NOV sign on the building at its headquarters in Houston. (Source: Shutterstock.com)

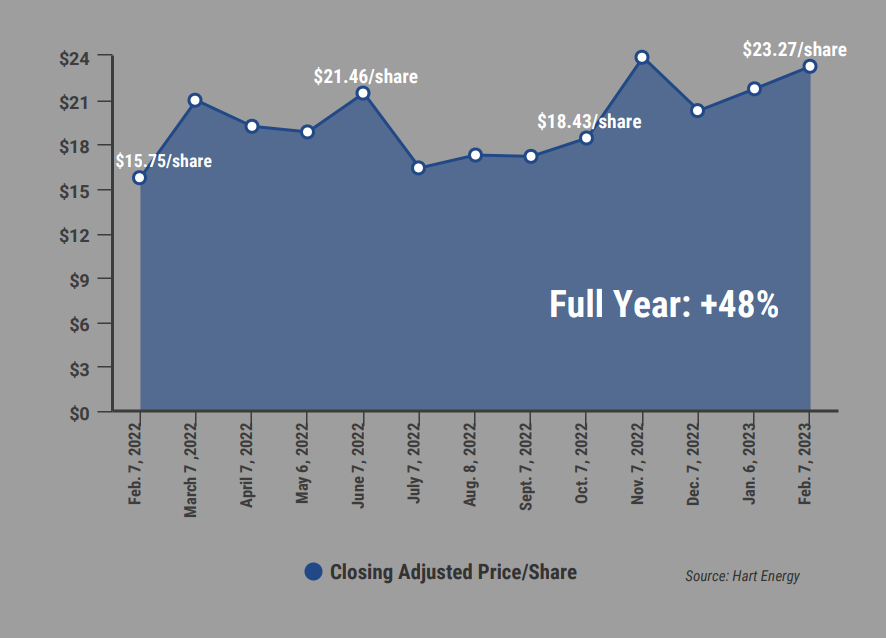

Key oilfield technology supplier NOV Inc. reported fourth-quarter earnings and revenue on Feb. 7, topping analyst expectations despite lingering supply chain and finance constraints.

Revenue generated during the last three months of 2022 represented a 10% increase from the previous quarter; EBITDA increased 11.1% for the fourth quarter, said NOV CEO Clay Williams during a call with investors.

NOV earned $679 million in EBITDA on $7.2 billion in revenue for the full year of 2022, with renewable energy-related work accounting for $332 million during the year.

“Our team executed well in the face of continuing extraordinary challenges,” Williams said. “We introduced new products that we developed through the downturn that improve the efficiency, safety and environmental impact of our customers’ operations, including several greenhouse gas emissions-reducing technologies and an edge computing platform—the foundation for several new digital products.”

Annual income ($ millions)

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Total revenue | $8,453 | $8,479 | $6,090 | $5,450 | $7,237 |

| Total adjusted EBITDA | $910 | $885 | $350 | $172 | $679 |

| Net income | ($10) | $192 | ($118) | ($271) | $320 |

Quarter-over-quarter revenue is steadily growing, boosted from a low bar set by cost reductions in prior years. Williams said 2022 was a year of “learning” about challenges and constraints.

Quarterly income ($ millions)

| Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | |

|---|---|---|---|---|

| Total revenue | $1,548 | $1,727 | $1,889 | $2,073 |

| Total adjusted EBITDA | $103 | $150 | $195 | $231 |

| Net income | $18 | $82 | $125 | $96 |

“We learned that when economies reopen, after being closed for a pandemic, knock-on effects and unforeseen constraints are created, which reverberate far into our future,” he said.

Optimism at the beginning of 2022 soon gave way to a new understanding.

“Unfortunately, the fragility of our energy situation blew up on us with the outbreak of hostilities in Ukraine, which spiked energy prices and prompted renewed urgency and oilfield recovery,” William said. “That’s what exposed the manning obstacle course of constraints, through which the industry must navigate in order to ramp production. The industry’s constraints underpin our long-term bullish outlook.”

‘Constraints are everywhere’

Following years of limited exploration and reserve replacement, the industry’s ability to ramp up is restrained, Williams said.

“Nevertheless, this is beginning to change,” he said. “The balance of 2022 taught us just how crucial – and capital intensive – the industry we serve is. Oil and gas is the industry that powers all other industries. Our way of life would not exist without it.”

Still, the cyclical nature of oil and gas means that each peak and valley share some common traits. Companies that maintenance expenses and lay off workers during a low point soon enough find themselves scrambling to replace the workers and rebuild their efficiencies.

“But never before has this industry faced the constraints we face today, from raw materials to finished components to workforce to freight, to availability of capital, to higher interest rates, to hostile political pressure and tightening regulations,” he said.

Achieving growth again “will be as daunting as it ever has been throughout the industry's 164-year history.”

This side of the cycle is besieged by such extraordinary constraints it will take years for the domestic industry to recover, he said.

“But we simply must overcome them to restore the critical energy security required for economic growth and improving standards of living, particularly for those living in energy poverty,” Williams said.

Workforce

The U.S. land rig count remains below 800, as reported by Baker Hughes on Feb. 3. Williams said that represents a near-term ceiling held in place largely by insufficient labor.

“North American [E&Ps] are citing service availability as the biggest risk to achievement of their production targets, but our oilfield service customers tell us that crew availability is the real root cause,” Williams said.

Labor is so short in the hottest U.S. basins that in West Texas and North Dakota, oilfield services’ wages are shooting up by 50% in some instances, he said. Adding the increase in per diems, bonuses and overtime worked by chronically shorthanded crews, and the costs continue to rise.

The new hires are hard to find, and the crews that are successful hiring new green hands are less safe and demonstrably less efficient, Williams said.

International demand

Meanwhile, North American E&Ps “are waking up to the idea of buying on value and service as opposed to strictly buying on price,” Williams said.

International markets hesitant to adopt new technology a decade ago are coming to grips with the need for efficiency. That could provide for more near-term growth opportunities for firms like NOV abroad than in the U.S.

“We are bullish on international end markets and offshore,” Williams said.

NOV’s enthusiasm for the international and offshore markets reflects that of peers, such as SLB Inc. and Halliburton, which also reported optimism for those regions during fourth-quarter earnings calls in January.

“In places like the Middle East and Argentina, national oil companies are frustrated with materially lower efficiencies compared to North America,” Williams said.

And that’s a boost to large services providers.

“The first two high-spec rigs delivered by our new plant in Saudi Arabia are performing very well, and interest is growing for other land drilling contractors in the region. We also see rising demand for newer coiled tubing equipment, as well as the directional drilling kit bits.”

The apparent inflection and acceleration in both the international and offshore markets should benefit NOV particularly, said analyst Don Crist in a Feb. 6 note to Johnson Rice and Co. investors.

“Historically, approximately 30% of reactivation costs are related to upgrading, recertifying or [purchasing] new products that NOV supplies,” Crist said.

Recommended Reading

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.