Callon Petroleum’s exit of the Eagle Ford and the E&P’s singular focus on the Permian Basin should benefit investors and the company’s inventory runway, analysts said.

Alongside first-quarter earnings last week, Houston-based Callon Petroleum Co. announced two deals. The first divests its Eagle Ford assets. The other, an acquisition, expands its footprint in the Permian’s Delaware Basin. Taken together, the transactions are valued at about $1.13 billion.

Callon’s decision to leave the Eagle Ford to become a pure-play Permian operator was generally viewed as a good move by analysts. Besides extending its Permian inventory, Callon is expected to reduce its debt load by about $310 million — knocking it down below $1.9 billion after closing the two deals.

Closing the deals will also enable Callon to initiate a two-year, $300 million share repurchase program in the third quarter of this year.

“While the combination causes slightly less net production, we believe the incremental capital for debt repayment and incremental future total potential feet to drill (slightly fewer locations) more than outweighs the lower production,” analysts for Truist Securities wrote in a May 3 research report. “Bottom line, we view the deals as a positive step for the company as it answers the common hesitant investors’ questions.”

Analysts at TD Cowen believe Callon’s management team will attempt to walk and chew gum at the same time by running the share buyback program while continuing to reduce the debt load below $1.5 billion.

RELATED

Callon Adds Delaware Assets, Exits Eagle Ford in Deals Worth $1.1 Billion

Art of the deal

Callon is extending its runway in the Delaware Basin by acquiring the membership interests of Percussion Petroleum Operating II LLC in a $475 million cash and stock deal.

The transaction also calls for potential contingency payments of up to $62.5 million depending on WTI price, for a total of $537.5 million.

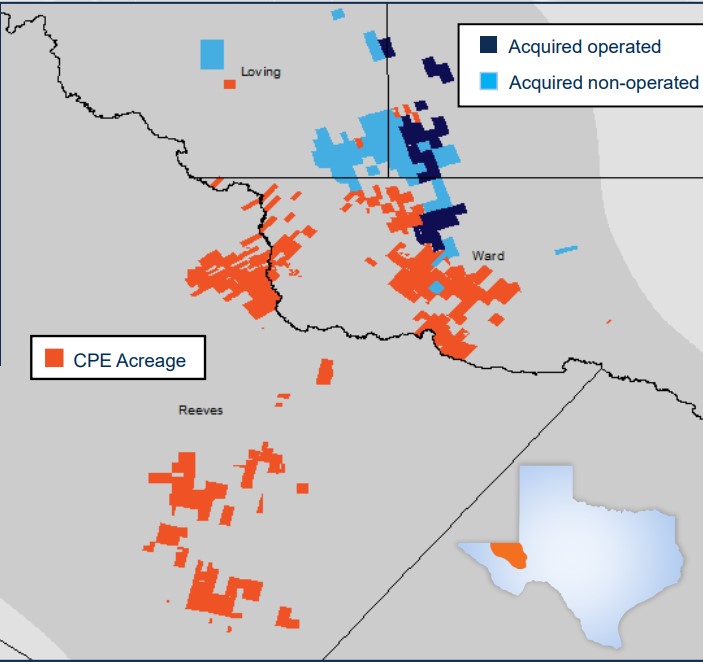

The Percussion Petroleum deal includes about 18,000 net acres in Ward, Winkler and Loving counties, Texas, and about 70 well locations. The acreage Callon is scooping up from Percussion is largely contiguous with Callon’s existing footprint in the Delaware.

Estimated production from Percussion’s Permian assets averaged about 14,000 oil-equivalent barrels per day (boe/d), approximately 70% of which is oil.

TD Cowen assumes Callon paid about $35,000 per flowing oil-equivalent barrel of production for a PDP (proved developed producing) value of approximately $490 million. That leaves around $47.5 million attributed to acreage and locations, suggesting about $679,000 per location.

Examining the 50 parent locations Callon acquired, the breakeven at less than $50/bbl puts the price per location at $1.1 million each, Andrew Dittmar, research director at Enverus Intelligence told Hart Energy.

In a separate transaction, Callon agreed to sell its Eagle Ford Shale assets to Ridgemar Energy Operating LLC for $655 million in cash. The deal also includes potential contingency payments of up to $45 million.

Callon’s Eagle Ford position consists of about 52,000 net acres and estimated production of around 16,300 boe/d (71% oil) as of April.

The deal implies Callon is receiving about $40,000 per flowing boe of production for its Eagle Ford assets – a fair price, TD Cowen analysts said. Dittmar’s numbers were similar. He said the asset transacted for PDP value of $42,900 per boe/d assuming all contingent payments are made.

“On a discount basis, the Eagle Ford seems to have traded at PV13 to PV15 depending on how much of the contingent payments are made,” he said.

The $265 million cash portion of Callon’s Percussion acquisition will be funded by the sale of its Eagle Ford position to Ridgemar Energy. Ridgemar is backed by private equity firm Carnelian Energy Capital Management LP.

Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co., said both of Callon’s deals were priced close to their PDP valuations.

Callon has also identified opportunities for over $10 million in annual G&A cost savings through integrating the Delaware Basin asset.

The deals are anticipated to boost Callon’s adjusted free cash flow by 15% in 2023 and by 55% in 2024 at recent strip prices, Callon President and CEO Joe Gatto said on the company’s first-quarter earnings call on May 4.

RELATED

McKinsey: Over Half of Upstream M&A Has Hurt Shareholder Value

Consolidating power in the Permian

Once the deals close, which is expected to happen for both transactions in July, Callon will focus 100% of its capital spend and operational teams on the Permian Basin, Gatto said on the earnings call.

“The bottom line, we will generate more free cash flow with our investment dollars through significant capital efficiency gains and cost savings as a focused Permian company,” he said.

Callon’s post-transaction Permian position will include 145,000 net acres and 107,000 boe/d of production.

The Percussion deal will also extend Callon’s decade-long inventory to more than 1,500 oil-weighted drilling locations in the Permian.

“From a free cash flow standpoint, they're somewhat similar on the baseline PDP,” said Jeff Balmer, senior vice president and COO at Callon, on the earnings call. “But we're going to have more opportunities for development on a longer term basis in this new Delaware asset just because our Eagle Ford inventory was getting a little bit short.”

Callon isn’t the only public E&P that’s searched for scale and inventory in the Permian, the Lower 48’s top oil-producing region.

Large players including Ovintiv Inc., Matador Resources and Diamondback Energy have spent billions of dollars signing deals to grow their Permian positions in the past year.

Producers will probably continue to tap M&A markets to extend their Permian inventories for the next several years, Pioneer Natural Resources CEO Scott Sheffield recently told Hart Energy.

Despite the Permian’s popularity among E&Ps, dealmaking in the Eagle Ford soared in the first quarter.

Deal value in the Eagle Ford topped $5 billion in the first quarter, the most transacted in the South Texas shale play in nearly a decade, according to data from Enverus.

RELATED

Exclusive: Scott Sheffield Offers Peek Behind the Permian’s M&A Curtain

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2024-02-02 - Baker Hughes said U.S. oil rigs held steady at 499 this week, while gas rigs fell by two to 117.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.