Led by Chesapeake Energy co-Founder Tom Ward, Anadarko Basin E&P Mach Resources is the second public offering by an MLP this year. (Source: Shutterstock)

Midcontinent MLP Mach Natural Resources ended its first day listed on the New York Stock Exchange, trading down about 3.5% after opening its IPO at $19 per unit.

The offering was the second energy-related MLP public offering on the NYSE this year. TXO Partners, an MLP led by Bob Simpson, went public in late January.

Mach Resources, trading under the ticker symbol MNR, offered 10 million units on Oct. 25 at $19. At the close of markets, its units were valued at $18.34.

Mach Resources is led by CEO Tom Ward, an industry veteran who has founded or co-founded three companies including Chesapeake Energy and SandRidge Energy Inc.

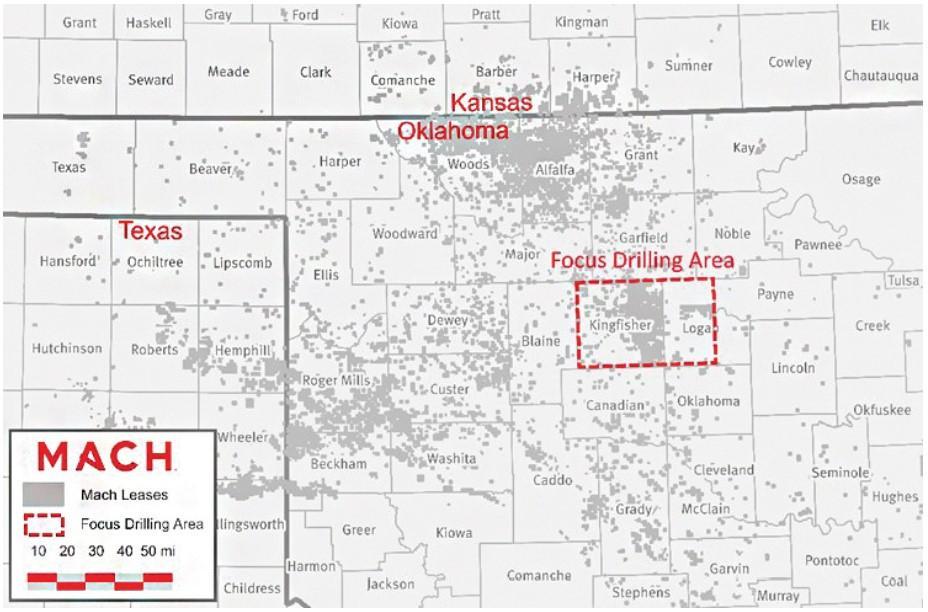

The Anadarko Basin E&P has about 4,500 producing wells on 936,000 net acres in western Oklahoma, southern Kansas and the panhandle of Texas. Mach Resources’ net oil production totaled 3.37 MMbbl through the first six months of 2023; natural gas output totaled about 38.7 Bcf, while NGL production totaled 2.05 MMbbl, regulatory filings show.

Mach Resources described its position in the basin as a “ combination of our large inventory of low-risk drilling locations with the low decline production profile of our Legacy Producing Assets leads to a sustainable production profile,” according to a Securities and Exchange Commission (SEC) filing.

Douglas Getten, partner at Baker Botts, the Houston-based law firm that advised the underwriters of the IPO, said there should be investor demand for Mach Resources as investors look for capital returns. Mach Resources, similar to other MLPs, is set up to distribute all available cash to unitholders each quarter after costs, expenses and reserves, according to the company’s SEC filing.

“This one’s more about distributions, and that’s a big story. I think, in general, the investor interest with E&Ps right now is free cash flow and wanting to see a return of capital,” Getten told Hart Energy.

He said the Mach Resources IPO timing is well suited in an environment in which E&P consolidation is underway.

“It creates an opportunity for some new companies to enter the public sphere as the larger public company majors are acquired,” Getten said. “From a demand perspective as an investor, if you’re looking for that kind of opportunity to participate in some growth, I think this is where they’re looking on deals like this.”

Mach Resources built its position in the Anadarko through consolidation of its own. “From January 2018 through September 2023, we have successfully executed 16 acquisitions for an aggregate purchase price of approximately $960 million, increasing our net acreage to 936,000, and our average net daily production to approximately 65 MBoe/d for the 12 months ended June 30, 2023,” the company said in its SEC filings. “Additionally, during the same period, we distributed approximately $653 million in cash to our members.”

Mach Resources notes in its SEC filing that “the market demand for equity issued by master limited partnerships has been significantly lower in recent years than it has been historically, which may make it more challenging for us to finance our capital expenditures with the issues of additional equity.

Mach Resources has around 936,000 net acres in the Anadarko Basin; the E&P is focused on drilling projects in Kingfisher and Logan counties, Oklahoma. (Source: Securities & Exchange Commission)

Hinds Howard, a CBRE portfolio manager who writes a newsletter on MLPs, said the oil and gas industry’s MLPs are mostly in the midstream sector. An upstream MLP is extremely rare, he said.

“Historically, upstream assets have not worked well in the MLP structure, especially if the goal is to maintain a steady distribution rate. This is because oil and natural gas production from a given oil well declines, and commodity prices tend to be volatile,” Howard told Hart Energy. “Mach is planning to hedge some production, but it doesn’t appear they plan to hedge 100% of production like we saw in the 2006-2007 wave of upstream MLPs.

“So, it’s odd to see this company choosing this structure, although I’m sure they have their reasons. There are some midstream assets included in the mix here, but only enough to complicate the company and cloud the potential investor base who might be interested in such a story.”

Mach Resources plans to use the bulk of the net proceeds from its offering to repay credit facility debt.

Ward, who also founded Tapstone Energy, has been CEO of Mach Resources since the Oklahoma City-based company’s founding in 2017. Former Oklahoma Gov. Francis Keating is nominated as a company director in the SEC filing.

Recommended Reading

Solaris to Acquire Mobile Energy Rentals, Rename to Solaris Energy Infrastructure

2024-07-10 - Following the closing of its deal to acquire Mobile Energy Rentals, Solaris Oilfield Infrastructure will also be rebranding to Solaris Energy Infrastructure to more closely represent its expanded solutions offerings.

Come Together: California Resources, Aera Merge for Scale, Drilling Runway

2024-07-10 - California Resources Corp. closed an acquisition of Aera Energy to become California’s top oil and gas producer. Now, CRC President and CEO Francisco Leon wants to grow from a one-rig to an eight-rig drilling program—but faces stiff pushback from regulators and environmental advocates in the Golden State.

Blackstone Buys Enagás’ Tallgrass Stake for $1.1 Billion

2024-07-11 - Spain’s Enagás is selling its Tallgrass Energy interests to Blackstone Infrastructure Partners in exchange for some needed capital.

APA Closes Midland Basin, Eagle Ford Divestitures for $660 Million

2024-07-11 - APA Corp. and subsidiary Apache sold non-core assets in the Permian Basin and Eagle Ford Shale sooner than expected, and for less, as the company looks to reduce debt from its Callon Petroleum deal earlier this year.

Firms Blast ‘Conflict-ridden’ Martin Midstream Deal, Launch Counteroffer

2024-07-11 - Two New York-based capital firms say a May proposal by Martin Resource Management to buy Martin Midstream for $100 million represents a “below market and conflict-ridden proposal,” while the firm’s own offer has been rebuffed.