Nations around the globe are increasingly demanding secure supply of U.S. LNG. Gulf Coast LNG developers are tapping Haynesville gas to answer the call.

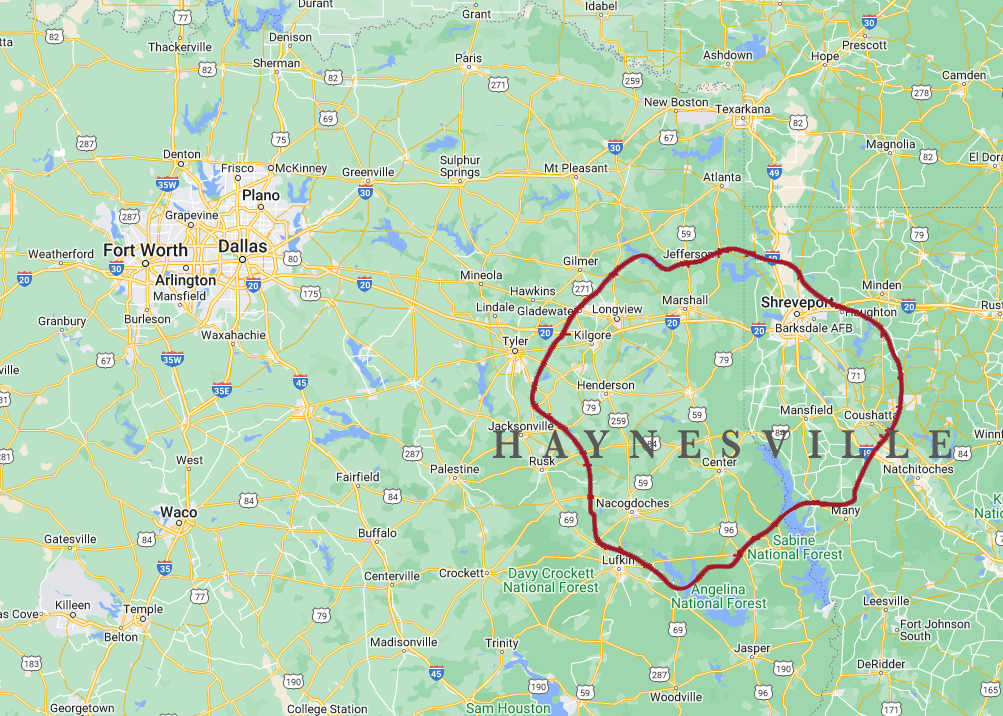

The sprawling Haynesville Shale, which stretches from northwestern Louisiana into eastern Texas, has boomed into a hub of U.S. natural gas production since the play was pioneered by Chesapeake Energy and Petrohawk Energy in 2008.

Natural gas volumes from the Haynesville were expected to average 16.43 Bcf/d during December 2023, according to the Energy Information Administration (EIA). Only Appalachia (35.76 Bcf/d) and the Permian Basin (24.86 Bcf/d) are more prodigious than the Haynesville in shale gas output.

The Haynesville is home to several of the nation’s top public gas producers, including Chesapeake, Southwestern Energy and Comstock Resources. Privately held E&Ps Aethon Energy and Rockcliff Energy II are also producing significant gas volumes from Louisiana and East Texas.

The past few years have been extremely volatile for the natural gas sector.

After Russia’s invasion of Ukraine, Henry Hub natural gas prices rose above $9/MMBtu in August 2022—their highest levels since the 2008 Great Recession, per EIA figures.

Producers chased high prices and raked in big profits. Once again, high prices proved to be the cure for high prices.

Instead of the structural market shortages seen during 2022, today the market is glutted with natural gas.

Henry Hub spot prices are expected to average around $2.80/MMBtu this winter, the EIA reported in its latest Short-Term Energy Outlook. That’s down over 60 cents from the November forecast.

“The downward revision reflects both a warmer-than-average start to the winter, which has reduced demand for space heating in the residential and commercial sectors, and high natural gas production,” the EIA said.

U.S. natural gas inventories will end the winter 22% above the five-year average at over 2 Tcf in storage.

RELATED

Gas E&Ps Fixated on Rising Demand for US LNG Exports

The liquefaction gravy train

Instead of raking in big profits, gas E&Ps have had to hedge production and lick their wounds amid the collapse in prices.

But all eyes have fixated on the proverbial light at the end of the tunnel: hockey stick-like demand growth from U.S. LNG export facilities in the coming years.

Gas demand for U.S. LNG exports is expected to grow by 17.4 Bcf/d between 2023 and 2030, said Justin Carlson, co-founder and chief commercial officer at East Daley Analytics; LNG will make up more than one-fifth of total U.S. gas demand by that time—far outweighing projected gas demand growth for residential consumption, power generation or pipeline exports to Mexico.

It’s a huge amount of demand growth in a relatively short amount of time. For context, the EIA said U.S. LNG exports averaged 11.81 Bcf/d during 2023.

And questions linger about whether U.S. gas supply, hampered in some regions by regulatory red tape, can meet the growing demand.

“What’s sustainable and where is all this gas going to come from?” asked Alan Smith, co-founder, president and CEO of Haynesville-focused E&P Rockcliff Energy, at Hart Energy’s America’s Natural Gas Conference in September.

Due to the basin’s close proximity to several Gulf Coast projects under construction, the Haynesville’s shale gas will be tapped by the LNG industry in a big way.

Of the roughly 20 Bcf/d of total U.S. gas demand growth through 2030, approximately 13 Bcf/d is expected to come from Haynesville output, says East Daley.

The Haynesville’s nearness to LNG export facilities is its saving grace, because a lot of the most cost-competitive gas production is located in other parts of the U.S. The Haynesville is a deep play. Equipment to drill wells has to be able to withstand extremely high temperatures. These factors all translate into higher drilling costs.

The cheapest gas production, by and large, is coming out of Appalachian plays like the Marcellus Shale.

But getting greater volumes of Appalachian gas across state borders to the Gulf Coast is easier said than done. The Mountain Valley Pipeline recently required an act of Congress to move forward.

Associated gas output from Permian Basin oil wells is also cheaper than Haynesville gas. But the Permian, historically a play for crude oil, is dealing with gas takeaway constraints of its own.

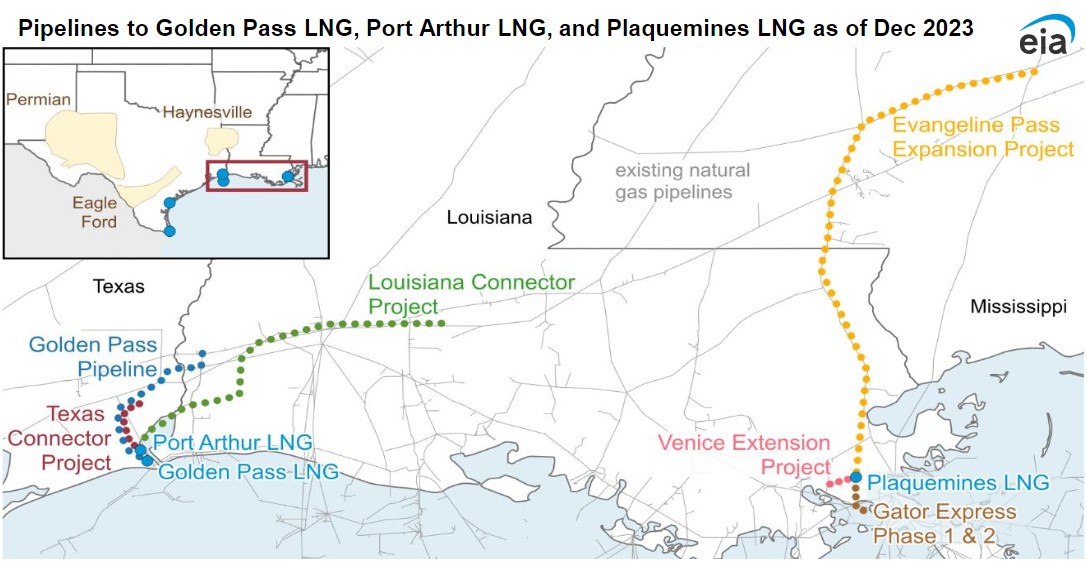

The good news for the industry is that more than 20 Bcf/d of new pipeline capacity to feed LNG export projects is under construction, partly completed or approved, according to the EIA. Around 13.5 Bcf/d is currently under construction.

Five new LNG export terminals—Plaquemines LNG, Golden Pass LNG, Port Arthur LNG, Corpus Christi LNG Stage III and Rio Grande LNG—have one or more pipelines under development.

RELATED

US LNG: A Growing Market Presence

Gas M&A outlook

The U.S. shale patch has seen a lot of activity for oil-weighted M&A. The Permian Basin has been the epicenter of upstream deal activity; recent megadeals include Exxon Mobil’s $60 billion acquisition of Pioneer Natural Resources and Occidental Petroleum’s $12 billion acquisition of private E&P CrownRock.

Extreme natural gas price volatility has chilled the market for gas-weighted transactions. But experts think that could be changing.

In late December, Quantum and Rockcliff inked a deal to be acquired by a subsidiary of Tokyo Gas Co. for $2.7 billion. The deal comes after reports in early January that Tokyo Gas wanted to acquire Rockcliff for about $4.6 billion before the deal reportedly fell apart, apparently due to declines in natural gas prices.

In a rare gas deal last summer, a consortium led by family office investment groups took ownership of Wyoming gas producer PureWest Energy in a $1.84 billion cash deal.

Rumors are also swirling that Chesapeake could merge with Southwestern to create a premier public natural gas E&P. Both companies already have large positions in the Haynesville and in the Marcellus.

Combined, Chesapeake and Southwestern would have a production of around 8 Bcfe/d—positioning the combined firm ahead of EQT, the nation’s current largest gas producer, analysts say.

RELATED

Analysis: Will $2.7B Tokyo Gas-Rockcliff Deal Reopen Natgas M&A?

Recommended Reading

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

Flame Acquisition Holders Approve Merger with Sable Offshore

2024-02-14 - The business combination among Flame Acquisition Corp., Sable Offshore Holdings and Sable Offshore Corp. will be renamed Sable Offshore Corp.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.