Ovintiv Inc.’s latest $4.275 billion acquisition in the Permian Basin adds highly sought-after core inventory and should be a boon in the eyes of investors, analysts say. (Source: Shutterstock)

Ovintiv Inc.’s latest $4.275 billion acquisition in the Permian Basin adds highly sought-after core inventory and should be a boon in the eyes of investors, analysts say.

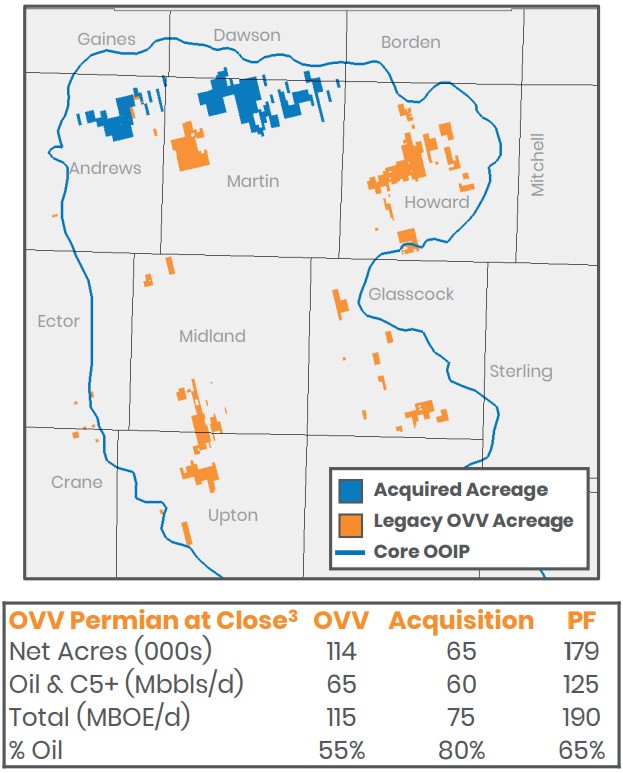

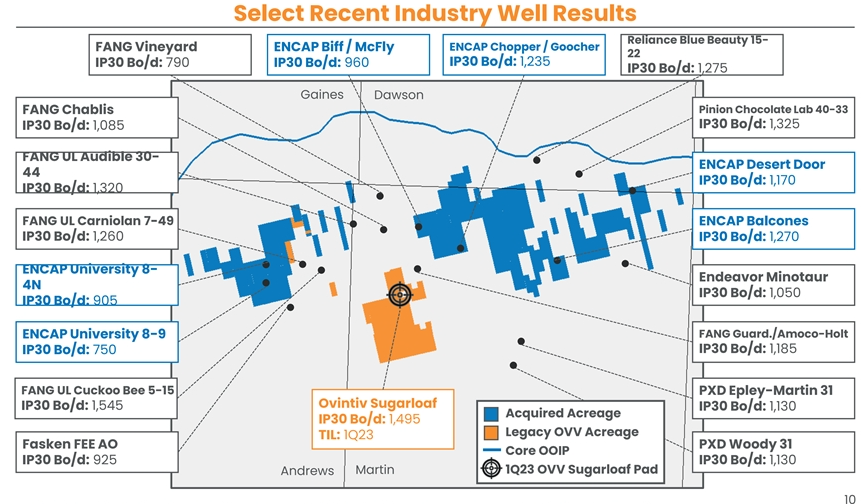

Ovintiv agreed on April 3 to acquire 65,000 net acres and 1,050 net horizontal locations in the Northern Midland Basin from three portfolio companies backed by EnCap Investments LP: Black Swan Oil & Gas, PetroLegacy Energy and Piedra Resources.

The cash-and-stock deal addresses the relatively short runway of core drilling locations Ovintiv had in its existing portfolio, a key concern for investors prior to the transaction, said Andrew Dittmar, director at Enverus Intelligence Research.

“Since investors are closely scrutinizing inventory life when valuing oil-focused E&Ps, adding the additional locations should help the company improve its equity multiple and rerate higher,” Dittmar said in an April 3 research note.

Some of the assets Ovintiv is picking up are a bit more fringe on the northern edge of the Midland, including in Andrews County, Texas, where there’s historically been less drilling activity, Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co. told Hart Energy.

Still, Black Swan, PetroLegacy and Piedra represented the highest quality remaining private-equity backed opportunities in the Midland Basin, Dittmar said. And a substantial amount of acreage was also acquired in Martin County, Texas. Martin was the second biggest producer of crude among Texas counties as of January 2023, according to the Texas Railroad Commission.

And at just over $20,000 per acre, after adjusting for production value, the purchase price reflects a significantly competitive market for core acreage acquisitions in the Permian.

“The cost of high-quality acreage and drilling inventory has escalated substantially over the last year as public companies targeted acquisitions that could boost their runway and the number of opportunities remaining dwindled,” Dittmar said.

Ovintiv also announced on April 3 an agreement to sell its entire position in the Williston Basin’s Bakken play to Grayson Mill Bakken LLC, another EnCap portfolio company, for $825 million in cash. The divestiture is expected to close on June 12, subject to customary closing conditions, according to an Ovintiv regulatory filing.

Offloading non-core Bakken assets with very little inventory remaining to pick up oilier acreage in the Permian was a good move for Ovintiv, Sorbara said.

“You get rid of a high-cost play like the Bakken and you deploy capital toward the Permian,” Sorbara said. “Investors like the Permian.”

RELATED

Ovintiv to Acquire EnCap’s Midland Basin Assets for $4.2 Billion, Exit Bakken

Boosting oil production

Ovintiv’s portfolio is still quite weighted toward natural gas, but the acquisition in the Permian deepens the company’s footprint in crude oil production.

As of the end of last year, Ovintiv’s estimated net proved reserves consisted of about 24% oil, 26% NGL and 50% natural gas, the company said in its latest annual report.

After integrating the EnCap-backed Midland Basin assets, that mix could look more like 28% oil, 23% NGL and 49% natural gas in the third quarter, Sorbara said.

Brendan McCracken, president and CEO at Ovintiv, said the acquisition will enable the company to nearly double Permian oil and condensate production to approximately 125,000 barrels per day (bbl/d).

“We add significant inventory depth, increase our oil mix and create a big enhancement to our capital efficiency and lower our cash costs,” McCracken said in an April 3 conference call with analysts.

Ovintiv’s existing Permian footprint – about 114,000 net acres — averages 115,000 barrels of oil equivalent per day (boe/d). The company produces 65,000 bbl/d of oil and condensate, of which 55% is oil.

The acquired 65,000 net acres and 75,000 boe/d of production has an 80% oil and condensate cut, Ovintiv said. That will boost the company’s oil production profile in the Permian to about 65%.

However, that mix should start to even out over time, McCracken said.

“As that base position matures and as we slow growth and flatten it out, we do expect that [gas-oil ratio] is going to climb,” McCracken said. “That’s just the nature of the Permian everywhere, but inclusive of the northern Midland Basin.”

Across the company’s North American footprint, total oil and condensate production in 2024 is expected to grow to over 200,000 bbl/d, the company said. Ovintiv expects roughly 60% of its 2024 capital spend between $2.1 billion and $2.5 billion to be deployed in the Permian.

“Next year, we will spend roughly the same amount of capital at the midpoint as we guided to for 2023 pre-transaction, but that capital will produce an additional 30,000 bbl/d of oil and condensate,” McCracken said.

Slowing rig activity

Ovintiv plans to pull back on drilling activity in the new acreage after the deal closes, which is expected to occur by the end of the second quarter.

The company anticipates moving from a pro forma 10-rig drilling program in the Permian to a 5-rig program by the fourth quarter. Rig activity on the newly acquired assets is expected to dwindle from seven operated rigs down to two.

The three EnCap-backed operating companies have collectively run seven rigs, and oil production is on a ramp up through the first half of 2023, McCracken said.

“There will be a peaking of production in the third and fourth quarter this year,” McCracken said. “Then we’re going to run it at a more stable rate for free cash flow and returns going forward.”

Dropping rig activity after a public-to-private deal like this isn’t all that uncommon. Private operators tend to take a more aggressive approach to developing assets in general – particularly when one of those assets is getting close to hitting the market, Dittmar said.

“[Public companies are] not looking to grow volumes; they’re looking to sustain them and use all that excess capital to generate shareholder returns and dividends,” Dittmar said.

Another reason Ovintiv will pull back on drilling in the northern Midland Basin is to protect the life of its inventory – one of the company’s main considerations for going after the deal in the first place.

“They don’t want to have to burn through that quicker than they need to,” Dittmar said.

RELATED

By Hook, Crook and Bolt-on, E&Ps Scramble to Add Inventory

Bolstering shareholder returns

Investors seem to like Ovintiv’s deal to add more Permian inventory. After closing at $36.08 per share on March 31, Ovintiv’s stock price ticked up nearly 12% to close at $40.38 per share on April 3, according to Yahoo Finance data.

But investors also like share buybacks and dividends. Ovintiv said it remains committed to delivering at least 50% of its post-base dividend free cash flow back to shareholders through buybacks or variable dividends.

On April 2, the Ovintiv board of directors declared a quarterly cash dividend of $0.30/share, up 20% from the company’s dividend last quarter. The dividend will be payable on June 30 to shareholders of record as of June 15.

On top of the $4.275 billion Midland Basin deal, Ovintiv also announced completing another $200 million in what it called accretive bolt-on acquisitions during the first quarter.

While the company is open to higher-quality bolt-on deals in the future, Ovintiv is heavily focused on executing and paying down debt in the near-term, McCracken said.

“We’ve raised the bar for additional bolt-ons, and we expect minimal spending going forward while we focus on cash returns and debt reduction,” McCracken said.

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.