Shearwater platform with walkway leading to wellhead jacket in the North Sea. (Source: Shell)

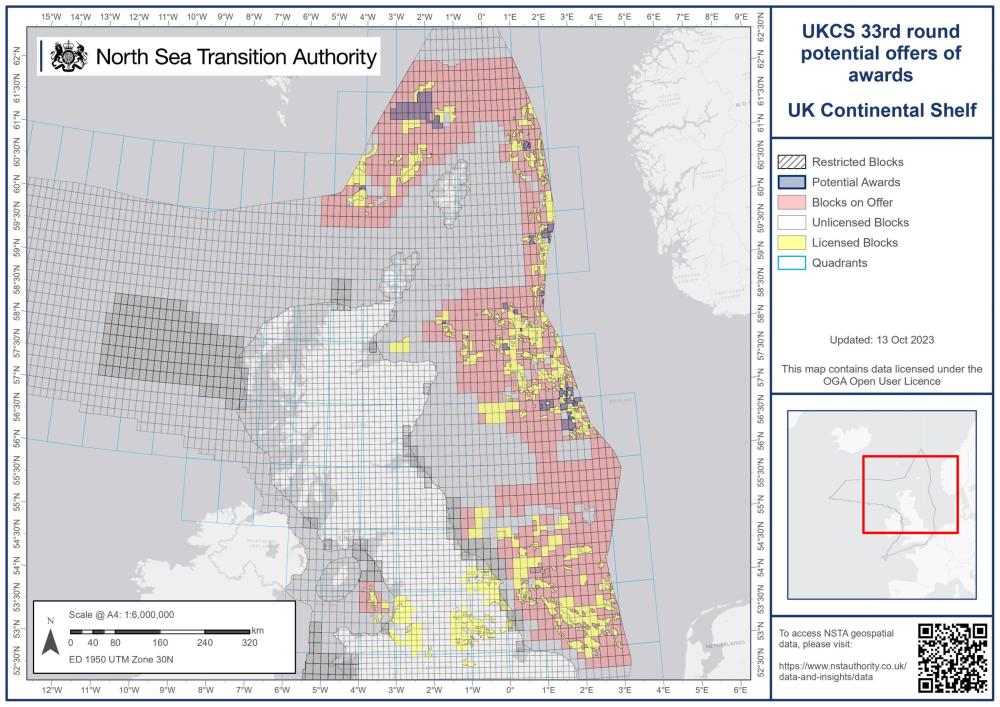

The North Sea Transition Authority (NSTA) offered 27 licenses as part of the 33rd Oil and Gas Licensing Round that launched in October 2022, the NSTA announced on Oct. 30.

When bidding closed on the round in January, NSTA reported receiving 115 applications from 76 companies for 258 blocks or partial blocks. That marked the highest participation in a U.K. licensing round since the 29th round held in 2016 and 2017, the NSTA said. That round put 931 blocks and partial blocks up for licensing.

NTSA said it prioritized awarding 27 licenses because they have the potential to go into production quicker than others. Six other blocks were also ready to be offered and have been merged into five existing licenses.

The awarded licensees, blocks and stakes include:

- Anasuria Hibiscus U.K. Ltd., blocks 15/12a, 15/18a and 15/19a, 100%;

- Athena Exploration Ltd., blocks 208/11a, 208/12b, 208/13b, 208/17a and 208/18b, in partnership with Triangle Ltd. Energy (UK) Proprietary Ltd.;

- Bridge Petroleum 3 Ltd, Block 211/27a, 100%;

- DNO North Sea (U.K.) Ltd., blocks 9/9f, 9/10c, 9/14c and 9/15d in partnership with Aker BP UK Ltd.;

- Eni Elgin/Franklin Ltd., blocks 29/15, 30/6d, 30/11c and 30/16i, 100%;

- Equinor, blocks 9/10a and 16/13b, 100%;

- Equinor, Block 9/12d, in partnership with Ithaca SP O&G Ltd. and One Dyas E&P Ltd.;

- Finder Energy U.K. Ltd., blocks 16/8b and 16/13c, in partnership with Equinor U.K. Ltd.;

- Ithaca Energy (UK) Ltd., blocks 13/23a, 30/1b and 30/2f, 100%;

- Ithaca MA Ltd., Block 15/29d in partnership with NEO Energy (ZEX) Ltd.;

- Ithaca Zeta Ltd., Block 22/9b in partnership with Dana Petroleum (E&P) Ltd.;

- Neo Energy, Block 30/13b, 100%;

- Ping Petroleum U.K. Plc, blocks 21/2a, 211/27b and 211/28b, 100%;

- Shell U.K. Ltd., blocks 22/30d, 23/26c, 29/21, 29/3b, 29/5a, 29/10c, 30/1a, 30/2g, 30/2b and 30/6c in partnership with Neo Energy;

- Shell U.K., Block 204/20d in partnership with BP Exploration Operating Company Ltd.’

- Shell U.K., blocks 208/26b, 208/1, 208/6, 214/4a, 214/5, 214/8, 214/9, 214/10, 214/13b, 214/14a, 214/15a, 213/10b, 213/15a, 214/6, 214/7, 214/11a, 214/12b, 100%;

- Tailwind Energy Chinook, Block 29/2c, 100%;

- Tangram Energy Ltd., Block 14/26c, 100%;

- TotalEnergies E&P North Sea UK Ltd., blocks 23/21b and 23/26g in partnership with BP; and

- TotalEnergies E&P UK Ltd., Block 22/29b, in partnership with Eni U.K. Ltd.

DNO said its awarded area is adjacent to the Norwegian border and just west of the Aker BP-operated Alvheim hub on the Norwegian Continental Shelf. The area also comprises the Agar discovery from 2018, in which they held a 25% interest until it was relinquished in 2020.

DNO said the technical work associated with the area involves acquiring additional 3D seismic and potentially reprocessing the data to reduce risk and volume uncertainty. The first phase will last up to two years, after which a decision on committing to a well will be made.

U.K. seeking energy security

All 258 blocks applications have gone through the initial Habitat Regulation Assessment (HRA) and the blocks being awarded have been identified as not requiring further assessment.

The licenses in the Central and Northern North Sea and West of Shetland were awarded first to let operators press ahead with their plans to explore and develop oil and gas resources. The recent average time from license award to production is about five years.

There are currently 284 offshore fields in production in the U.K. North Sea, and an estimated 5.25 Bboe in total projected production to 2050, according to NSTA.

A recommendation for the remaining 203 blocks will be made after completion of further habitat assessment.

The license awards are part of the NSTA’s efforts to support energy security for the U.K. On Oct. 12, the NSTA published the Wells Insight Report 2023, which found that fewer wells were drilled offshore the U.K. in 2022 than in years past.

Recommended Reading

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

Tech Trends: Safety, Speed, Savings: Automation is Transforming Drilling

2024-03-26 - Drilling is getting smarter through automation, delivering efficiency, consistency and reliability.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.