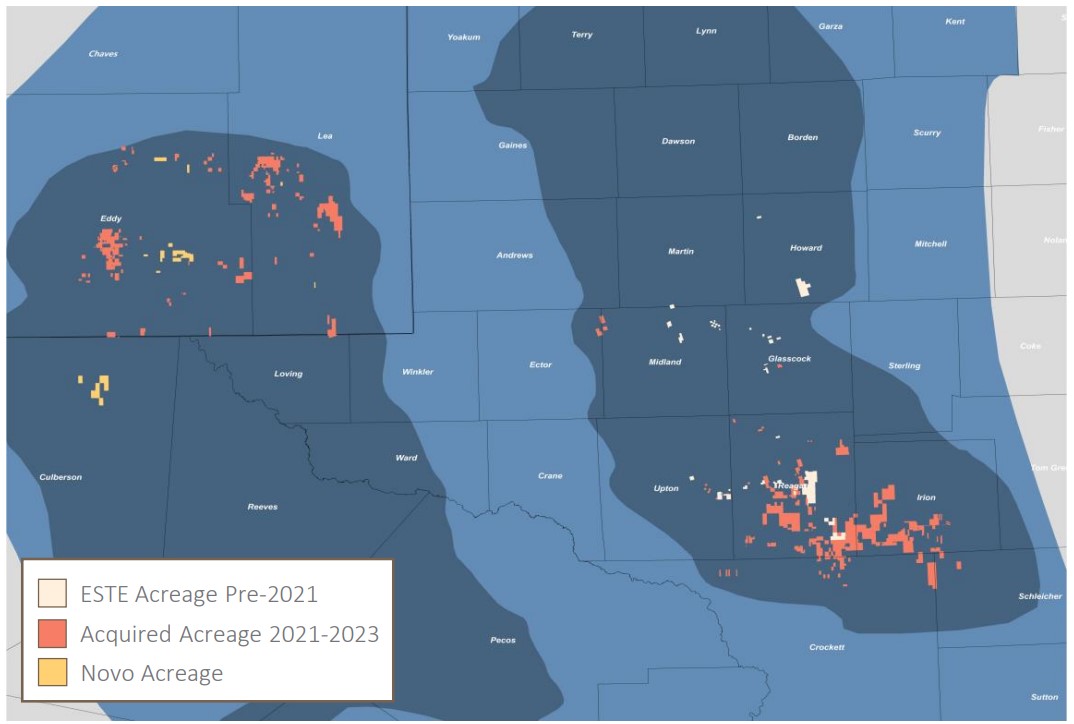

After selling oil and gas assets in New Mexico and West Texas last year, Novo Oil & Gas is reloading with EnCap backing to pursue Delaware Basin acquisitions. (Source: Shutterstock)

Novo Oil & Gas II is taking off and targeting Permian Basin acquisitions after making a $1.5 billion exit last year.

Novo Oil & Gas Holdings II LLC is launching with an equity capital commitment from private equity firm EnCap Investments, Novo announced April 23. Financial terms of EnCap’s investment in Novo II were not disclosed.

The second Novo aims to build on the strategy employed by its predecessor, Novo I, which built up a sizeable Delaware Basin position.

Novo II also plans to pursue unconventional asset acquisitions with a particular focus on the Delaware side of the basin. The company will acquire both operated and non-operated mineral positions.

The company is led by CEO and Co-Founder John Zimmerman, who served as CFO for Novo I.

“We are excited to once again focus on the acquisition and development of high-quality upstream assets throughout the Delaware Basin, one of the most prolific oil and gas regions in North America,” Zimmerman said in a release.

“EnCap has been a trusted partner for more than a decade, and we are grateful for their continued support as we leverage our existing relationships and expertise to drive value through innovative exploration, drilling and completion techniques,” he said.

The Novo II team also includes President and Chief Commercial Officer Brandon Patrick, CFO David Avery and COO Kurt Shipley. All in-house Novo II employees previously held roles within Novo I.

Formed in 2016, Novo I exited in a $1.5 billion sale to Earthstone Energy and Northern Oil & Gas last year.

Earthstone acquired two-thirds of the company for $1 billion; Northern Oil & Gas acquired a 33.33% undivided stake in the Novo assets for $500 million.

Novo’s assets included around 11,300 net acres across Eddy County, New Mexico, and Culberson County, Texas.

“Our tenured partnership with John Zimmerman and Novo has led to multiple successful exits across different basins,” said EnCap Managing Director Jason DeLorenzo. “They have a proven track record of value creation, and we look forward to continuing our successful partnership with them.”

Just days after Earthstone and NOG closed the Novo acquisition, Earthstone itself was acquired by growing Delaware Basin producer Permian Resources for $4.5 billion.

RELATED

Recommended Reading

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.