HighPeak Energy is cutting drilling plans and costs as the E&P continues to position itself for a potential sale. (Source: Shutterstock.com)

HighPeak Energy is cutting drilling plans and costs as the E&P continues to position itself for a potential sale.

HighPeak announced in January that the company was evaluating strategic alternatives in order to boost value for shareholders.

The Midland Basin E&P plans to reduce its rig count from four to two rigs from June through the end of 2023, HighPeak recently laid out in first-quarter earnings.

The company plans to run an average of two completion crews through the remainder of the year to complete drilled-but-uncompleted (DUC) wells generated by its previous six-rig drilling program.

HighPeak said the scaled-back drilling plan is expected to reduce its 2023 capital spending by about $250 million from its original budget.

Jack Hightower, chairman and CEO at HighPeak, said the company is cutting its drilling plans in an effort to strengthen its financial position and accelerate its transition to positive free cash flow.

Recent volatility in commodity prices also played a part in reducing drilling activity, HighPeak said.

“Nobody knew what was going to happen relatively to oil prices. We had a big decline today. We are perhaps going into a recession,” Hightower said on a May 11 earnings call with analysts. “Our attitude is to under-promise, over-perform and be careful going forward.”

Under the revised development plan, HighPeak anticipates generating free cash flow by the third quarter at current commodity prices.

“It's a testament to the high quality of our asset base that allows us to slow down our development cadence for the remainder of the year, while keeping our production guidance very close to our initial range – approximately doubling last year's production,” Hightower said.

HighPeak plans to ramp back up to a four-rig drilling program early in 2024 and to fund the effort entirely through operating cash flow. The company aims to boost production by another 30% next year, he said.

RELATED: Midland Basin E&P HighPeak Energy Exploring Possible Sale

Strategic alternatives

HighPeak is working to shore up its balance sheet and maximize value as the independent E&P explores a potential sale.

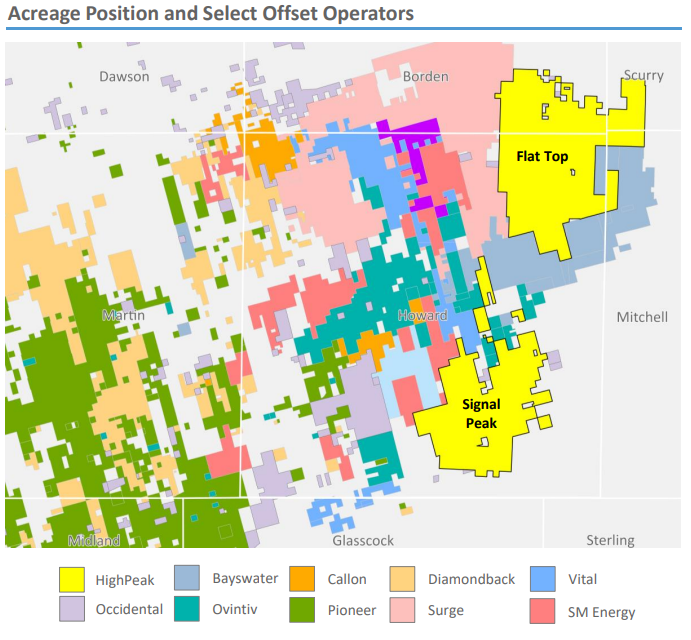

Hightower has argued that the company’s stock is undervalued given its “premium inventory.” The company’s acreage is primarily in Howard and Borden counties, Texas, in the northeastern portion of the Midland Basin. HighPeak had 113,600 net acres in the Midland as of late April, according to regulatory filings.

HighPeak produced an average of 37,222 barrels of oil equivalent per day (boe/d) during the first quarter.

The company anticipates producing between 45,000 boe/d and 51,000 boe/d on average this year, before ramping up to over 60,000 boe/d in 2024. HighPeak had forecasted producing between 47,000 boe/d and 53,000 boe/d this year before slashing its drilling outlook.

But with about 2,500 gross, undeveloped drilling locations in its portfolio, HighPeak believes it could be an attractive target to be scooped up by a larger Permian producer.

“That’s a conservative estimate on the number of locations that are commercial for this company,” Hightower said. “That’s still great growth, and a great potential exit strategy relative to strategic alternatives.”

When it comes to pursuing strategic alternatives, more production is “unquestionably” better than cutting output, Hightower said. But HighPeak needed to slash drilling activity in order to meet its long-term development plan, he said.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.