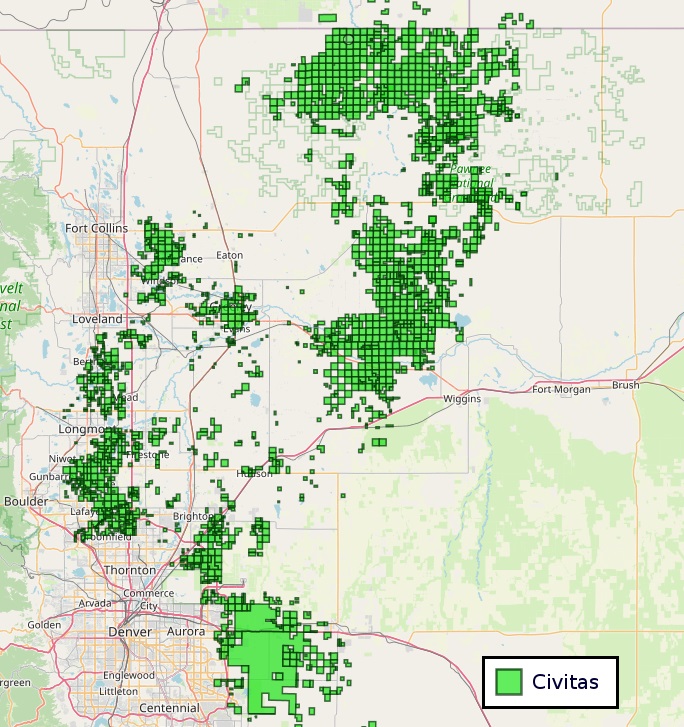

Civitas was born in 2021 through the combination of three Colorado producers: Bonanza Creek Energy, Extraction Oil & Gas and Crestone Peak. At the time of the merger, Civitas was the largest pure-play E&P in Colorado.

But the company has been offloading non-core interests in Colorado and prioritizing investment into the Permian: Civitas announced an $85 million divestiture of non-core D-J assets in its own fourth-quarter earnings on Feb. 27.

Civitas made a splashy entrance into the Permian with nearly $7 billion in acquisitions last year. The first pair of deals, signed with NGP-backed privates Hibernia Energy III and Tap Rock Resources, delivered assets in the Delaware Basin.

Civitas announced a second Permian deal last October—a $2.1 billion acquisition of Midland Basin E&P Vencer Energy, backed by global commodities trading house Vitol.

“Civitas recently disclosed that their 2024 DJ Basin development plan is focused on the highly prolific Watkins area, a region that contains Box Elder, one of the larger CAPs on the D-J Basin acquisition acreage,” McDavid said.

RELATED: Analysts: Will Occidental Sell in GoM, Rockies After $12B Permian Deal?

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.