Civitas Resources Inc. is extending its drilling runway outside of the Denver-Julesburg Basin with $4.7 billion in Permian M&A. (Source: Shutterstock.com)

Editor's note: This article has been updated to include comments made by Enverus.

Civitas Resources Inc. is extending its drilling runway outside of the Denver-Julesburg Basin with $4.7 billion in Permian M&A.

Civitas’ agreements to acquire oil and gas assets in the Midland and Delaware basins will help the company establish a substantial foothold in the Permian Basin, the Lower 48’s top oil-producing region.

The Denver-based E&P is acquiring private Permian operators Hibernia Energy III LLC and Tap Rock Resources LLC in a cash-and-stock transaction valued at approximately $4.7 billion, Civitas announced June 20. Both Hibernia and Tap Rock are backed by private equity firm NGP Energy Capital Management.

Not only do the deals help establish a sizable footprint in the Permian, the acquisitions are expected to increase free cash flow per share, leading to debt reduction and continued strong shareholder returns, according to analysts at Truist Securities.

“With a pro-forma ~20% FCF yield, strong shareholder returns, solid leverage and notable inventory, [Civitas] should check most investors' boxes, in our view,” Truist Securities Managing Director Neal Dingmann wrote in a June 20 research note.

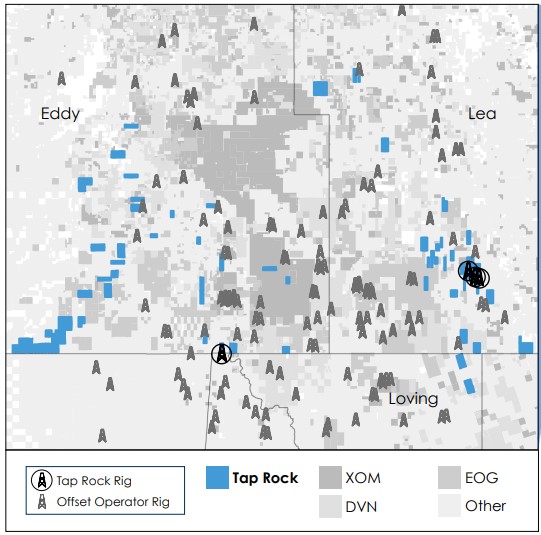

Civitas is acquiring a portion of Tap Rock’s assets in the northern Delaware Basin, which include around 30,000 net acres and average production of around 59,000 boe/d (52% oil).

Civitas agreed to pay $2.45 billion for the Tap Rock assets, including $1.5 billion in cash and approximately 13.5 million shares of Civitas common stock valued at $950 million.

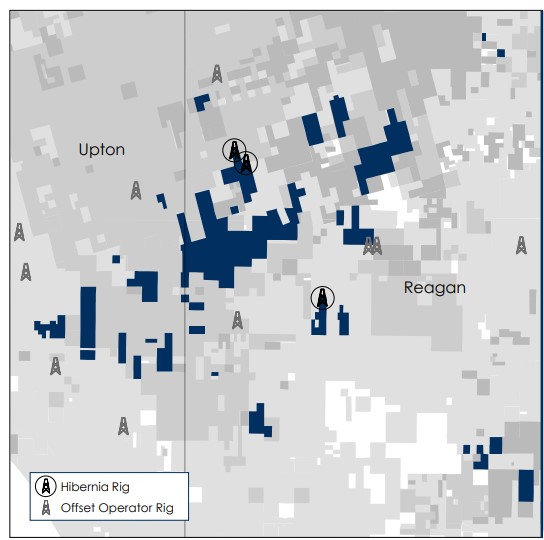

In the Midland Basin, Civitas agreed to purchase Hibernia’s assets for $2.25 billion in cash. The Hibernia transaction includes about 38,000 net acres and average production of around 41,000 boe/d (56% oil).

The deals also add around 800 gross drilling locations to Civitas’ inventory.

Civitas is paying about $45,000 per flowing oil-equivalent barrel in what Truist Securities describes as an “attractively-priced acquisition.”

The company paid around $7,000 per acre for Tap Rock’s Delaware assets and nearly $17,000 per acre for Hibernia’s Midland assets, according to data provider Enverus.

“Pricing looks like other recent Permian transactions that have also broadly priced in that range for acreage and around the 3x EBITDA that Civitas is paying,” Enverus Director Andrew Dittmar wrote in a June 20 research note.

“However, some of those assets were a bit less developed than Tap Rock and Hibernia, and Civitas may have had to pay a bit of a premium relative to remaining inventory to secure two of the few remaining large-scale opportunities left in the play,” he wrote.

Increasing pricing for core Permian inventory has emerged as a key theme in 2023’s M&A market—and it doesn’t look likely to reverse any time soon, Dittmar said.

RELATED

Civitas Enters Permian in $4.7B in Deals for Tap Rock, Hibernia

Rig reductions

Like other E&Ps boosting inventories through M&A, Civitas plans to reduce drilling activity on the acquired assets when the deals close—expected during the third quarter.

Tap Rock is currently running four rigs on its Delaware acreage position, Civitas President and CEO Chris Doyle said during a June 20 conference call with analysts. Civitas plans to reduce activity to a two-rig program in the Delaware, he said.

Hibernia is running a three-rig program on its acreage; Civitas also plans to drop drilling activity by a rig in the Midland Basin.

Those two-rig programs in the Delaware and Midland will complement Civitas’ two drilling rigs deployed in the D-J Basin, Doyle said.

“This gives us tremendous flexibility to drive competition for capital and to optimize capital allocation across those three high-quality positions,” he said.

Civitas aims to keep production roughly flat on the acquired assets after closing. The company expects production to average approximately 105,000 boe/d from close through the end of the year.

Other E&Ps with recent acquisitions in the Permian, like Ovintiv Inc. and Callon Petroleum, are pursuing similar strategies in order to better preserve their undeveloped inventories.

“While Civitas’ remaining D-J drilling locations are economic at current prices, future expansion opportunities in the play look limited with few remaining private companies to roll up,” Dittmar wrote. “That was likely a key factor in why Civitas’ peer PDC Energy decided to sell to Chevron and why Civitas is jumping into the Permian Basin.”

On a combined basis, Civitas expects total production to average between 200,000 boe/d and 220,000 boe/d in 2023. That’s slated to rise to between 270,000 boe/d and 290,000 boe/d in 2024, according to updated guidance from Civitas.

RELATED

Exclusive Q&A: Patterson-UTI, NexTier CEOs Talk Merger, Shale Dominance

Lookout on leverage

Civitas expects the acquisitions to be accretive on multiple fronts, including shareholder dividends. The company anticipates its pro forma dividend to increase by about 20% in 2024.

The E&P anticipates its leverage ratio to be about 1.1x in the third quarter after closing the acquisitions. But Civitas aims to reduce its leverage to less than 1x by the end of 2024.

In order to finance portions of the acquisitions, Civitas plans to offer $1.35 billion in senior unsecured notes due 2028 and $1.35 billion in senior unsecured notes due 2031 through a private placement.

Proceeds from the offering, along with cash on hand and borrowings under Civitas’ credit facility, will fund a portion of the consideration for the transactions.

To accelerate reducing its debt load, Civitas plans to sell around $300 million in non-core assets in its portfolio. Doyle said monetization of potential non-core assets could include non-operated acreage positions.

“When we look at the current assets that we operate, are there areas that we could monetize that are maybe more valuable in others’ hands?” Doyle said.

Civitas is also lowering its target for share buybacks in order to prioritize debt reduction. The company authorized $500 million in share repurchases through the end of 2024—down from its previous $1 billion share repurchase framework.

Recommended Reading

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

Powder in the Hole: Devon May Fire up its PRB in Coming Years

2024-08-23 - Devon Energy is perfecting its spacing and completion recipe in Wyoming’s Powder River Basin play to possibly unleash full-field development later this decade.

Crackin’ It at Kraken: Inside the Bakken’s Ramped-up Private E&P

2024-07-24 - Kayne Anderson-backed Kraken Resources is producing more than 80,000 boe/d today and has a new Fitch Ratings credit score to take to the M&A bank.

How Liberty Rolls: Making Electricity, Using NatGas to Fuel the Oilfield

2024-08-22 - Liberty Energy CEO Chris Wright said the company is investing in keeping its frac fleet steady as most competitors weather a downturn in oil and gas activity.

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.