According to the report, a dozen E&A wells are forecast to be drilled in 2023, while 17 are expected in 2024. (Source: Shutterstock)

Fewer wells were drilled offshore the U.K. in 2022 than in years past, according to the Wells Insight Report 2023 published by the North Sea Transition Authority (NSTA) on Oct. 12.

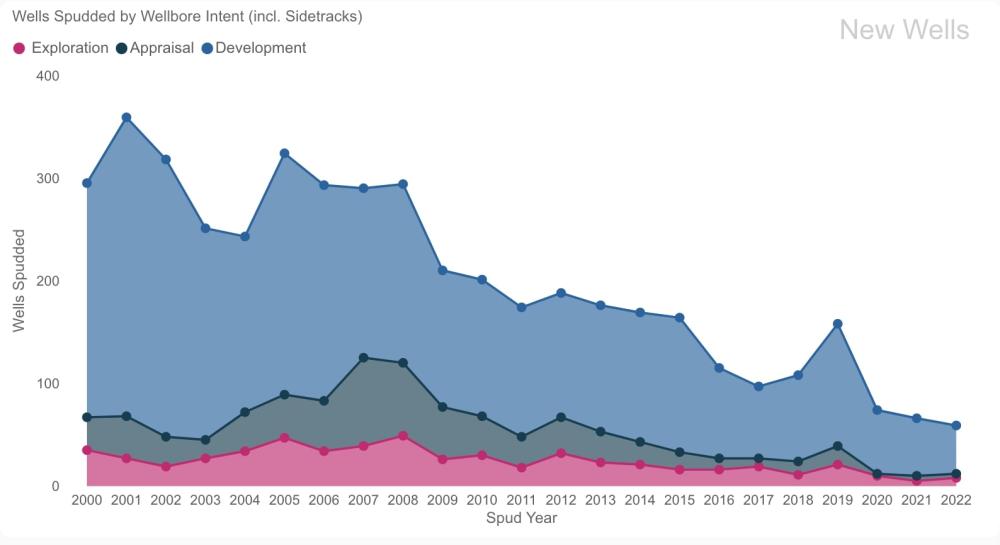

In the last three years, 334 MMboe of potential hydrocarbons have been discovered. Exploration and appraisal (E&A) well count increased to 12 in 2022, up from a 2021 low of 10 wells, but down from the 67 E&A wells drilled in 2012.

The NSTA suggested part of the decline in E&A activity might be attributable to limited capital availability and noted that low E&A activity has a knock-on effect of lowering subsequent development drilling activity.

According to the report, a dozen E&A wells are forecast to be drilled in 2023, while 17 are expected in 2024.

There were 48 development wells spudded in 2022, down from 62 in 2021 and 73 in 2020. For comparison, in 2001, there were 291 development wells drilled, along with 41 appraisal wells and 27 exploration wells.

Of the 48 wells in 2022, 40 are producers and the remainder are water injectors. In 2022, there were 24 wells in the Central North Sea, 17 wells in the Northern North Sea, three in the Southern North Sea and four wells West of Shetland.

The total development well spend was $1.5 billion (£1.23 billion) in 2022, only slightly less than the $1.6 billion (£1.33 billion) spent in 2021 to drill 62 development wells, indicating that the average wellbore cost on the U.K. Continental Shelf (UKCS) has risen. The report noted that some of the development wells were high pressure/high temperature or designed to higher specifications to maximize production, and thus were more costly. In addition, nonproductive time costs accounted for 22% of overall well spending in 2022, up from 15% in 2021 and 12% in 2020, according to the report.

For 2023, there were 61 potential development wells, of which 41 had been approved, while in 2024, 53 wells are planned and 36 wells are slated for 2025.

The NSTA’s baseline ambition is for 60 development wells per year to slow an ongoing production decline and provide more domestic hydrocarbons. The authority said in a press release it is concerned that operators only achieve about 60% of their projected drilling activity and noted that improving that figure would give the supply chain confidence in the amount of work coming through.

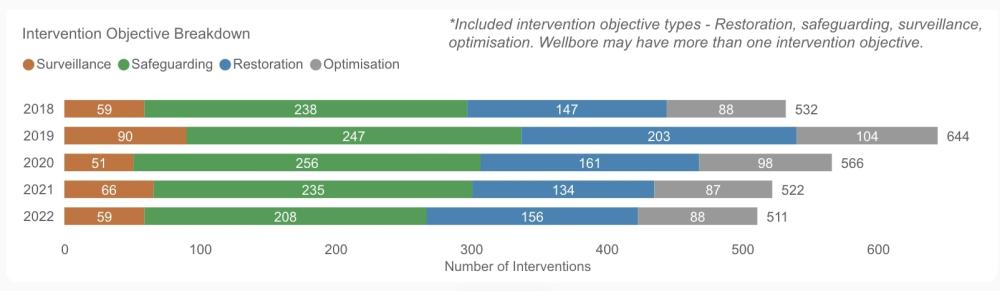

Well interventions also dropped to 511 in 2022 from 522 in 2021 and 566 in 2020. About 15% of wellbores are intervened per year. The report found that well intervention happens more often on platform wells, while only 28 subsea well interventions were performed in 2022.

According to the report, the UKCS well stock total is 2,567—that is, the number of completed wells that have not been permanently abandoned within producing fields. The well stock number is declining as the number of wells drilled is not keeping up with the number of wells reaching end of life. About 30% of all wells are shut in, and many are awaiting decommissioning, intervention or export routes to be reinstated.

In 2022, the average age of operating wells was 22 years.

The UKCS has 3,270 wells that will need to be commissioned, with 2,028 expected to be decommissioned in the next decade.

Recommended Reading

SM Energy Targets Prolific Dean in New Northern Midland Play

2024-05-08 - KeyBanc Capital Markets reports SM Energy’s wells “measure up well to anything being drilled in the Midland Basin by anybody today.”

Vår Selling Norne Assets to DNO

2024-05-08 - In exchange for Vår’s producing assets in the Norwegian Sea, DNO is paying $51 million and transferring to Vår its 22.6% interest in the Ringhorne East unit in the North Sea.

Crescent Energy: Bigger Uinta Frac Now Making 60% More Boe

2024-05-08 - Crescent Energy also reported companywide growth in D&C speeds, while well costs have declined 10%.

SLB OneSubsea JV to Kickstart North Sea Development

2024-05-07 - SLB OneSubsea, a joint venture including SLB and Subsea7, have been awarded a contract by OKEA that will develop the Bestla Project offshore Norway.

Chevron, Total’s Anchor Up and (Almost) Running

2024-05-07 - During the Offshore Technology Conference 2024, project managers for Chevron’s Anchor Deepwater Project discussed the progress the project has made on its journey to reach first oil by mid-2024.