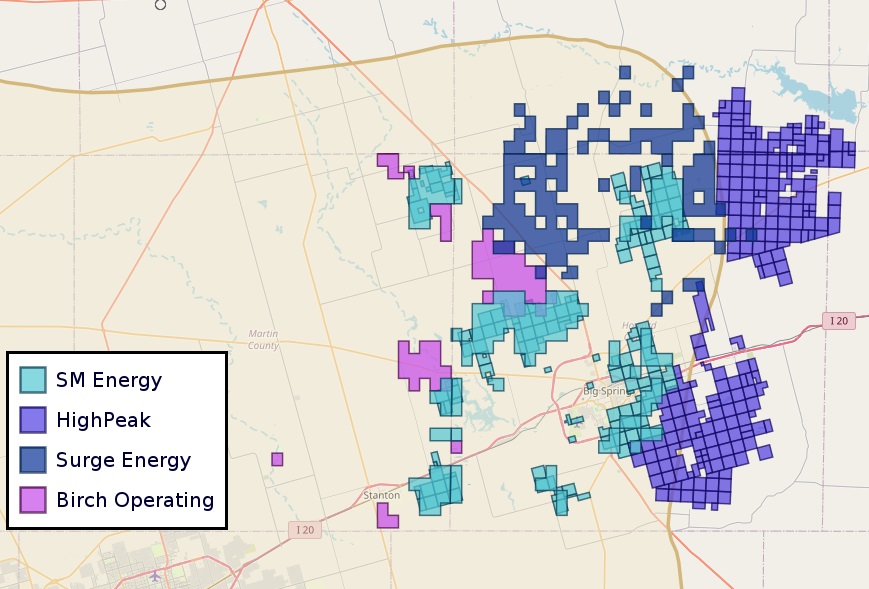

A view of Surge Energy’s operations in the northern Midland Basin. (Source: Surge Energy)

Conventional wisdom put little stock in Surge Energy’s development plan for the northern Midland Basin when the company launched in 2015. Instability was the rule of oil prices and the startup was buying acreage that was widely known to be expensive to drill.

Nearly a decade later—after a pandemic, an almost-recession and a profound consolidation trend—Surge is one of the top private producers still standing in the Permian Basin.

And as larger E&Ps scour the Permian for low-cost drilling inventory, several of Surge’s close neighbors in the northern Midland have recently signed deals to be acquired.

Surge has come a long way since 2015. But CEO Linhua Guan admits that the investment community’s skepticism when the company first launched was certainly understandable.

Oil prices were low: average WTI priced at $48.66/bbl in 2015, down more than 47% from $93.17/bbl the year before, according to the Energy Information Administration.

The price environment made it difficult for some of the industry’s most adept producers to turn a profit and dozens of E&Ps filed for bankruptcy during the ensuing years.

But while the industry languished, Surge was quietly building its portfolio, albeit in parts of the Permian still largely unproven at that point.

Surge, through subsidiary Moss Creek Resources, made two key acquisitions on the Texas side of the Permian during its first year: a 5,000-acre waterflood asset in Crosby County and a 76,000-acre position in Howard and Borden counties.

There were several areas within Howard County that showed little promise for drilling, Guan told Oil and Gas Investor. Borden County, located on the edge of the shelf, wasn’t viewed as economic for horizontal development during a period of low commodity prices.

“I think it took the management team of Surge Energy two or three years to persuade [Wall Street] we could produce economically from Borden County,” said Guan, who joined Surge as chief business development officer in 2018 before becoming CEO the following year.

Surge’s production was coming in at less than 4,000 boe/d when the company launched in May 2015. Oil prices sunk even lower in 2016 and stayed at depressed levels the following year; Surge was burning through a lot of cash, Guan said.

But Surge managed to push through the downturn, growing its northern Midland portfolio with incremental acreage acquisitions in Howard and Borden counties.

And the company kept pushing into the oily fringes of the basin’s northern reaches with acquisitions in Dawson and Gaines counties in 2022.

It was in 2022, when WTI prices averaged around $95/bbl—the highest levels seen in nearly a decade—that Surge generated record free cash flow of over $500 million for the year.

A few months later, S&P Global Ratings upgraded its credit rating.

“That pretty much changed everything in how Wall Street viewed Surge Energy,” Guan said.

Today, Surge isn’t alone in seeing untapped opportunity in the northern part of the basin.

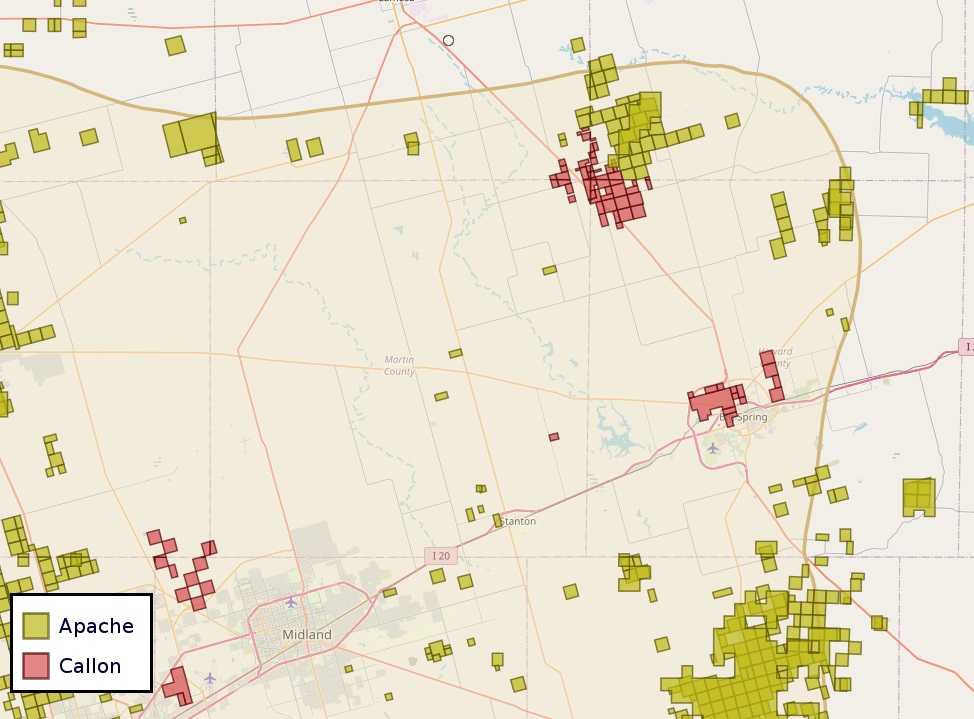

EOG Resources, SM Energy and Callon Petroleum are testing well designs in Dawson and Gaines, neither of which have historically attracted much drilling activity. But permitting is starting to heat up. In Dawson County, just over 250 permits to drill horizontal wells have ever been requested from the Texas Railroad Commission; 60 permits, nearly a quarter of Dawson’s total permits, were issued just last year.

By the end of third-quarter 2023, Surge’s average output had, ahem, surged up past 65,000 boe/d, the company reported this spring.

“We survived two downturns and kind of turned crisis into opportunity—and continued growing,” he said.

Surge aims to continue its growth story in the northern Midland Basin.

After participating in quite a few marketing processes, Surge closed some smaller acquisitions in 2023; nothing large enough to warrant a press release, Guan said.

“There was quite a big gap in expectations between sellers and buyers, so we could not close any sizable deals last year,” he said. “This year, I hope the bid-ask spread will be narrower.”

Surge is open to making acquisitions this year where it makes sense. The company has a few hundred million dollars cash in its war chest and more than $1 billion in liquidity.

And the company is also focused on making organic gains. Surge plans to operate three rigs this year, a similar level of activity compared to 2023, Guan said. But the company also expects to bring its costs down year over year due to deflation in the oilfield services market.

Still, if a buyer were to come knocking, you can never say never to a potential sale, Guan said.

“If the price is right, likely the board of directors could sell Surge Energy,” he said.

RELATED

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

Inventory scramble

A deluge of M&A activity has washed over the Midland Basin since the summer, and it’s being driven by a dwindling number of top-quality drilling locations. As the middle of the basin gets bought up at premium prices, E&Ps are looking at the northern edges for potential deals.

Some of the basin’s biggest and oldest producers have been scooped up into the portfolios of larger E&Ps in a matter of months:

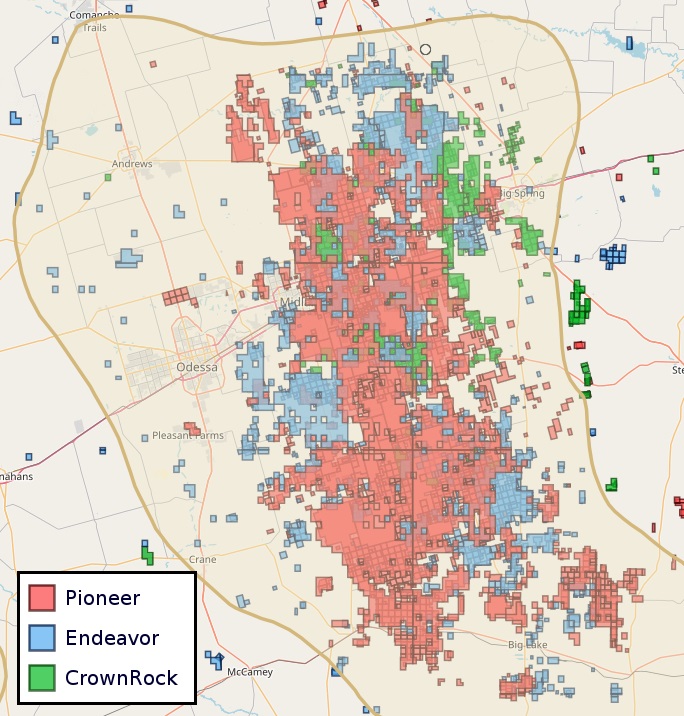

- The public Permian juggernaut Pioneer Natural Resources agreed to an eye-popping $64.5 billion sale to Exxon Mobil in October;

- In December, CrownRock sold to Occidental Petroleum in a $12 billion deal;

- Endeavor Energy Resources agreed in February to a $26 billion buyout by Diamondback Energy—the largest acquisition of a private upstream company ever, according to Enverus Intelligence Research; and

- APA Corp., an Apache subsidiary, picked up Callon Petroleum—which has acreage in the Midland and Delaware basins—for $4.5 billion.

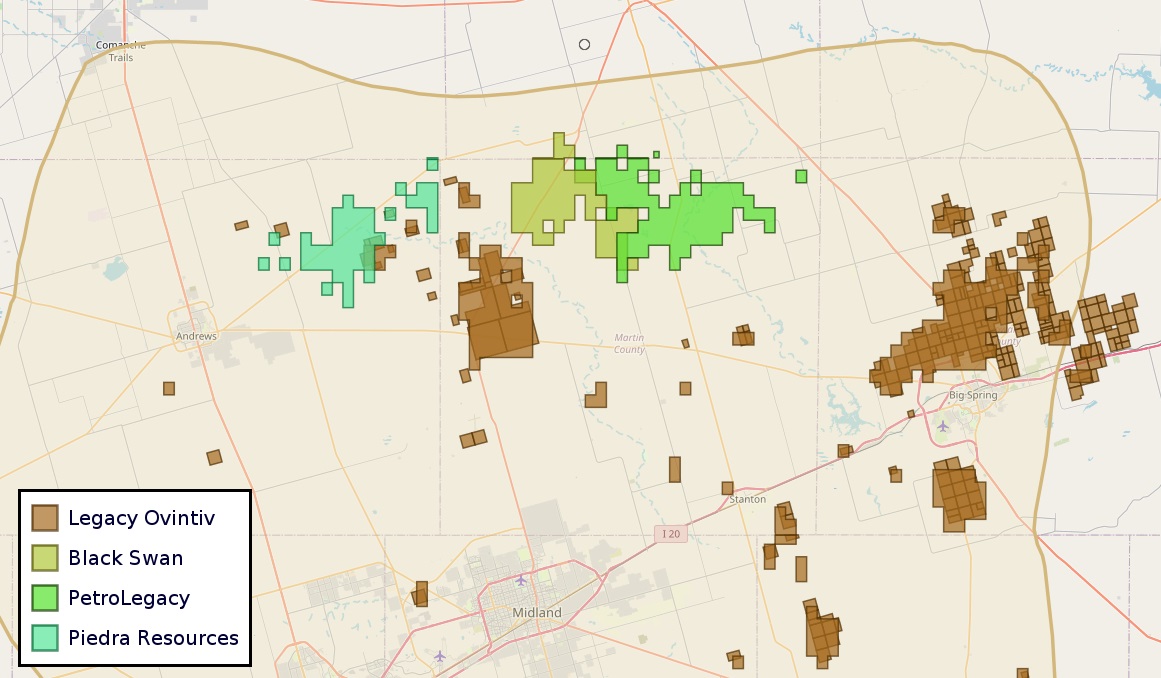

Several other large private Midland E&Ps—Vencer Energy, Tap Rock Resources, Hibernia Resources, Black Swan Operating, PetroLegacy Energy and Piedra Operating—have been scooped up by public players including Civitas Resources, Ovintiv and Vital Energy.

When it comes to undeveloped inventory, companies like Pioneer, Endeavor and CrownRock were the belles of the Midland ball. These E&Ps held large swaths of premium undrilled land in the core-of-the-core of the basin.

This land is coveted by larger E&Ps because it’s cheaper to drill a gushing oil well there than in other places. Take Exxon’s massive acquisition of Pioneer: the deal extends Exxon’s future drilling runway by about 6,300 net locations that can generate at least a 10% return in a sub-$50/bbl oil price environment.

But prices that low would make drilling new wells uneconomic for many E&Ps with lower-quality inventory. A prolonged period of low prices could sink them—like what happened after the 2014-2015 price downturn and again during the COVID-19 pandemic.

Even before selling to Exxon, Pioneer CEO Scott Sheffield acknowledged that survival through the COVID downturn for many independent E&Ps would require consolidation. The northern Midland Basin still isn’t as quality as the core of the basin, analysts say, and companies like Endeavor have some of the most-economic drilling locations remaining across the Lower Spraberry, Wolfcamp A and Wolfcamp B intervals, according to an analysis by Novi Labs.

Brandon Myers, head of research at Novi Labs, said many of Endeavor’s remaining drilling locations fall into the top quarter of the Midland Basin’s most-quality inventory.

Comparatively, the vast majority of Surge’s acreage—around 83% of the company’s remaining locations—falls into the third quartile of inventory quality, according to Novi’s analysis.

“Point being that [Surge] is not going to fetch that [5x-6x] operating cash flow premium that Diamondback paid for Endeavor,” Myers told OGI.

“A good analogy would probably be Permian Resources and Earthstone,” he said, referring to Permian Resource’s $4.5 billion takeover of Earthstone Energy last year.

RELATED

After Record Year, Permian Basin Set for Even More M&A in 2024

Living on the edge

The northern edge of the Midland Basin might not be as attractive as core-of-the-core acreage. But the northern Midland is still appealing to major E&Ps hunting for scale and inventory runway.

Ovintiv bought a package of three EnCap portfolio companies—Black Swan, PetroLegacy and Piedra Resources—in a $4.275 billion cash-and-stock deal last year.

APA’s $4.5 billion acquisition of Callon Petroleum includes roughly 26,000 net acres in the Midland Basin. The transaction also includes a significant footprint in the Delaware Basin, where Callon holds about 119,000 net acres.

Some of Surge’s other publicly traded neighbors say they are open to consolidating.

One is SM Energy, which has holdings in the Midland Basin and in South Texas. During SM’s fourth-quarter earnings call, CEO Herb Vogel said the company is agnostic about whether it acquires a smaller player or is itself acquired by a bigger player.

But SM has long been a believer in upstream consolidation, and in the balance sheet accretion and industrial logic M&A can deliver.

“We sit on 10-plus years of inventory, so we don’t have to really overpay to get something to just move along,” Vogel said. “But if the right deal comes along, we’d be there.”

Further to the east, super-oily HighPeak Energy continues to pursue strategic alternatives, including a potential sale.

The company hired Texas Capital Securities and Wells Fargo Securities to “assist us in our pursuit of strategic alternatives,” HighPeak reported in fourth-quarter earnings. The E&P’s efforts to sell the company in the first half of 2023 didn’t materialize.

Fourth-quarter production averaged 50,000 boe/d, 81% oil and 11% NGL. The company’s leasehold totals 132,000 net acres.

Privately held Birch Operations has also grown a significant foothold in the area. Birch ranks as the fourth-largest private E&P in the Permian Basin, coming in behind only Mewbourne Oil, Endeavor and CrownRock, according to Rystad Energy.

Surge and Birch are two of the top private producers remaining in the Permian, but from a remaining inventory standpoint, these players wouldn’t fetch a premium like Endeavor or CrownRock, said Matt Bernstein, a Rystad senior analyst.

There are other Midland Basin E&Ps that aren’t producing as much oil—but have a deeper and more attractive inventory, Bernstein said. These inventory-focused privates include Double Eagle IV, Summit Petroleum and BTA Oil Producers.

In the current cycle of upstream mega-consolidation, there’s a widening gap between the $50 billion-plus super-independents and the smaller independents. And there’s a shrinking number of companies on the market for a larger producer to score inorganic growth.

Surge and some of its fringy northern Midland neighbors might not be attractive to acquire in one-off deals by themselves, Myers said. A merger between a few of these contiguous landholders might make sense to investors, though.

“Maybe rock quality is Tier 3, but if you can get to a place where you’ve got best-in-class cash costs and you’ve got really high netbacks on an operating cash flow basis, you can start to look really attractive from that side,” Myers said.

“There could be a role for them if they get big enough.”

RELATED

Recommended Reading

ProPetro to Provide eFrac Services to Exxon’s Permian Operations

2024-04-29 - ProPetro has entered a three-year agreement to provide electric hydraulic fracturing services for Exxon Mobil’s operations in the Permian Basin.

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-28 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.