U.S. natural gas E&Ps were on top of the world last year as prices reached levels not seen in over a decade. But it’s been a much different story for gas producers so far this year.

Henry Hub natural gas prices rose above $9/MMBtu in August last year due to a confluence of geopolitical and macroeconomic factors—like structural supply-demand imbalances emerging from the COVID-19 pandemic and Russia’s invasion of Ukraine upending the European energy market.

Henry Hub prices rose to levels not seen since April 2008 in the midst of the Great Recession, according to Energy Information Administration (EIA) data.

Producers raised output, chased the high prices accordingly and raked in big profits. But as the old adage goes: High prices are the cure for high prices.

Instead of the structural shortages seen last year, today the market is glutted with too much natural gas.

U.S. natural gas inventories remain well above the five-year average with nearly 2 Tcf in storage, the EIA reported in its latest Short-Term Energy Outlook.

“Inventories are full because of high natural gas production and warmer-than-average winter weather, which reduces demand for space heating in the commercial and residential sectors,” the EIA wrote in the report.

Henry Hub prices are expected to average $3.20/MMBtu this November, down from $5.50/MMBtu a year prior.

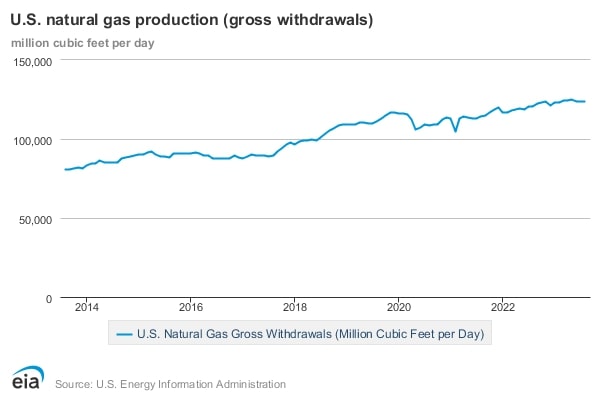

Yet total U.S. natural gas production remains higher than output levels seen during the period of sky-high prices last year, the EIA’s latest figures show.

Profits plunge

The volatility in natural gas prices resulted in lower earnings for gas producers compared to last year.

Third-quarter profits were down year-over-year for U.S. supermajors Exxon Mobil Corp. and Chevron Corp.

Both companies cited lower natural gas realizations as headwinds to profitability for the quarter. However, analysts had largely anticipated the sharp drops in both Exxon and Chevron’s earnings.

Appalachia giant EQT Corp., the nation’s largest pure-play gas producer, brought in a third-quarter net income of $81.2 million, or $0.20/share—down from $683.6 million, or $1.69/share, during the same period last year.

Chesapeake Energy, which sold off its final oily acreage in the Eagle Ford Shale this year, reported third-quarter net income of $70 million, or $0.49 per diluted share—compared to $883 million, or $6.12 per diluted share, in the same quarter a year ago.

But lower operating costs help offset some of the headwinds from lower natural gas prices, Chesapeake told investors.

Southwestern Energy’s third-quarter net income was $45 million, or $0.04 per diluted share—down from $450 million, or $0.40 per diluted share, during the third quarter of 2022.

Rumors are also swirling that Chesapeake could scoop up Southwestern to create a premier publicly traded gas E&P.

RELATED

Analysts: Chesapeake-Southwestern Deal Could Create Top US Shale Gas E&P

Natural gas E&Ps benefitted from a quarter-over-quarter increase in commodity prices. But prices are still so low, it’s difficult for gas producers to actually generate free cash flow.

By EQT’s analysis, a natural gas price of $3.50/MMBtu is needed for operators in the Haynesville Shale to even begin generating cash flow in maintenance mode, CFO Jeremy Knop said during EQT’s third-quarter earnings call.

“Meaning below this price, no shareholder value is being created and inventory optionality is being depleted,” Knop said.

Further, he said, EQT sees the price required to generate corporate returns for Haynesville producers at above $4/MMBtu, based on current market valuations.

EQT’s own free cash flow fell into negative territory in the third quarter—$2 million in the red—though that was partly due to one-time charges associated with EQT’s multibillion-dollar acquisition of Tug Hill.

RELATED

Analysts: EQT Integrates $5.2B Tug Hill Deal Faster Than Expected

LNG: the light at the end of the tunnel

Despite months of price volatility and steep year-over-year declines in earnings, the outlook by most U.S. gas producers largely remains optimistic.

That’s because they’ve kept their eyes on the proverbial light at the end of the dark tunnel: rising natural gas demand from LNG developers on the Gulf Coast.

Gas demand to fuel U.S. LNG exports is forecasted to grow by 17.4 Bcf/d between 2023 and 2030, according to figures from East Daley Analytics. More than a half dozen new LNG export projects are currently under construction and expected to start up in the coming years.

Last year, total peak LNG export capacity was about 13.9 Bcf/d, per EIA figures.

Producers like EQT think the natural gas market will grow increasingly tighter in late 2024 and into 2025 as more LNG export capacity comes online.

“We see the potential for pricing to move asymmetrically higher,” Knop said.

Gas E&Ps are hard at work getting ready for the huge increase in demand. Chesapeake announced on Oct. 31 it is entering into a long-term LNG supply heads of agreement (HOA) with global commodities trader Vitol Inc.

Under the agreement, Chesapeake will supply up to 1 million tonnes per annum of LNG to Vitol for a period of 15 years; prices will be indexed to the international Japan Korea Marker (JKM).

Earlier this year, Chesapeake signed a long-term LNG supply agreement with commodities trader Gunvor Singapore Pte Ltd.

EQT signed a long-term LNG supply agreement of its own: a 15-year tolling agreement with Commonwealth LNG’s facilities in Cameron, Louisiana.

Still, the anticipated growth in domestic natural gas demand to supply liquefaction capacity is so huge, even some of the largest gas producers wonder from where it will all be produced.

RELATED

Rockcliff CEO on US LNG: ‘Where Is All This Gas Going to Come From?’

Recommended Reading

OFS Sector Loses Jobs, but Trade Org Says Growth Potential Remains

2024-05-08 - According to analysis by the Energy Workforce & Technology Council, the OFS job market may still have potential for growth despite a slight decrease in the sector in April.

Exxon Appoints Maria Jelescu Dreyfus to Board

2024-05-08 - Dreyfus is CEO and founder of Ardinall Investment Management, a sustainable investment firm, and currently serves on the board of Cadiz Inc. and Canada-based pension fund CDPQ.

E&P BW Energy Undergoes ‘Technical’ Ownership Restructuring

2024-05-08 - The restructuring will not involve any change to the ultimate control of BW Energy as the shares currently held by BW Group will be sold to BW Energy Holdings.

Hess Midstream Subsidiary Plans Private Offering of Senior Notes

2024-05-08 - The proposed issuance is not expected to have a meaningful impact on Hess Midstream’s leverage and credit profile, according to Fitch Ratings.

Wood Mackenzie Appoints Jason Liu as CEO

2024-05-07 - Liu replaces former CEO Mark Brinin, who is departing to pursue other opportunities, Wood Mackenzie said.