Ascent's daily average was some 20,200 bbl/d. Its 2023 output was 27% of the state’s total 27.8 MMbbl of oil production. (Source: Ascent Resources)

Ohio’s top Utica gas producer and rising oil producer Ascent Resources Utica Holdings picked up a positive outlook from credit reviewer Fitch Ratings, which sees free cash flow rising from the Oklahoma City-based operator soon.

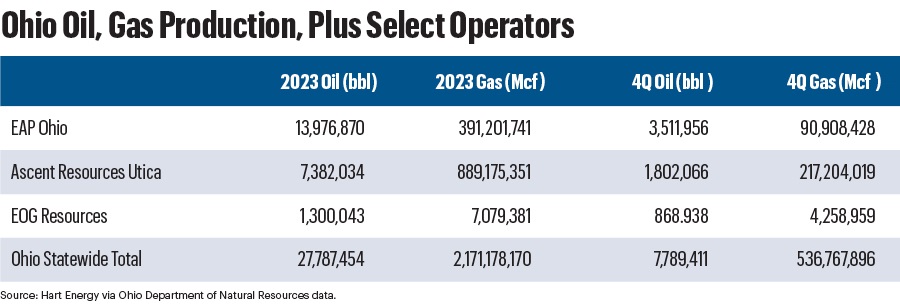

Ascent is Ohio’s No. 2 oil and NGL producer, surfacing some 7.4 MMbbl last year, primarily from new-drill Utica oil-targeted wells supplemented by vintage laterals dating back to the early 2010s, according to Ohio state data.

The company’s daily average was some 20,200 bbl/d. Its 2023 output was 27% of the state’s total 27.8 MMbbl of oil production.

Houston-based Encino Energy’s business unit EAP Ohio holds the state’s No. 1 oil producer title with some 14 MMbbl in 2023 that was 50% of all Ohio oil production.

Meanwhile, Ascent, the No. 1 Ohio gas producer, put into pipe some 889 Bcf last year or an average of 2.4 Bcf/d. Its 2023 output was 41% of the state’s 2.17 Tcf of gas production.

EAP Ohio, the state’s No. 2 gas producer, had an 18% share.

Utica newcomer EOG Resources produced 1.3 MMbbl in 2023 and 7.1 Bcf, according to state data.

Credit-rating cred

Fitch upgraded Ascent’s long-term issuer-default rating from B to B+ on April 22. It also raised the operator’s secured revolver to BB+/RR1 and its unsecured rating to BB-/RR3.

“The rating outlook is ‘Positive,’” it summarized.

In addition to free cash flow, Fitch expects upcoming debt reduction and above-average production scale.

“Ascent's reserve base and production scale are credit positives,” Fitch reported. “Across both of these metrics, Ascent is meaningfully larger than other 'B' category peers.”

At more than 2 Bcfe/d of production, Ascent “is larger than all of its 'B' category peers,” it added.

In the category, Comstock Resources produced some 1.4 Bcfe/d at year-end. It has a Fitch rating of B+ with a negative outlook.

Also in the B category is CNX Resources at 1.5 Bcfe/d. Fitch has a BB+ rating on CNX with a stable outlook.

Ascent’s “ability to maintain production while spending below [cash flow] further supports the credit quality,” Fitch reported. “Fitch believes that the company's scale and consistent ability to generate positive free cash flow differentiates it relative to other 'B' category peers.”

Ascent’s free cash flow last year was $61 million.

Meanwhile, Ascent has more than 70% of 2024 and 2025 gas production hedged at between $3.54 and $3.82/Mcf. About 50% is hedged into 2026 at $3.73.

“While many peers have begun to deemphasize hedging, Ascent maintains a robust hedging program, which is a credit-positive,” Fitch reported.

Ascent’s RBL debt at year-end was $765 million.

Recommended Reading

1Q24 Dividends Declared in the Week of April 29

2024-05-03 - With earnings season in full swing, upstream and midstream companies are declaring quarterly dividends. Here is a selection of dividends announced in the past week.

Analyst Questions Kimmeridge’s Character, Ben Dell Responds

2024-05-02 - The analyst said that “they don’t seem to be particularly good actors.” Ben Dell, Kimmeridge Energy Partners managing partner, told Hart Energy that “our reputation is unparalleled.”

Tellurian Reports Driftwood LNG Progress Amid Low NatGas Production

2024-05-02 - Tellurian’s Driftwood LNG received an extension through 2029 with authorization from the Federal Energy Regulatory Commission and the U.S. Army Corps of Engineers.

Zeta Energy Appoints Michael Everett as COO

2024-05-02 - Prior to joining Zeta Energy, a lithium-sulfur battery developer, Michael Everett previously served as president and COO at Advanced Battery Concepts.

Shell Launches $3.5 Billion Share Buyback Program

2024-05-02 - Shell, which posted first-quarter adjusted earnings of $7.7 billion, will cancel all of the shares it buys.