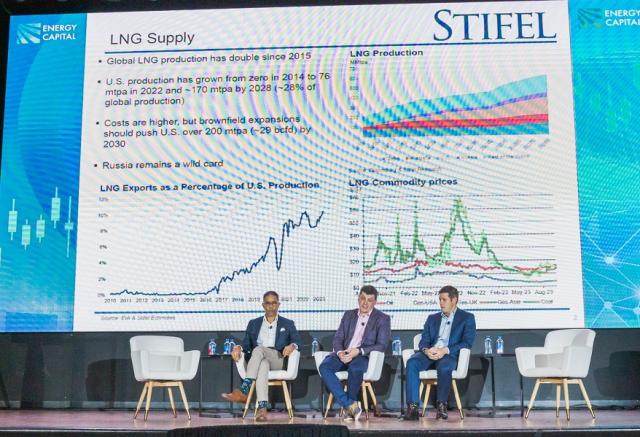

Pietro D. Pitts (left), Hart Energy's international managing editor, discusses discusses LNG financing with Benjamin Nolan, managing director of Stifal Financial Corp. and Tyler Kruse, Mexico Pacific Ltd.’s vice president for corporate finance at Hart Energy’s Executive Capital Conference in Dallas.

DALLAS — Gas production from the U.S. Permian Basin will anchor Mexico’s Pacific’s Saguaro Energía LNG facility and offer the basin’s producers a relief valve for associated gas — straight into premium LNG markets in Asia, Tyler Kruse, vice president of corporate finance for Mexico Pacific Ltd. said on Oct. 2.

“The facility will connect the cheapest natural gas from the Permian Basin's Waha hub to the world's largest demand center, Asia,” Kruse said during a panel discussion at Hart Energy’s Energy Capital Conference.

Kruse added that Permian associated gas is approximately $1/MMBtu cheaper than gas supplying Gulf Coast LNG projects from Henry Hub. Saguaro Energía LNG will connect the lowest-cost U.S. gas basin with high-demand markets in Asia through liquefaction on Mexico’s west coast, he added.

Stifel Financial Corporation managing director Ben Nolan said during the panel that "unless there’s a global recession there is a case to be made for 8% LNG growth through the end of this decade," which bodes well for Mexico Pacific.

Mexico Pacific’s anchor project, the Saguaro Energía LNG export facility is in Puerto Libertad, Sonora, Mexico. The facility will include three trains with a processing capacity of five million tonnes per annum (mtpa), each with a combined nameplate capacity of 15 mtpa (roughly 2 Bcf/d). The company envisions future expansions to include three additional trains with 5 mtpa of capacity each.

Saguaro Energía LNG, located on Mexico’s western Pacific coast, aims to leverage its access to low-cost Permian gas. The facility will source gas from Waha and be shipped along a 253 km pipeline on the U.S. side of the border. The line will connect with an 802 km pipeline on the Mexican side of the border. Both segments have capacity to handle 2.8 Bcf/d of gas.

Kruse said the Mexican government is supportive of LNG infrastructure development and that the risk from the drug cartels has been studied and “taken seriously, but not a major concern.”

FID imminent

Kruse said a final investment decision (FID) related to Mexico Pacific’s Saguaro Energía LNG facility is imminent and will come by year-end 2023. The facility is expected to start up by year-end 2027.

Kruse said the initial FID is focused on Train 1 and Train 2 with Train 3 expected to follow in quick succession. Mexico Pacific is continuing to secure financing to commence construction of the facility.

Quantum Capital Group is the controlling owner and lead sponsor of Mexico Pacific.

Saguaro Energía LNG advantage

Once the Permian gas reaches the Puerto Libertad liquefaction facility, Mexico Pacific expects the facility to capitalize on a shorter shipping route to Asia as its LNG cargoes will not have to pass through the Panama Canal.

The facility’s Pacific Coast location provides for a 55% shorter shipping route, which translates into savings of $1/MMbtu or more and a 60% lower carbon emissions profile compared to Gulf Coast peers, Kruse said.

The facility has the backing of Shell, Exxon Mobil and ConocoPhillips with key additional end-user customers secured, including Chinese firms Guangzhou Gas and Zhejiang Energy.

“Contracted customers pay fixed fees for pipeline and liquefaction services under 20-year take-or-pay SPAs [sale and purchase agreements], removing commodity risk exposure,” according to the to Mexico Pacific's website.

Recommended Reading

What's Affecting Oil Prices This Week? (March 11, 2024)

2024-03-11 - Stratas Advisors expects oil prices to move higher in the middle of the year, but for the upcoming week, there is no impetus for prices to raise.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

Oil Rises After OPEC+ Extends Output Cuts

2024-03-04 - Rising geopolitical tensions due to the Israel-Hamas conflict and Houthi attacks on Red Sea shipping have supported oil prices in 2024, although concern about economic growth has weighed.

What's Affecting Oil Prices This Week? (March 25, 2024)

2024-03-25 - On average, Stratas Advisors are forecasting that oil supply will be at a deficit of 840,000 bbl/d in 2024.