Just weeks after going public on the New York Stock Exchange, Mach Natural Resources is growing its position in Oklahoma with an $815 million acquisition. (Source: Shutterstock)

After recently going public, Mach Natural Resources is growing its position in the Anadarko Basin with an $815 million acquisition.

Oklahoma City-based Mach Natural Resources LP is acquiring oil and gas properties, rights and assets in Oklahoma from Paloma Partners IV LLC, an upstream company backed by private equity firm EnCap Investments.

Total cash consideration for the transaction is $815 million, subject to closing price adjustments. The deal is expected to close Dec. 29, with an effective date of Sept. 1.

Mach’s latest acquisition comes just over two weeks after the Midcontinent E&P listed its shares on the New York Stock Exchange.

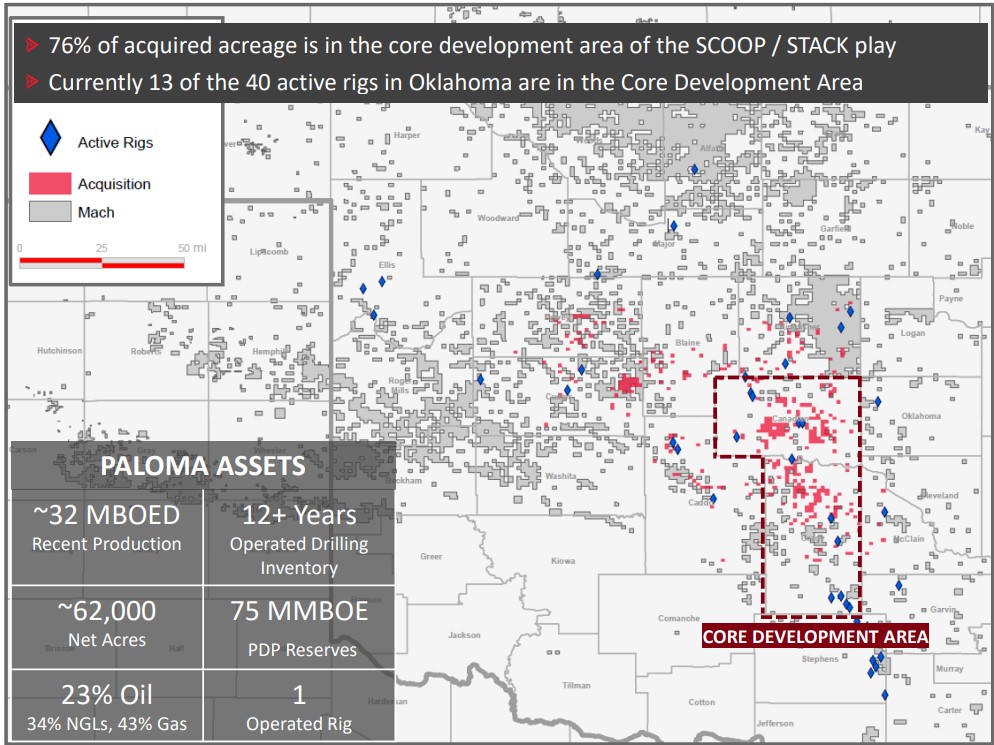

The acquisition from Paloma will add approximately 62,000 net acres spanning across Canadian, Grady, McClain, Caddo, Custer, Dewey, Blaine and Kingfisher counties, Oklahoma, Mach announced Nov. 13. More than 75% of the newly acquired acreage falls within Mach’s core development area in Canadian and Grady counties.

The acquired assets include recent production of about 32,000 boe/d (23% oil, 57% liquids), as well as proved reserves of approximately 75 MMboe.

RELATED

MLP Mach Resources’ IPO Gets Off to Solid Start

There is currently one rig running on Paloma’s acreage in Grady County; six wells are expected to be completed between the effective and closing dates, Mach said.

Mach plans to fund the acquisition with new debt financing. The company has secured $825 million in senior secured financing from a group led by Chambers Energy Management and EOC Partners; Mercuria Investments US Inc., Macquarie Group and funds managed by Farallon Capital Management LLC are also participating in financing the loan.

Mach expects that its debt-to-EBITDA ratio will remain below 1.0x after closing the deal.

Mach is led by Tom Ward, an oil and gas industry veteran who previously co-founded Chesapeake Energy Corp., SandRidge Energy and Tapstone Energy.

Chesapeake and SandRidge are both publicly traded E&Ps; Tapstone was acquired by Diversified Energy for $419 million in 2021.

The newly public MLP Mach, similar to other MLPs, is set up to distribute all available cash to unitholders each quarter after costs and expenses. The company said the Paloma acquisition will be accretive to both total cash available for distribution and expected cash distribution per unit.

Kirkland & Ellis is serving as legal advisor for Mach. Vinson & Elkins is serving as legal adviser and RBC Richardson Barr is serving as financial adviser for the sellers. Latham & Watkins serves as legal adviser for the term loan participants.

RELATED

Former Chesapeake, SandRidge Exec Plans IPO for Anadarko E&P

Recommended Reading

EDF Renewables, SCPPA Sign PPA for Bonanza Solar

2024-02-28 - The site is expected to start delivering electricity to SCPPA’s customers by Dec. 31, 2028.

SCF Acquires Flowchem, Val-Tex and Sealweld

2024-03-04 - Flowchem, Val-Tex and Sealweld were formerly part of Entegris Inc.

Enbridge Closes First Utility Transaction with Dominion for $6.6B

2024-03-07 - Enbridge’s purchase of The East Ohio Gas Co. from Dominion is part of $14 billion in M&A the companies announced in September.

Pembina Cleared to Buy Enbridge's Pipeline, NGL JV Interests for $2.2B

2024-03-19 - Pembina Pipeline received a no-action letter from the Canadian Competition Bureau, meaning that the government will not challenge the company’s acquisition of Enbridge’s interest in a joint venture with the Alliance Pipeline and Aux Sable NGL fractionation facilities.

Global Partners Buys Four Liquid Energy Terminals from Gulf Oil

2024-04-10 - Global Partners initially set out to buy five terminals from Gulf Oil but the purchase of a terminal in Portland was abandoned after antitrust concerns were raised by the FTC and the Maine attorney general.