Next month, the federal government begins the sales process for the entire Federal Helium System, a major supplier of global helium demand.

Helium is often thought of in association with party balloons and zeppelins. But helium, a product recovered from natural gas, is commonly used for defense applications, medical devices such as MRIs, and aerospace technology, amongst other sectors.

And the Federal Helium System, managed by the Bureau of Land Management, is an important part of the global helium market. Phil Kornbluth, president of helium consultancy Kornbluth Helium Consulting LLC, told Hart Energy the federal system accounts for between 15% and 17% of global helium supply.

But under the direction of Congress, the BLM is required to sunset its management of the helium production and storage system and dispose of the assets—part of a multi-decade effort to reduce government spending and privatize the reserve that has provided refined helium since the 1960s.

The disposal process, being led by the General Services Administration (GSA), is now slated to begin on July 12, 2023, according to a June 22 announcement.

And as the sales process begins to ramp up, industry experts and stakeholders have expressed concerns about disruptions to helium supply if the system is eventually transferred to a private owner.

“Without federal intervention to delay the disposal of the BLM’s [Federal Helium Reserve], the supply of helium will be reduced and important sectors of the economy—including government users, such as the military—will be imperiled,” the Compressed Gas Association, an industry trade association, wrote in a statement last year. “As a result, the national security of the United States will be significantly and negatively impacted.”

Floating a sale

Many of the assets included in the Federal Helium System package are concentrated in the Cliffside gas field northwest of Amarillo, Texas.

The sales process will include the Bush Dome—a natural geologic reservoir that stores federally- and privately-owned helium.

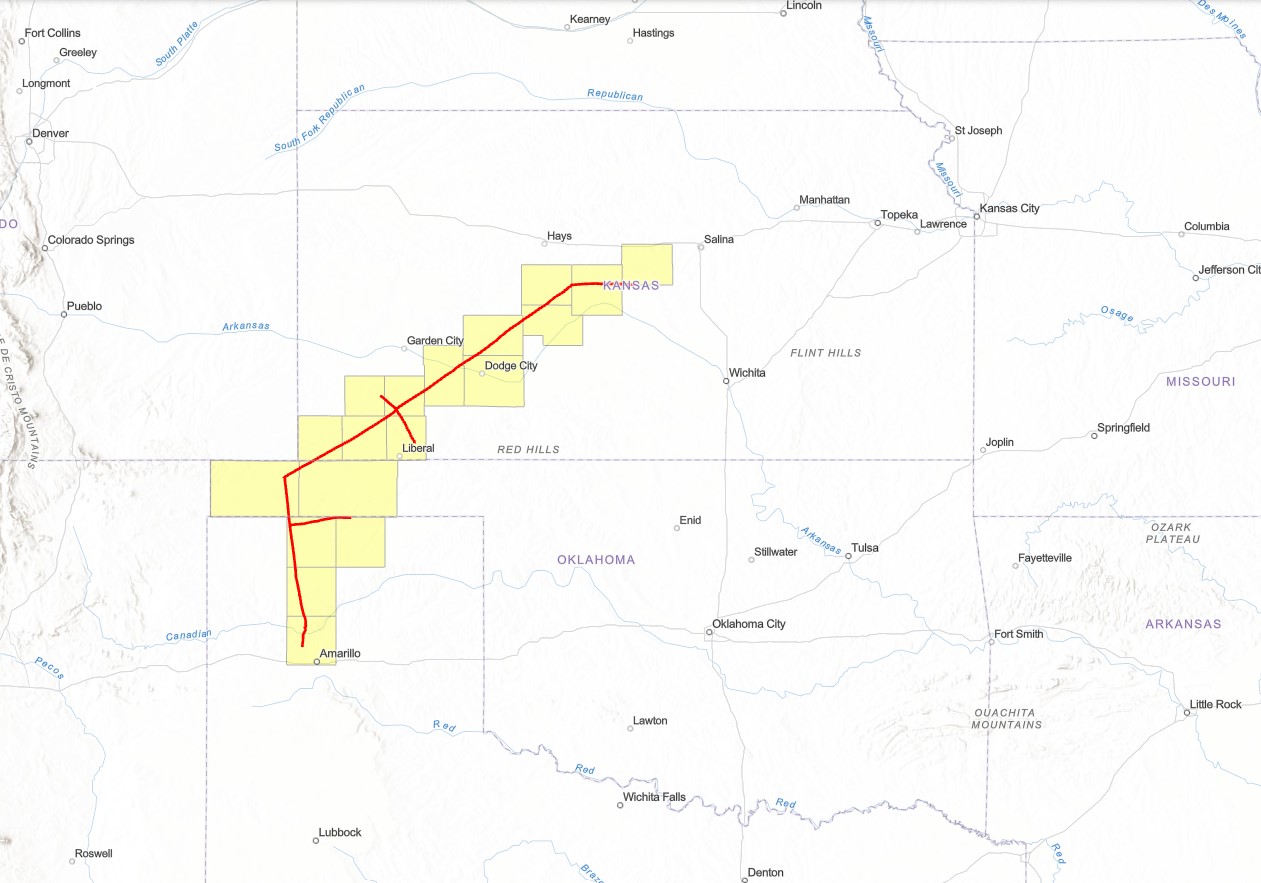

The government is also selling a roughly 425-mile helium pipeline system connected with privately owned helium refineries in Texas, Oklahoma and Kansas.

Included in the GSA sales is the Cliffside Gas Plant, approximately 12 miles northwest of Amarillo; subsurface oil and gas mineral interests; 23 gas-producing wells developed in the 1960s and 1970s; and various federally-owned plant equipment, according to the announcement.

Perhaps most notably, the GSA is also marketing around 1.8 Bcf of crude helium.

“The most valuable asset that’s up for sale is the crude helium itself,” Kornbluth said.

As the industry experiences another prolonged shortage of helium since early 2022, the helium sector is at the peak of a pricing cycle as future prospects for new global supply come into view.

“[The crude helium] is very valuable at today’s market price,” he said. “The issue is the deliverability—it’s going to take many years to get it out of the ground at the current rates of deliverability.”

A buyer would likely pay in the area of $300+ per thousand cubic feet for the crude helium the federal government is marketing, Kornbluth said.

The estimated price for private industry buying purified, Grade-A helium was about $310/thousand cubic feet in 2022, according to data from the U.S. Geological Survey.

The value of the physical assets in the partially depleted Cliffside field is likely much smaller than the value of the crude helium itself, he said.

“The hard assets probably don’t have that much value—except for the fact that they give you some element of control over the ability to get [helium] out of the ground, and the cost of getting it out of the ground,” Kornbluth said.

RELATED: Tumbleweed Midstream Spotlight: High on Helium

Major headaches

GSA said it expects the entire sales process to last between eight and nine months as it engages with industry and stakeholders to efficiently transfer the assets.

But the industrial gas sector has raised concerns about the processes for the privatization of the helium system.

Several major industrial gas players—names like Air Products, Linde PLC and Messer Group—have plants for purifying and refining crude helium connected to the BLM system.

The Compressed Gas Association, which represents more than 100 companies in the industrial, medical and food gases space, laid out several issues it has with the GSA’s disposal plan last year. Congress originally directed the BLM to phase out the helium system by September 30, 2021, but BLM delayed the sale and transferred the assets to GSA for auction last year.

The BLM operates and performs minor maintenance on the Crude Helium Enrichment Unit (CHEU), a piece of equipment critical to extracting and enriching helium from natural gas. But the CHEU is owned by the Cliffside Refiners LP, which is made up by Air Products, Messer, Praxair Inc. and Kinder Morgan Inc.

The CHEU is not part of the GSA’s disposal process, so the new purchaser would have to negotiate a contract with Cliffside Refiners to operate the unit—or build a new one itself, CGA said.

The BLM has also not had to comply with certain state and federal permitting laws and regulations that the new purchaser, likely a private entity, would be subject to in the future, the association said.

Hart Energy has reached out to CGA for comment on the federal government’s updated sales process.

Despite concerns, Kornbluth said there is general interest by the industrial gas sector in acquiring the helium assets marketed by the federal government.

The most natural buyers would likely be the companies with plants connected to the federal helium pipeline, which have invested in continued refining operations and would put the crude helium to use.

GSA said specific details on how and where to place bids for the helium assets have yet to be determined.

RELATED: Floating Above 'The Helium Cliff'

Recommended Reading

Elk Range Royalties Makes Entry in Appalachia with Three-state Deal

2024-03-28 - NGP-backed Elk Range Royalties signed its first deal for mineral and royalty interests in Appalachia, including locations in Pennsylvania, Ohio and West Virginia.

E&P Highlights: Feb. 12, 2024

2024-02-12 - Here’s a roundup of the latest E&P headlines, including more hydrocarbons found offshore Namibia near the Venus discovery and a host of new contract awards.

Marketed: Paloma Natural Gas Eagle Ford Shale Opportunity in Frio County, Texas

2024-02-16 - Paloma Natural Gas has retained EnergyNet for the sale of a Eagle Ford/ Buda opportunity in Frio County, Texas.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.