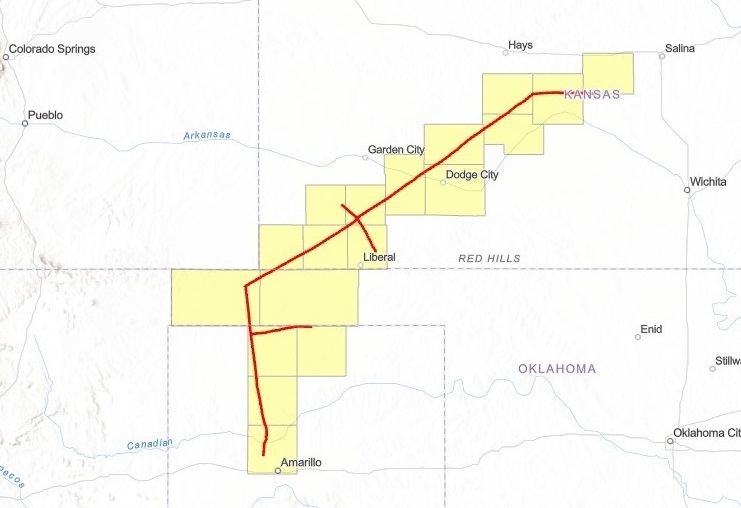

The Federal Helium System at Cliffside, outside of Amarillo, Texas. (Source: BLM)

Producers and industrial gas stakeholders are urging officials to delay the upcoming sale of the Federal Helium Reserve, a major supplier of global helium demand.

The Federal Helium System, managed by the Bureau of Land Management (BLM), supplies more than 20% of the domestic demand and 9% of the global demand for helium.

But at the direction of Congress, the BLM is ending its management of the helium production and storage system and trying to sell the assets to potential buyers.

After a lengthy marketing process led by the General Services Administration (GSA), the GSA plans to open sealed bids for the marketed assets on Jan. 25 at 2 p.m. CT.

The sales process and the plans to unseal bids this week have drawn scrutiny by producers and industry groups that rely on helium, a scarce product derived from natural gas.

The Compressed Gas Association (CGA), the Advanced Medical Technology Association (AdvaMed), the Semiconductor Industry Association (SIA) and other groups are pushing back on the sale, citing concerns that helium supply from the reserve could potentially be reduced—or shut off completely—after the assets are handed over to a private owner.

“Issues with the impending sale, if not adequately addressed, could lead to severe disruptions in the U.S. helium supply chain, impacting vital sectors such as healthcare, semiconductor manufacturing, defense, aerospace and research,” the CGA said in a Jan. 18 release.

Rich Gottwald, president and CEO of the CGA, is pushing the White House to immediately intervene to delay the sale until industry and stakeholder concerns are resolved.

“There are a number of issues that need to be addressed before [the reserve is] transferred to a private owner,” Gottwald told Hart Energy. “Because if they’re not addressed, the system will need to shut down. We are very, very confident about this.”

Securing supply

The CGA has supported the privatization of the helium reserve since Congress first mandated its transfer to the private sector.

But the group and its members argue that the new owner will face regulatory oversight—red tape the federal government itself didn’t face while operating the reserve—that will inevitably shut the system down for some length of time.

Those hurdles could include applying for air quality and environmental permits, implementing OSHA safety regulations and new requirements for operating the system’s 423-mile helium pipeline, which interconnects with several private helium refineries.

The GSA, to its credit, remedied a number of the CGA’s concerns leading up to the planned sale, Gottwald said. But the group believes the remaining issues will ultimately lead to helium supply chain interruptions.

The CGA maintains that a domestic helium supply interruption wouldn’t just impact the bottom lines of industrial gas companies—it would be a matter of national defense.

Helium isn’t just used to fill party balloons and blimps. It’s commonly used for military and defense technologies. It’s also used to manufacture semiconductors.

The CGA argues that the sale of the Federal Helium Reserve is happening as funds passed under the CHIPS Act in 2022 begin to flow for domestic semiconductor fabrication.

Indeed, a December 2023 survey from the Department of Commerce found that semiconductor stakeholders expressed concerns about future helium supply due to the Congressionally-mandated sale.

Air Products, a major industrial gas player that owns large volumes of helium stored at the reserve near Amarillo, Texas, sued the government last year in an attempt to shut down the sales process; the CGA also filed an amicus brief in support of Air Products, Gottwald said.

But in an opinion issued in November, U.S. District Court Judge Matthew Kacsmaryk found that the company’s request for a preliminary injunction to halt the sale was too speculative, and that an injunction wouldn’t be an appropriate remedy for a company’s financial risks.

“What the judge said at the end of the day is, ‘You haven’t been hurt yet,’” Gottwald said. “Basically, ‘When you’re hurt, come back and talk to us then.”

The government’s marketing process was allowed to continue. GSA said the operation of the system and delivery of helium continued as usual despite the litigation.

Other major industrial gas players have also made known their unease about privatizing the reserve.

“The Federal Helium Reserve is a vital resource for the U.S. economy, and the planned privatization may impact reliable supply of helium,” industrial gas company Messer said in a Jan. 22 release. “Therefore, Messer believes technical ability and expertise are critical requirements that must be prioritized over privatization to avoid supply disruption from the BLM helium system.”

Helium is scarce, and much of it is sourced from volatile, less-secure regions of the globe.

Qatar was the second-largest producer of helium globally behind the U.S. in 2022, according to U.S. Geological Survey data. And with the geopolitical unease surrounding the Houthi rebel attacks taking place in the Red Sea, some experts believe Qatar’s helium supply chain could eventually be effected.

The pariah state of Russia is also expanding its footprint in the market, having recently started to supply helium from its Amur gas processing plant.

“But because of the [Ukraine] war, now helium, for all intents and purposes, is not available to the western world,” Gottwald said.

RELATED

Hitting the Market Soon: The Entire Federal Helium System

Floating a sale

The federal government is marketing a diverse set of assets for helium extraction, refining and transport—sprawling from the Cliffside gas field near Amarillo, Texas, through the Oklahoma Panhandle and into Kansas.

The GSA’s auction includes the Bush Dome, a roughly 13,000-acre underground storage reservoir at the Cliffside field containing 1.8 Bcf of federally-owned helium. The Bush Dome formation also holds large volumes of helium owned by private interests, like Messer and other industrial gas companies.

The auction also includes the Federal Helium Pipeline, a 423-mile pipeline system that connects the Cliffside facilities with privately owned helium refineries into southern Kansas.

In addition, the GSA is selling 23 producing gas wells—developed in the 1960’s and 70’s—and the associated mineral rights.

But the most valuable asset up for grabs is the federal government’s 1.8 Bcf of crude helium itself, helium consultant Phil Kornbluth told Hart Energy when the GSA began the marketing process last year.

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.