The U.S. government is auctioning off the Federal Helium System, located near Amarillo, Texas. (Source: Shutterstock)

Industrial gas player Air Products is pushing back against the federal government’s auction of the Federal Helium System—a major supplier of domestic and global helium—by taking them to court.

At the direction of Congress, the U.S. General Services Administration (GSA) officially started the process to auction off the Federal Helium System to a private buyer this summer—part of a multi-decade effort to reduce government spending and privatize the helium reserve.

But the sales process has drawn condemnation from players in the helium and industrial gas sectors, which argue that privatizing the system could lead to significant disruptions to global helium supply.

Air Products LLC is seeking an injunction prohibiting the GSA and other federal agencies from moving forward with the current sales process, according to a September petition filed in the U.S. District Court for the Northern District of Texas.

Air Products alleges that the government’s invitation to solicit bids to purchase the Federal Helium System is unlawful. The company contends that the sale conditions “virtually guarantee” that the buyer will not be able to deliver helium safely and consistently after the system changes hands.

The federal government owns most of the physical infrastructure that makes up the Federal Helium System—largely in and around the Cliffside gas field northwest of Amarillo, Texas.

But a critical piece of the system—the Crude Helium Enrichment Unit—isn’t owned by the government. The CHEU is a privately-owned processing facility operated by the government on long-term leases for two decades, Air Products said in its complaint.

Without access to the CHEU, the new buyer won’t be able to extract helium from underground and distribute it to other facilities along the system for further processing and refining, the company said.

Air Products also cites safety and compliance concerns should the system end up in the hands of a private buyer. The federal government is largely exempt from several pipeline, safety and environmental regulations that would ultimately apply to a private buyer.

The company also wants to ensure access to its helium stored underground at the reserve—helium that Air Products purchased from the government in the past.

The Federal Helium System includes the Bush Dome, a 12,000-acre underground storage reservoir that currently holds about 4 Bcf of helium. Roughly half of that volume, or 1.8 Bcf, is owned by the government and is being marketed through the auction.

Private entities, including Air Products, own the remainder. Air Products currently owns around 800 MMcf of helium stored in the reserve, “and its value far exceeds the amount Air Products paid for it,” the company said.

Air Products alleges that the disruptions caused by selling the Federal Helium Reserve to a private entity will result in “grave public and private harms that can never been undone.”

Bidding for the auction is currently slated to close on Nov. 15. However, the GSA noted that the lawsuit, or any decision made by a court or the agency, could affect the current bidding process.

RELATED

Hitting the Market Soon: The Entire Federal Helium System

‘Literally nothing like it’

Helium, a product recovered from natural gas, is used in more than party balloons. The gas is widely employed in energy, military, industrial and medical applications.

The Federal Helium System is a unique and important component of the global helium marketplace, accounting for between 15% and 17% of global supply, Phil Kornbluth, president of helium consultancy Kornbluth Helium Consulting, told Hart Energy this summer.

“There is literally nothing like it in the country,” Air Products said in its petition.

The system’s operations are “closely tied” to the overall health of the helium market because it’s one of the few places on Earth that can store such large volumes of helium underground.

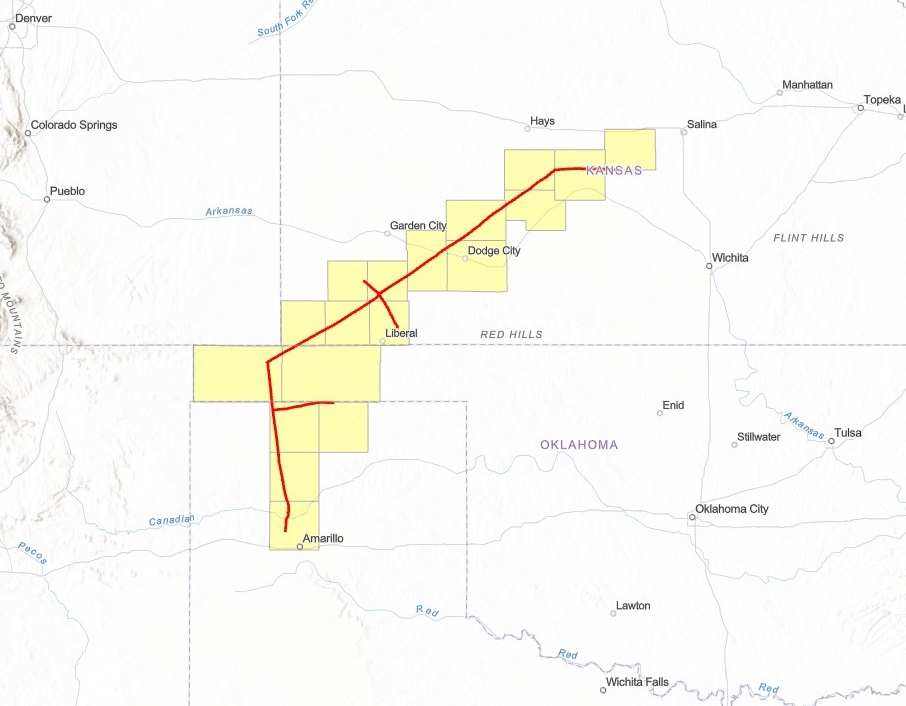

The GSA’s auction includes the Bush Dome underground storage reservoir; a 423-mile helium pipeline connecting with private helium refineries in Texas, Oklahoma and Kansas; equipment and facilities at the Cliffside Gas Plant near Amarillo; natural gas wells and associated mineral rights; and 1.8 Bcf of federally owned crude helium.

Recommended Reading

Chouest Acquires ROV Company ROVOP to Expand Subsea Capabilities

2024-05-02 - With the acquisition of ROVOP, Chouest will have a fleet of more than 100 ROVs.

SLB, OneSubsea, Subsea 7 Sign Collaboration Deal with Equinor

2024-05-02 - Work is expected to begin immediately on Equinor’s Wisting and Bay Du Nord projects.

SilverBow Makes Horseshoe Lateral in Austin Chalk

2024-05-01 - SilverBow Resources’ 8,900-foot lateral was drilled in Live Oak County at the intersection of South Texas’ oil and condensate phases. It's a first in the Chalk.

Petrobras Sending Nearly Half of Oil Exports to China

2024-04-30 - Conflict in the Middle East has enabled Brazil’s state-owned Petrobras to change the flow of its oil exports, with China being the primary beneficiary, followed by Europe.

Equinor Says EQT Asset Swap Upgrades International Portfolio

2024-04-30 - Equinor CFO Torgrim Reitan says the company’s recent U.S. asset swap with EQT Corp. was an example of the European company “high-grading” its international E&P portfolio.