Mexico is poised to become the world’s fourth-largest exporter of LNG when the terminal on its West Coast is complete, a financial backer of the project said.

The key to Houston-based Mexico Pacific’s $14 billion project, said Blake Webster, partner at Quantum Energy Partners, is the abundance of natural gas produced in the Permian Basin.

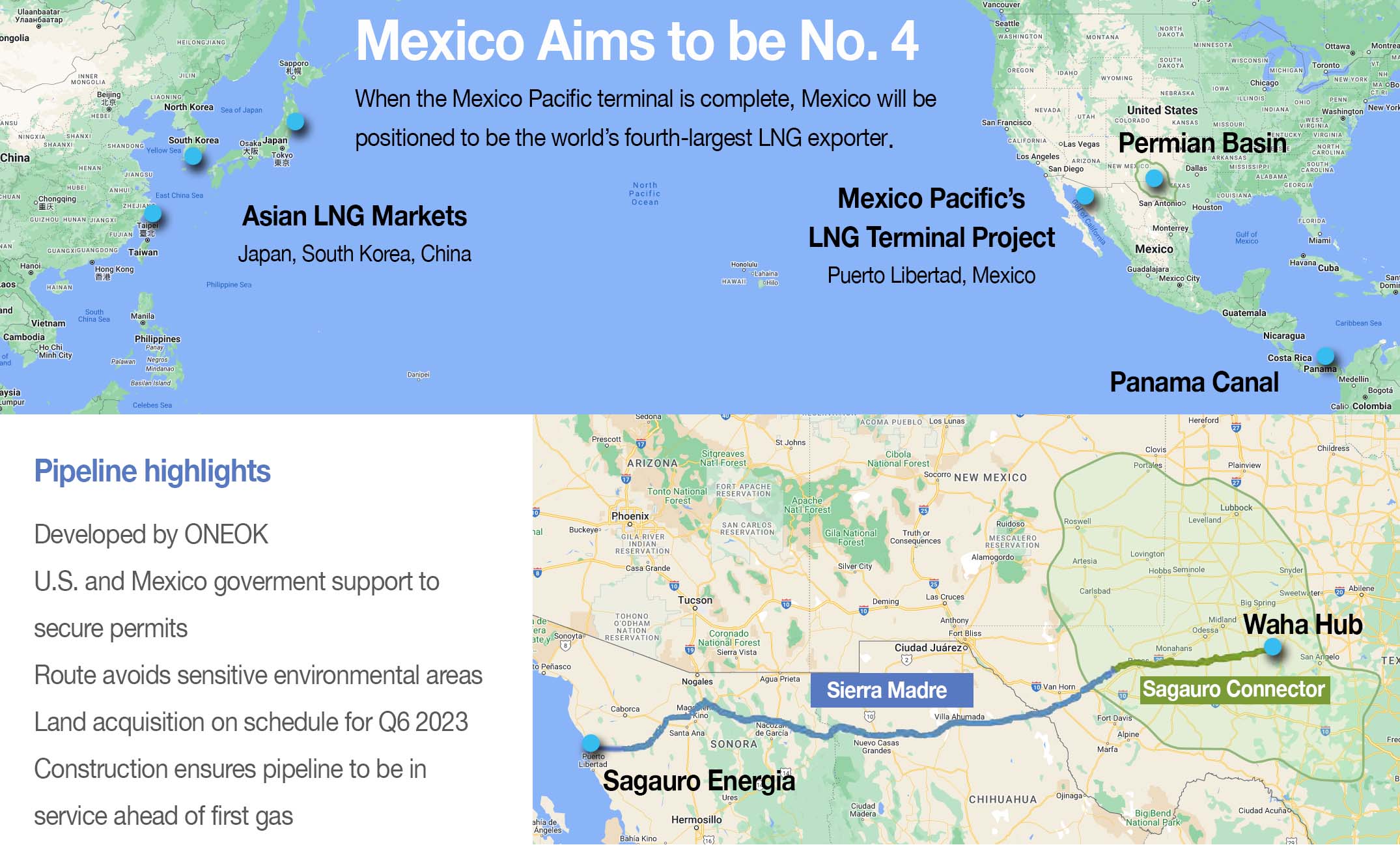

“There’s a direct line connecting the Waha Hub, which is the main gas hub in the Permian Basin, directly over to the West Coast of Mexico where you see Sagauro Energia, which is our facility,” Webster said at Hart Energy’s America’s Natural Conference in Houston on Sept. 27. “From there, you have a direct access around Baja directly to the Asian markets.”

The line he referred to is the proposed Sierra Madre pipeline, to be built by ONEOK. The 1,000-km pipe is designed to move as much as 2.8 Bcf/d from Waha in the Permian Basin to Puerto Libertad, in the Mexican state of Sonora. Sagauro Energia will eventually consist of three trains producing 5 million tonnes per annum (mtpa) each, or 15 mtpa as a whole. There is land around the facility for future expansion.

“This is the first and only independent LNG project that’s backed by three supermajors,” Webster said, listing ConocoPhillips, Exxon Mobil and Shell. The rationale to commercially support the project came down to the ability to lock in 20-year fixed contracts, including one signed in July with China’s Zhejiang Energy.

“It’s a real testament to the value that they see in taking those volumes and routing them through our infrastructure, and being able to access Asian markets a little bit more,” he said.

RELATED: Chart Talk: Mexico and Argentina’s Big Bet on LNG Exports

A critical component of the project is the Sierra Madre conduit. At the start of the facility’s development, there was already plenty of pipeline capacity from Waha into Mexico, and the partners explored leveraging that existing infrastructure.

“Ultimately, we felt like this was something that was critical for not only the company but also the customers to be able to provide that flow assurance and really having our own dedicated pipeline,” Webster said.

Another selling point is government support on both sides of the border.

“This is a project that, I think, the U.S. looks at technically, not only just from a decarbonization standpoint as we think about U.S. natural gas displacing coal in Asian markets, but it’s also a big driver of jobs in the Permian Basin,” he said. The estimate is 13,000 jobs directly tied to the project and, indirectly, employment for another 21,000 workers.

The Mexico Pacific project enjoys a significant advantage over U.S. Gulf Coast LNG terminals because tankers will be able to reach Asian markets without passing through the Panama Canal. The trips are shorter, so less fuel is used, emissions from the carriers are reduced and canal tolls are avoided.

RELATED: Permian Producers Fancy Larger Piped-gas Exports to Mexico

For example, the round trip from Mexico Pacific’s terminal to Asian ports is 36 days, with a shipping cost of $1.03/MMBtu. Shipping that cargo from the U.S. Gulf Coast via the Suez Canal adds 34 days at a cost of $2.42/MMBtu. Shipping from the Gulf Coast through the Panama Canal adds more than 30 days at a cost of $2.22/MMBtu, and shipping via the Cape of Good Hope adds more than 40 days at a cost of $2.13/MMBtu.

And then there’s the spread. Webster noted that the estimated 600 Tcf of natural gas reserves in the Permian, along with the breakeven price that has at times been at zero, should make many projects viable.

“There is a disconnect on that price, which over the last five years has been about a buck,” he said, referring to the difference between Waha and Henry Hub. “More recently it’s been closer to $1.50/MMBtu, so we feel like the buyers of this gas are going to have a real advantage there.

On Sept. 27, the Asian JKM (Japan Korea Marker) LNG price was $14.60/MMBtu for November deliveries. The Waha price was $1.76/MMBtu, or a $0.76 discount over the Henry Hub close of $2.52/MMBtu. The early morning Henry Hub price on Sept. 28 was $2.94/MMBtu.

Recommended Reading

Matador Stock Offering to Pay for New Permian A&D—Analyst

2024-03-26 - Matador Resources is offering more than 5 million shares of stock for proceeds of $347 million to pay for newly disclosed transactions in Texas and New Mexico.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.