(Source: G B Hart / Shutterstock.com)

Independent E&P HighPeak Energy Inc. is exploring a potential sale of the company among strategic alternatives, the company said in a Jan. 23 press release.

The Fort Worth, Texas-based operator, with acreage in the Midland Basin and a market capitalization of about $3 billion, said its board had voted to initiate a “evaluate certain strategic alternatives to maximize shareholder value.”

Jack Hightower, HighPeak’s chairman and CEO, said the company sees an opportune time to capture value that management and the board don’t feel is reflected in the company’s current share prices. The company’s share price was $29.05 on Jan. 23, up roughly 8% in after-hours trading.

“We have worked diligently over the last few years to secure this [Midland Basin] position and are poised to capitalize on the favorable energy market outlook,” Hightower said in a news release that also presented the company’s 2023-24 guidance.

Given what Hightower termed the company’s deep, high-return inventory, high margins and long-term free cash flow assets, the HighPeak’s share price should be attractive to larger companies. “We believe our share price should move up the trading multiples currently realized by certain potential purchasers and large cap pure play owners of Midland Basin assets,” he said.

“We believe we are currently trading at a substantial discount to our intrinsic value and our investors will benefit materially as we transition into a free cash flow mode,” he added. “Likewise, we believe many companies would benefit from owning our portfolio to extend their premium inventory life and enhance their return on capital.”

HighPeak was active in the M&A market in 2022. In June, HighPeak closed a transaction to acquire Hannathon Petroleum LLC, a Howard County, Texas, E&P and other interests in a cash-and-stock deal estimated to be worth about $347 million. And last February, the company disclosed that it had entered a series of agreements to purchase, in aggregate about 9,500 net acres in the Midland’s Borden and Howard counties. That deal consisted of $4 million in cash and 7.73 million HighPeak shares.

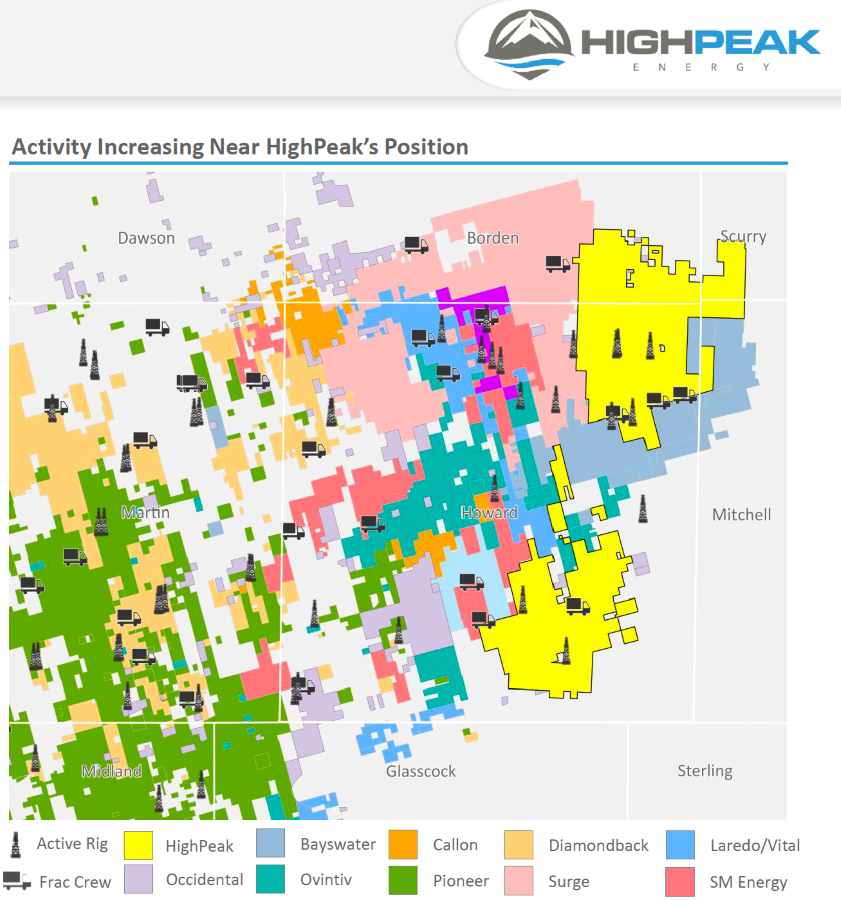

“Many investors remain unfamiliar with the extent of de-risking that has occurred in the eastern Howard County area of the Midland Basin,” Hightower said. “There are currently 11 oil and gas companies running 21 rigs in Howard County, with over 1,600 completions in the last three years. HighPeak successfully drilled 215 horizontal wells across the Wolfcamp and Spraberry formations since inception.”

Hightower said that in an economic backdrop of increasing scarcity of premium undeveloped inventory in the Permian Basin, the company has identified approximately 2,500 total well locations, including approximately 1,300 delineated primary locations which have a projected average return of 95% at a flat price of $90/bbl WTI and $4/MMBtu natural gas.

HighPeak’s production is more than 90% liquids and, based on public data, its margins are the “highest of any pure-play Permian Basin public company,” he said.

“Our primary inventory locations alone are expected to provide over 14 years of activity at a 4-rig pace,” which the company projects will maintain estimated 2024 production of around 75,000 boe/d, Hightower said.

HighPeak’s current acreage position spans approximately 110,000 acres, consisting of two “highly contiguous blocks [and] is configured optimally for efficient development,” Hightower said.

“From the beginning, we had the long-term goal to both develop this acreage to maximize our returns and to minimize future infill, parent-child related issues,” he said.

The company has planned its facilities, infrastructure and production corridors in an environmentally sound, efficient manner. Hightower said that with many years of high-return inventory, first-class infrastructure and production facilities, it is “one of the premier acreage positions in the Midland Basin.”

HighPeak has not set a timetable for the conclusion of its evaluation of strategic alternatives and it does not intend to comment further unless and until the board has approved a specific course of action.

The company has engaged Credit Suisse Securities (USA) LLC and Wells Fargo Securities as financial advisers and Vinson & Elkins LLP as legal counsel to assist in the review process.

For 2023, the company set guidance of 47,000 boe/d to 53,000 boe/d on capex, at the midpoint, at $140 million.

Recommended Reading

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

APA Corp., TotalEnergies Announce $10.5B FID on ‘Goliath’ Sized Deal Offshore Suriname

2024-10-01 - APA and TotalEnergies’ offshore Suriname GranMorgu development is estimated to hold recoverable reserves of more than 750 million barrels.

Oceaneering Acquires Global Design Innovation

2024-10-30 - Oceaneering purchased Global Design Innovation, the only provider certified by the United Kingdom Accreditation Service (UKAS) to perform remote visual inspection using point cloud data and photographic images.

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.