Permian Resources says it expects to begin development on the newly acquired acreage in 2024. (Source: Shutterstock)

Permian Resources said Jan. 30 it acquired more Delaware Basin acreage in two bolt-on acquisitions and an acreage swap.

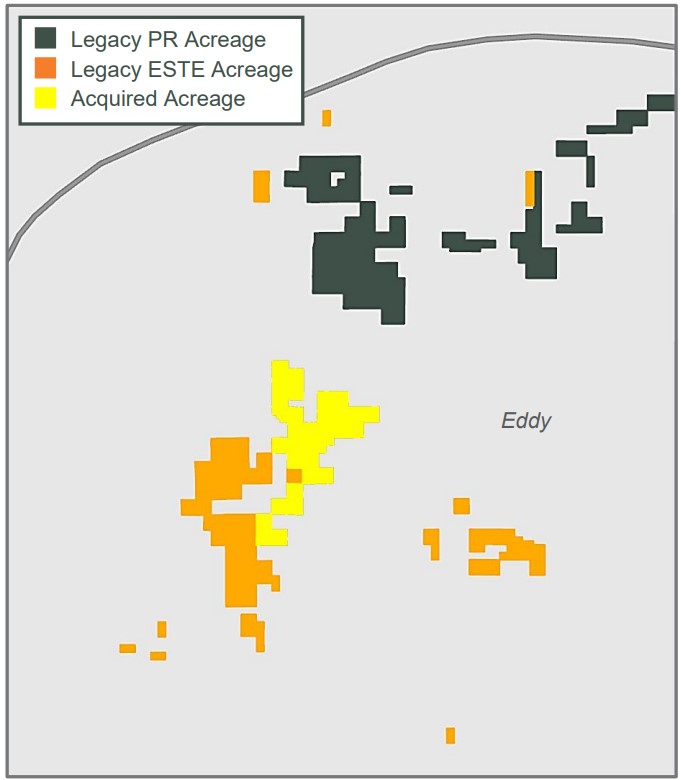

The Midland producer executed two separate transactions to acquire 11,500 net leasehold acres and 4,000 net royalty acres in Eddy County, New Mexico, for about $175 million.

Permian Resources acquired the properties for around $10,000 per net leasehold acre, after adjusting for the value of production.

The new properties consist of mostly undeveloped acreage and are largely contiguous with Earthstone Energy’s legacy position in the Delaware Basin. Permian Resources closed a $4.5 billion takeover of Earthstone last November, adding scale in both the Delaware and Midland basins.

“Since closing the Earthstone transaction, Permian Resources has added 14,000 net acres and 5,300 net royalty acres located in the core of the Delaware Basin at attractive valuations,” said James Walter, co-CEO of Permian Resources, in a press release.

“As a result of our portfolio management efforts over the past year, Permian Resources has more than replaced the approximately 150 wells included in its 2023 development schedule, effectively increasing inventory life,” he said.

Permian Resources said it has identified more than 100 gross operated, two-mile drilling locations on the acquired properties, which immediately compete for development capital.

“The quality of the acquired acreage is consistent with our core Parkway position, which represents one of the highest returning assets within our portfolio,” said Will Hickey, co-CEO of Permian Resources.

Permian Resources continues to make strides in its organic ground game M&A strategy, having added around 500 net acres across 35 grassroots transactions during the fourth quarter.

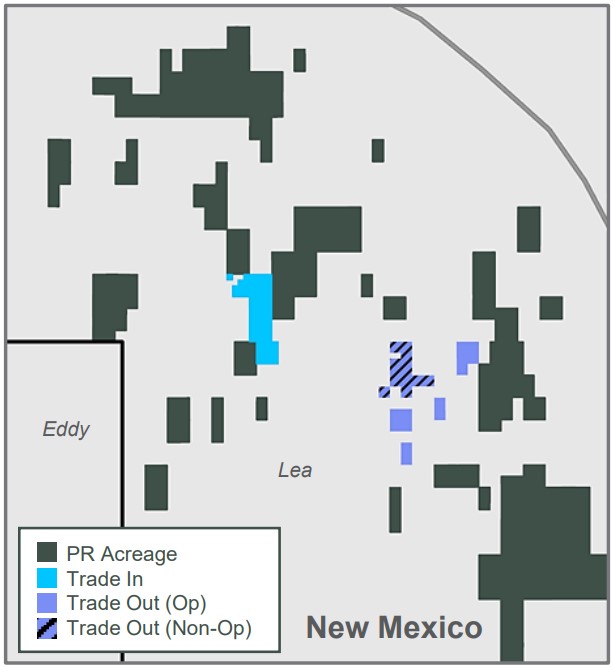

During first quarter 2024, Permian Resources also completed an acreage trade, furthering reinforcing its position in Lea County, New Mexico.

The company traded into approximately 2,000 net acres with “increased working interest” adjacent to its current position. The company also traded out of approximately 2,000 net acres of non-operated acreage and “lower working interest” operated acreage.

Permian Resources says it expects to begin development on the newly acquired acreage in 2024.

RELATED

Could Permian Resources Shop Midland Assets After $4.5B Earthstone Deal?

Recommended Reading

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.