Pioneer Natural Resources will operate between 21 and 23 rigs in the Permian Basin for the remainder of 2019. (Source: Pioneer Natural Resources)

It is no secret that the Permian Basin is the prime mover behind the U.S. shale revolution and the driver behind the U.S. becoming the world’s largest oil producer. The metrics that illustrate those dynamics are depicted on slideshows in boardrooms and conference rooms around the country, but they bear repeating if nothing else to show just how much the success of the shale industry hinges on West Texas and eastern New Mexico.

In March, ADI Analytics reported that U.S. oil output grew from 5.7 MMbbl/d in 2011 to a high of 12 MMbbl/d earlier this year. Of that production, the Permian Basin accounted for 3.8 MMbbl/d, or 32%. That portion is expected to increase to 5.6 MMbbl/d by 2023, according to ADI Analytics.

Meanwhile, according to a report Shale Profile issued in August, about 75% of all U.S. horizontal rigs, or 404, were drilling in the Permian Basin.

Despite the continuing prolific production, shale operators and service providers in the Permian Basin find themselves at a crossroads. Investors have shied away from investing in oil and gas, and those who have are demanding greater returns on their investments. This has pushed operators to cut costs and, as a result, drilling operations, while increasing production to generate higher cash flow.

The nature of shale wells, however, features sharp production declines. Essentially, operators must find ways to pull back an ebbing tide. But there are still efficiencies to be gained, particularly in well completion designs. Some companies are finding bigger might not always be better, especially if well spacing plans result in parent/child well interactions. In addition to solving the widespread challenge of frac hits, operators are faced with rapidly diminishing options for ways in which to handle their increasingly massive volumes of produced water.

A new batch of challenges has arisen in the Permian Basin, simply as a result of the sheer scope and volume of operations. But for an industry that has overcome challenges with every new evolution, adapting to new business models and applying innovative solutions is nothing new.

Operational trends

If the shale revolution has been a sports car speeding down the open highway, then the current market might represent a flashing yellow light along the way. Companies should stay on their path but probably need to hit the brakes.

In mid-November 2018, the rig count in the Permian Basin reached 493. A month later, when WTI prices began to plunge to below $50/bbl, the rig count dipped to 486, according to the Baker Hughes, a GE company, rig count. It was among the first indicators that a slowdown in drilling operations might be on the way. By mid-August of this year, the number of rigs had fallen to 441 as operators slowed activity in an effort to cut costs and generate more cash.

During the company’s first-quarter 2019 investor report conference call, Diamondback Energy announced it had dropped three rigs in an effort to reduce capex and focus on stock repurchases. “We made a promise in December that we’re going to cut activity and cut activity right away,” Diamondback Energy CEO Travis Stice said during the call. “We dropped two spreads immediately and dropped three drilling rigs.”

Diamondback plans to operate up to 22 rigs for the remainder of the year while still planning to grow its annual production by about 26%, according to the company’s first-quarter 2019 report. By the end of the second quarter, Diamondback projected its 2019 production to be between 277,000 boe/d and 284,000 boe/d, up from its year-end 2018 production of about 250,000 boe/d.

The company has budgeted $2.7 billion to $2.9 billion in capex this year, which includes completing between 300 and 320 wells with average lateral lengths of about 9,500 ft, according to its second-quarter 2019 report.

Pioneer Natural Resources has more than 680,000 acres in the Midland Basin and, like other independents in the Permian, is looking to ramp up its production while maintaining its rig count. According to the company’s second-quarter 2019 investor report, Pioneer is planning between 320,000 boe/d and 335,000 boe/d of production this year, compared to their third-quarter 2018 production guidance of up to 288,000 boe/d.

Craig Kuiper, vice president of production operations for Pioneer, said in an interview with E&P that the company possesses a “uniquely deep” inventory that will allow it to grow and develop its acreage at a well spacing plan that allows it to prioritize high returns and strong individual well performance. “We believe our depth of high-quality inventory and appropriate well spacing will differentiate us from those that don’t have the same quality and quantity of rock,” he said. “Many peers today appear inventory-constrained and are downspacing at the expense of well productivity.”

One of the challenges of operators that cut back on drilling rigs might be tasked with solving is how to replace the production lost as a result of the sharp decline curves inherent to shale wells. Speaking at this year’s Unconventional Resources Technology Conference (URTeC) in Denver, Robert Clarke, research director, Lower 48 Upstream for Wood Mackenzie, said for wells drilled so far this year in the Midland Wolfcamp, average IP rates are down 6%. “Steeper decline rates and smaller IPs in the Permian Basin will likely result in operators needing to drill more wells than originally planned if they’re committed to hitting previously established long-term goals,” Clarke said. “This will be especially challenging in the near-term because raising capital budgets today is effectively off-limits.”

He added that some companies in the Permian Basin are embracing economies of scale for both rigs and infrastructure as a way to enhance well performance and improve decline rates. “However, our analysis indicates this approach is more effective at cutting costs than improving production performance,” Clarke said.

Completions

Despite the slowdown in drilling activity and the shelving of rigs, Permian production rates have grown substantially. According to the U.S. Energy Information Administration (EIA), the Permian Basin continued to set record production levels this summer, reaching more than 4.3 MMbbl/d in August. The next closest was the Bakken, with 1.4 MMbbl/d, according to the EIA.

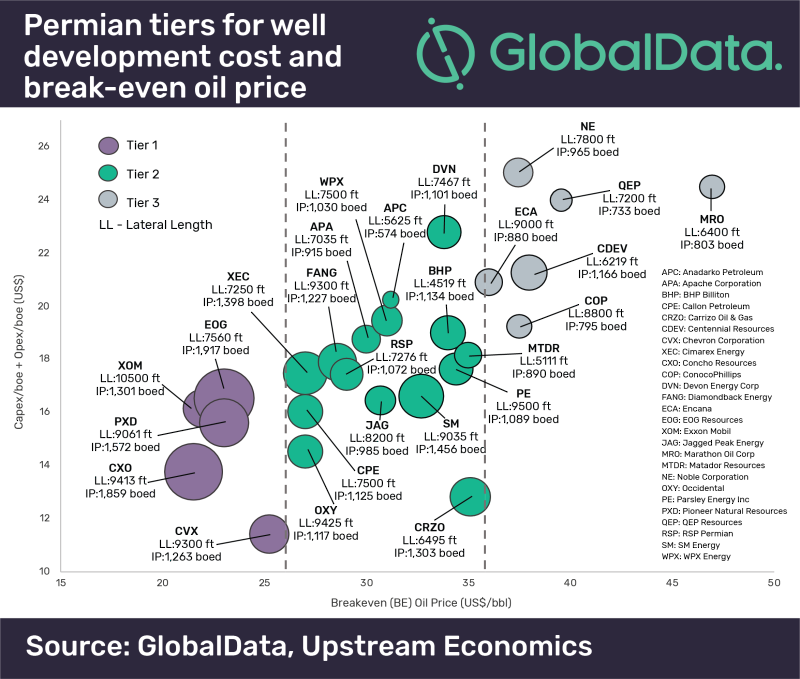

The allure of the Permian begins with its attractive breakeven costs. According to a recent GlobalData analysis of wells of 26 operators in the Permian Basin, breakeven prices ranged from $21/bbl to $48/bbl. The report stated that five Permian operators—EOG Resources, XTO Energy, Pioneer Natural Resources, Concho Resources and Chevron—saw breakeven prices for their most representative type of well of less than $26/bbl.

Beth McDonald, Pioneer vice president of Permian strategic planning and field development, said in an interview with E&P that part of the company’s focus on cost structure and delivering higher returns is utilizing local sand sources, reducing chemical usage and continuing to optimize completion designs. “There are always opportunities to improve and optimize completions to target intervals and development strategies,” she said. “The completion design must be customized with the sequencing, stacking and spacing plan for each specific area.”

In another sign that Permian production records will likely continue to escalate, Rystad Energy issued a report in August that found operators in the Permian set a record in June for the number of wells fractured, both on a daily basis and in terms of monthly wells.

The analytics company estimated that there were as many as 18 wells fractured per day throughout the Permian Basin in June, or nearly 550 wells during the entire month. The previous record was in August 2018 when Permian operators fractured about 520 wells, according to Rystad Energy.

Faraaz Adil, Halliburton business development manager, technical, said operators have continued to push for efficiencies and an improved understanding of well completion designs, particularly cluster spacing. “They’re reducing the cluster spacing and making an effort to use other tools in the toolbox to potentially increase their stage length and address larger sections in one go to reduce the operational costs but also create as much reservoir volume as they can without really leaving anything out,” he said.

Adil said over the past 18 months or so, operators have narrowed the gap on cluster spacing by 25% to 30%. “They’re making the clusters closer to each other so that they can access the entire lateral section and stimulate the entire lateral section effectively,” he said.

Some operators in the Permian have mostly settled on a typical lateral length, while others continue to push farther out. According to ADI Analytics, Devon averages 7,500 ft in lateral length per well, Occidental averages 7,884 ft, Concho averages 8,058 ft and Pioneer averages 9,000 ft.

However, as Sarp Ozkan, Enverus’ director of energy analytics, explained, some operators have tested super-long laterals, as much as 12,000 ft, with diminishing results. “So lateral lengths at that two-mile level are likely what we’re going to continue to see moving forward,” he said. “We don’t expect that they’re going to go much longer than that given the technology that we have today and completion designs that we have today; there could be diminishing returns after that point.”

Well interference

Of all the challenges facing operators in the Permian Basin, none are more vexing than well interference. The multiple stacked pays and vast quantities of high-quality acreage in both the Midland and Delaware basins have driven operators to drill multiple benches and develop multiple reservoirs from a single well pad. The result has often been wells spaced too closely together, which has led to infill wells, or child wells, “communicating” with parent wells—an event that often has resulted in production declines for the parent well.

“We saw it first in the Midland Basin, especially in the southern Midland Basin as operators tried to downspace,” Ozkan said. “Their results were poor, and they had to revert to wider spacing.”

The effects of production losses from parent/child well interactions have trickled down to Wall Street, where investors are not seeing the production rates promised to them by operators looking to grow production, he said. “When you’re developing these acreage positions, rather than focusing on the EUR of a single well, you really need to focus on the EUR of the actual acreage position that you are trying to extract hydrocarbons from,” Ozkan said. “A lot of the plans on Wall Street were made on wells that were drilled standalone with no pressure loss from any other wells around them.”

In an effort to curb the effects of well interference, operators are deploying a wide array of strategies, including rethinking their well spacing plans, implementing pressure gauges and pressure wall designs and using real-time analysis that can help avoid well interference as completions are carried out.

“A lot of people run downhole gauges on their gas-lift lines,” said John Burke, senior account manager for completion tools in the Permian Basin for National Oilwell Varco. “That will give them a live signal when they start their fracking. Then they can go shut it down and protect the well. But everyone’s still learning around here.”

FracRx, a service of MicroSeismic Inc., is a data analytics service; one of the issues it addresses is well interference. The system models the interference between wells and helps design well spacing plans and frac designs on future projects in the same field. According to the company’s website, the real-time analysis can allow for an intervention in a pumping program as soon as interference between wells is detected.

“Frac hits are a common problem of operators in unconventional horizontal and vertical development. We observe child/parent and child/child interactions during hydraulic fracturing in the majority of our projects,” said Asal Rahimi Zeynal, senior completions evaluation team leader for FracRx. “But moving beyond the dots-in-the-box allows a rapid evaluation of the impact of well interference, and the performance of both parent and child wells can be maintained by carefully sequencing the treatment and production of child wells.”

Ozkan explained that in addition to wider well spacing, some operators have found success in minimizing well interference issues with lighter proppant loading. “There has been a thought process around completions lately that if we pump more proppant, we can get higher recoveries,” he said. “That’s true if you’re looking at a single well draining a large area, but once you start drilling wells next to each other, you want to make sure you have frac barriers there, that your frac half-links don’t cross and you’re not stealing the other well’s thunder. And that’s going to continue to be a point of focus as operators start to deal with the reality that not every well is going to look like a standalone well.”

Water management

While the Permian Basin produces oil at record levels, with that oil comes substantial amounts of produced water. The Permian Basin accounted for 47% of all water produced in 2018, according to the SPE-2019-968 paper presented at this year’s URTeC by Akash Sharma, a senior analyst and consultant at Enverus. The growing amounts of produced water can be attributed in part to larger completion jobs and the move from crosslinker to slick water as a fracturing fluid.

Ryan Duman, senior analyst, Lower 48, for Wood Mackenzie, said during a presentation at URTeC that rising produced water volumes and expanding costs pose a significant risk to production growth in the Permian. “Without adequate investment and planning, produced water threatens to lower Permian production potential, as it can shift the entire Permian cost curve,” Duman said. “Water management in the Permian is becoming more expensive, in addition to slower permit approvals and the prospect of additional regulations.”

Duman suggested that companies can be in a better position to tackle complex and increasing water-related challenges by linking operator positions and offering economies of scale, such as self-built, third-party or a combination of solutions.

Compounding the produced water issue, disposal options are becoming more limited. Sharma’s study found that 75% of water produced in the Permian Basin is disposed of via injection wells, with the remaining 25% being recycled for fracturing operations. The study also reported that water production in the Permian leads the disposal volume by 5 MMbbl/d, and the gap is expected to continue widening.

“Looking at disposal trends in the region by flow rates suggests most wells in and around the Permian core areas are running close to their maximum permitted volume, bringing up concerns on sustainability of these wells on long-term ramp-ups,” the report stated.

Pioneer Natural Resources developed its own water management company, Pioneer Water Management, that McDonald said is responsible for delivering a water supply for the company’s completion operations and also mitigating disposal of produced water through a recycling program.

In July Concho Resources and Solaris Water Midstream formed a joint venture for produced water management for Concho’s operations in the Delaware Basin. Under the agreement, Solaris Water will manage Concho’s produced water gathering, transportation, disposal and recycling, while Concho will contribute 13 saltwater disposal wells and about 40 miles of produced water-gathering pipelines.

According to a press release, Solaris Water will deliver blended reuse source water to Concho, which enables a significant increase in the use of recycled water in Concho’s operations.

In his study on Permian water management, Sharma reported that at least 1.38 MMbbl/d of recycled water capacity have been developed in the basin, which he suggested was likely on the low end as a result of underreported usage of recycled water.

“As operators increasingly consolidate the position and operations in the Permian Basin, there has been an increased interest and investment in water handling and management in the basin,” the study stated. “Water midstream has become a key new growth sector for the region with an increasing amount of private-equity money being invested. As the basin continues to develop, efficient water handling and management would play a pivotal role in any Permian operators’ field development strategy.”

Check out the other "2019 Permian Playbook" chapters that appeared in the October issue of E&P magazine:

OVERVIEW:

Produced Water, Well Interference Challenge Growth in the Permian Basin

KEY PLAYERS:

Permian Operators Delivering Strong Production

TECHNOLOGY:

New Technology Primed and Prepped For Permian Challenge

MIDSTREAM:

Long-Haul Capacity from the Permian Close to Pulling Even with Production

Changing Paradigm of the Permian

PRODUCTION FORECAST:

Permian Poised to Deliver Strong Oil and Gas Production Growth

CASE STUDIES:

Producing Unconventional Wells without Electricity

Recommended Reading

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.