Halliburton reported its Q4 earnings rose 21%, as it announced it would return upwards of 50% of free cash flow to shareholders. (Source: Halliburton Co.)

Halliburton Co. reported a 21% hike in quarterly net income to $656 million on Jan. 24, beating analysts’ estimates with earnings per share (EPS) of $0.72—double that of the same period in 2021.

During a conference call with analysts, Jeff Miller, Halliburton’s chairman, president and CEO, said the company aimed to return half of its free cash flow to shareholders. He also said that development activity would take up more of its focus in the near term, with less emphasis on exploration.

The oilfield service company’s fourth-quarter 2022 revenues of $5.58 billion were a 30.5% jump on a year-over-year basis, rising 4.2% from third-quarter 2022 and matching Wall Street expectations. Full-year revenues totaled $20.3 billion, a 32.7% increase over 2021. Full-year net income of $1.57 billion represented an increase of 7.9% over full-year 2021.

“Halliburton’s execution in 2022 demonstrated the earnings power of our strategy, and I expect this earnings power to strengthen in 2023 and beyond,” Miller said earlier in a press release announcing the results. He added that profit margins were strong both in the North American and international markets.

North American revenue in the fourth quarter totaled $2.61 billion, a 46.4% year-over-year increase. Full-year revenue for North America leapt 50.6% to $9.6 billion. International quarterly revenue was up 19.1% to $2.97 billion year-over-year, with full-year revenue up 19.9% to $10.7 billion.

“About 40% of our international business is offshore today,” Miller said during the conference call. “That’s a good market for us.”

Luke Lemoine, senior research analyst with Piper Sandler, called the earnings a “slight positive with a 4% EBITDA beat that was driven by margin beats in both segments from strong international results.” He noted that inclement weather had affected North American results, but international revenues were very strong, rising 9% from the third quarter.

Weather negatively affected operations, leading to lower stimulation activity. That setback was offset by improved pricing, service efficiency and activity mix in North America land, as well as higher completion tool sales and cementing activity globally, according to Halliburton.

Halliburton also announced that it will up the rate of cash returned to shareholders.

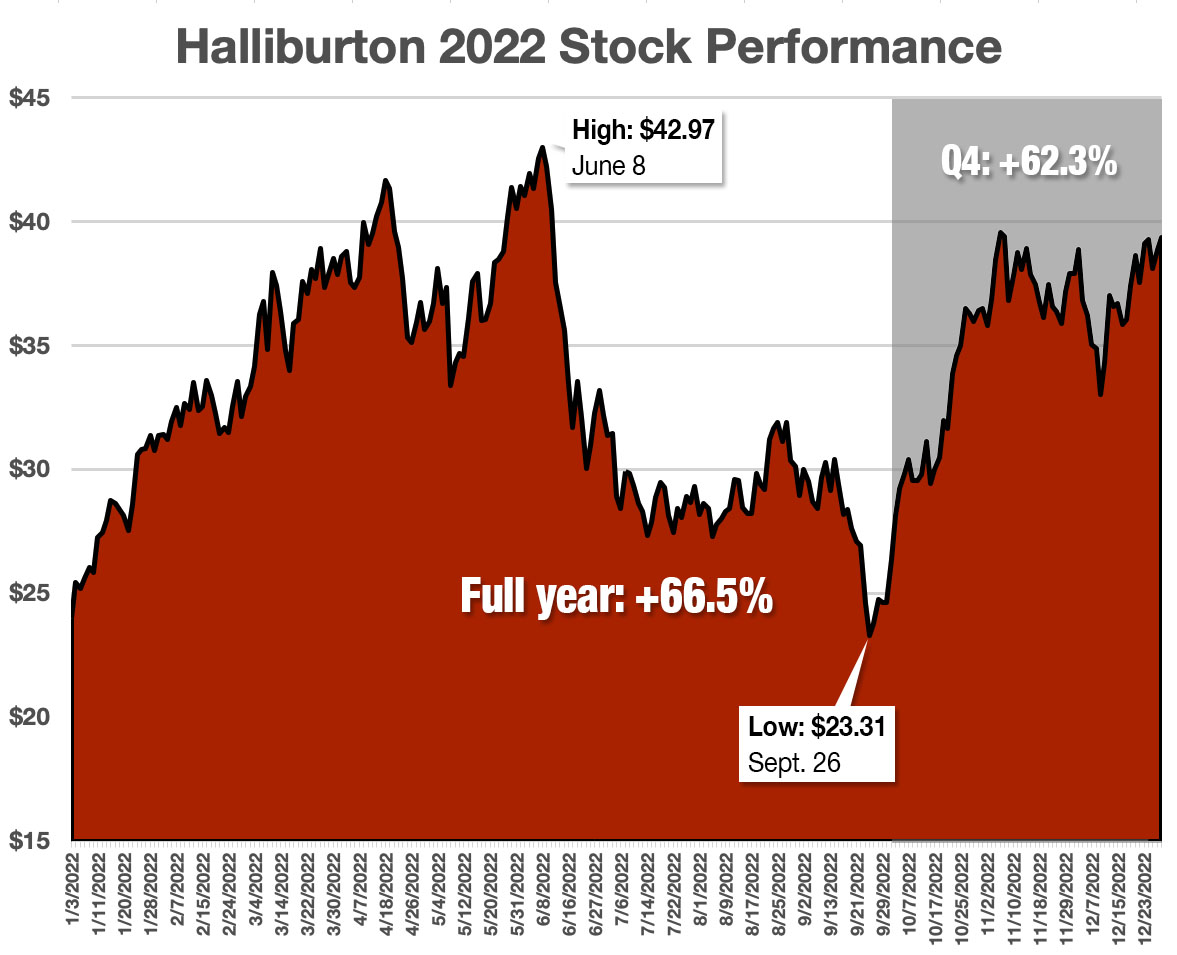

The company’s board increased its dividend about 33% to $0.16/share from $0.12/share beginning this quarter. Halliburton’s stock soared 66.5% in 2022 with a strong rally in the fourth quarter. Its price on Jan. 24 was down 2.8% to $39.44/share. The market as a whole has been wobbly as investors contemplate numerous earnings releases, economic news and fluctuating commodity prices.

Regarding stock buybacks, Eric Carre, Halliburton’s executive vice president and CFO, stressed that they are a mechanism to return cash to shareholders. The company’s 50% free cash flow target gives some level of certainty to what shareholders can expect to receive while giving the company optionality to invest in the business, and make bolt-on or other acquisitions that complement the business plan.

“And it also gives us optionality over the next few years,” he said, “to continue to work on strengthening our balance sheet.”

Outlook

In 2023 and beyond, Halliburton will likely follow its upstream partners in emphasizing development activity instead of exploration, as in prior cycles, Miller said.

“I think that’s very consistent with where operators are, from a capital discipline standpoint, in just producing more barrels sooner,” he said. “Development is a place where we have leading positions in a number of the service lines that allow that to happen—cementing, drilling fluids, completion tools. I think this is going to be a great, even better market for Halliburton.”

Miller was particularly optimistic about the future for Halliburton’s North American upstream partners.

“Growth is the only path for most of these (shale) companies,” he said, adding that he expects that to result in increased service intensity.

“I am very confident in what technology can do,” he said. Halliburton’s SmartFleet fracturing system gives users subsurface measurements in real time. That is the kind of innovation, Miller said, that operators will be using to enhance productivity.

“There’s a lot of R&D dollars in North America,” he said. “We try to put those dollars into what we think are most impactful.”

Spending

Cash generation in 2023 will mimic 2022 and be quite a bit weighted toward the back half of the year, Carre said.

“We’ll see significantly increased net income driven by growth in our revenue, improvements in our margins,” he told analysts.

Capex will probably increase by nearly 6% in 2023, he said, primarily driven by supply chain constraints and extended lead time in the supply chain.

“We continue to grow, so we continue to see some headwinds in terms of working capital,” Carre said. He noted that international growth consumes more working capital than growth in North America.

“The way all of that is going to land is a little north of 20% growth in terms of free cash flow over our 2022 performance,” he said.

Recommended Reading

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.