HighPeak Energy Inc. agreed on April 27 to acquire the Howard County, Texas, assets of Hannathon Petroleum LLC and other nonoperated working interest owners in a cash-and-stock deal estimated to be worth about $373.4 million.

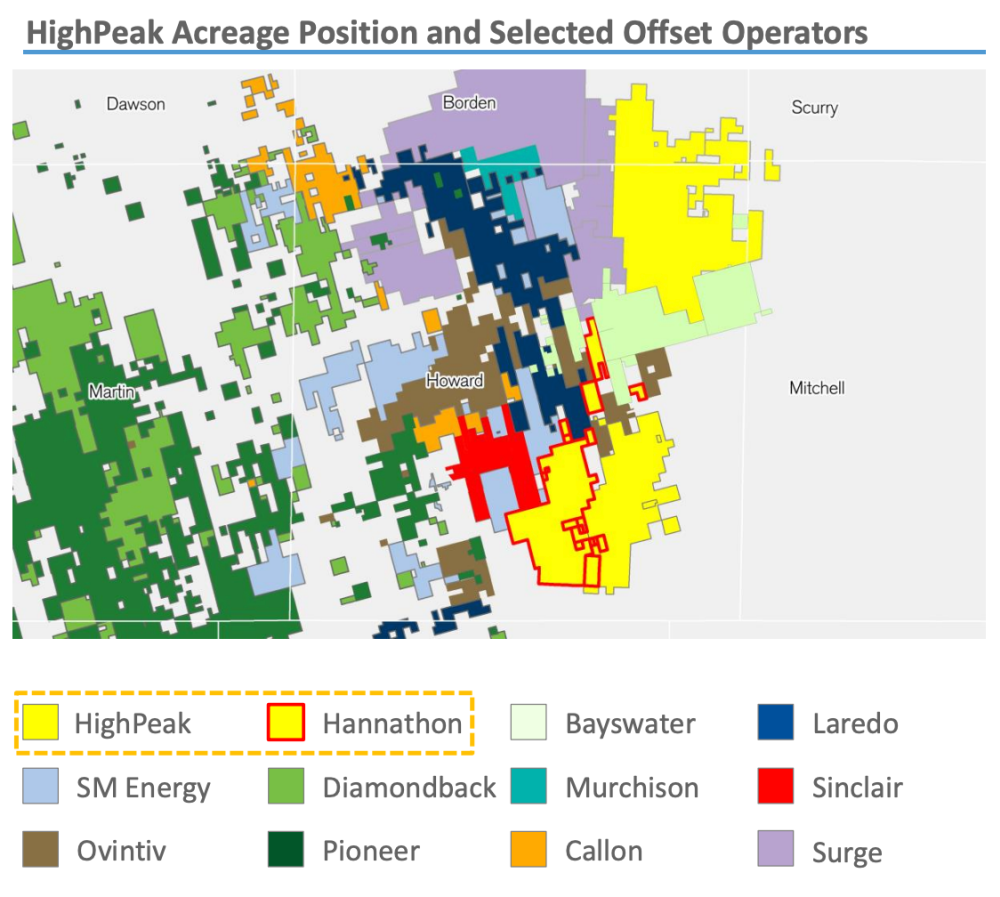

The bolt-on acquisition adds approximately 150 net locations and 18,600 net acres in the Midland Basin largely contiguous to the company’s existing Signal Peak position with 2022E average production of 5,000 boe/d (85% liquids). Chairman and CEO Jack Hightower said HighPeak began its strategic expansion in the Signal Peak area in August 2021 by acquiring a nonoperated ownership interest in these assets.

“Acquiring the balance of the working interest will bolster our drilling potential in the area and give us control of significant infrastructure to support, and accelerate, our development program in the region,” Hightower commented in a company release.

The Hannathon acquisition also marks HighPeak second strategic acquisition so far in 2022. The company unveiled in March it had entered into a series of agreements during the first quarter to acquire various crude oil and natural gas properties contiguous to its Flat Top operating area, which in the aggregate, consist of approximately 9,500 net acres.

“This acquisition, coupled with our targeted leasing, has increased our total acreage position to over 91,000 net acres,” Hightower added on April 27.

HighPeak Energy is a publicly traded independent crude oil and natural gas company, headquartered in Fort Worth, Texas, focused on the acquisition, development, exploration and exploitation of unconventional crude oil and natural gas reserves in the Midland Basin in West Texas.

The Hannathon acquisition is expected to add further momentum to HighPeak’s growth strategy by providing the ability to leverage substantial infrastructure-in-place to accelerate the pace of Signal Peak development. The company, however, still expects to maintain Hannathon’s existing one rig drilling program on the acquired acreage through 2022, according to the release.

HighPeak’s 2022 guidance updated for the Hannathon acquisition includes an average production rate of between 32,000 and 37,500 boe/d with an exit production rate of 47,000 and 53,000 boe/d. Total capex is now estimated to range from $825 million to $900 million for the year.

Purchase consideration due to the sellers, subject to customary closing adjustments, is comprised of $255 million in cash and approximately 3.78 million shares of HighPeak’s common stock. The cash portion of the consideration is expected to be funded with cash on hand and borrowings under the company’s revolving credit facility.

In connection with the close of this transaction and the annual Spring redetermination, HighPeak expects to receive consents from its bank group to substantially increase the aggregate elected commitments and borrowing base on its revolving credit facility, according to the release.

HighPeak added that the Hannathon acquisition was acquired at approximately a 3.0x multiple on 2022E EBITDAX with further uplift from synergies estimated at $70 million on a present value basis.

“We are very excited to report continued success in accretive consolidation and value creation for our shareholders,” Hightower continued. “We look forward to our first-quarter earnings call in May, which will provide additional guidance, technical information and recent results related to our drilling program in the Signal Peak area, which should continue to prove out the value of our position.”

The Hannathon acquisition has been unanimously approved by the HighPeak board of directors, Hannathon Petroleum and the other nonoperated working interest owners. The transaction has an effective date of Jan. 1, and is expected to close early in the third quarter of 2022.

Credit Suisse Securities (USA) LLC served as financial adviser to HighPeak Energy. Jefferies LLC acted as financial adviser to Hannathon. Akin Gump Strauss Hauer & Feld LLP and Vinson & Elkins, LLP served as legal advisers for HighPeak Energy and Shearman & Sterling LLP served as legal adviser for Hannathon.

Recommended Reading

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.