Editor's note: This article has been updated to include additional clarification on the termination fee mentioned in the ninth paragraph.

Chevron Corp.’s plans to acquire Hess Corp. in a $53 billion all-stock deal have reached a major snag. The dispute centers over Hess’ 30% interest in the prolific Stabroek Block offshore Guyana. Partners Exxon Mobil Corp. and China National Offshore Oil Corp. (CNOOC) believe they have a right of first refusal over the interest.

Speculation has run rampant on whether the squabble could kill Chevron’s deal to buy Hess since Feb. 26 when Chevron went public with Exxon’s claims.

“What is certain is that the Stabroek acreage was the real driver in this acquisition, and if that’s no longer available the rest of the portfolio becomes far less attractive,” Rystad Energy Senior Vice President and Head of Latin America W. Schreiner Parker told Hart Energy on Feb. 29.

Texas-based Exxon, which recently announced a $60 billion all-stock deal merger with Pioneer Natural Resources, doesn’t take its interests in Guyana lightly. Exxon is engaged in continued conversations with Hess and Chevron, Exxon said Feb. 28 in an e-mailed statement responding to questions from Hart Energy.

“We owe it to our investors and partners to consider our pre-emption rights in place under our joint operating agreement (JOA) to ensure we preserve our right to realize the significant value we’ve created and are entitled to in the Guyana asset,” Exxon Mobil said.

New York City-based Hess’ media department deferred to Chevron for comments on the matter. While the California-based oil giant did not respond to Hart’s questions about Exxon’s and CNOOC’s claims, it did provide ample details about the noise around Stabroek and Exxon in its Feb. 26 filing with the U.S. Securities and Exchange Commission (SEC).

“Hess, Chevron, Exxon and CNOOC have been engaged in constructive discussions regarding the Stabroek right of first refusal (ROFR), and Chevron and Hess believe these discussions will result in an outcome that will not delay, impede or prevent the consummation of the merger,” Chevron said in the filing. “In the event such discussions do not result in an acceptable resolution, either Hess or Chevron could elect for Hess Guyana Exploration Ltd., [a wholly owned subsidiary of Hess], to pursue arbitration to resolve the matter.”

Either Chevron or Hess can terminate the merger agreement if it hasn’t been completed by Oct. 22, 2024. The initial close by date was April 18, 2024, but Chevron and Hess each waived the right to exercise any termination right available with respect to that date.

However, if Hess stockholders don’t adopt the merger agreement or the merger is not completed, Hess may be required to pay Chevron a termination fee of $1.7 billion, according the filing.

Hess may be required to pay Chevron a termination fee of $1.7 billion under specific circumstances; however, the merger agreement does not provide for breakup fees relating to the right of first refusal provision.

Chevron acknowledged that the Stabroek JOA contained a Stabroek ROFR provision. Chevron said the provision, “if applicable to a change of control transaction and properly exercised, provides the Stabroek Parties [in this case, Exxon and CNOOC] with a right to acquire the participating interest in the Stabroek block held by the Stabroek Party subject to such transaction.”

Chevron said the value of the interest would be based on the “portion of the value of the change of control transaction that reasonably should be allocated to such participating interest and is increased to reflect a tax gross-up) only after, and conditioned on, the closing of such transaction.”

In terms of the Stabroek ROFR, Exxon and CNOOC believe it applies to the Chevron-Hess merger announced on Oct. 22, while Chevron and Hess don’t due to the structure of the merger and provisions language.

Herein lays the dispute, and Exxon, which operates Stabroek, is standing its ground regardless of whatever signal it could send to other international oil companies (IOCs) or national oil companies it partners with in similar deals around the world.

“As operator of the Stabroek block, Exxon Mobil has an obligation to ensure the rights and privileges of the Guyana government, as our host, are honored,” Exxon said in its e-mailed statement. “We are not going anywhere—our focus remains on developing the resources efficiently and responsibly, per our agreement with the Guyanese government.”

John B. Hess, the CEO of Hess, is “against any acquisition proposal or proposal made in opposition to or in competition with, or that would reasonably be expected to prevent, materially delay or materially impede the consummation of the merger or any other transactions contemplated by the merger agreement,” Chevron reported in its SEC filing.

Why Stabroek matters

English-speaking Guyana, home to around 800,000 citizens, just started producing oil from its Stabroek Block in December 2019. The small country—located in northern South America and between Venezuela on its west and Suriname on its east—is on track to become one of the largest oil producers in the Latin America and Caribbean region. The country is poised to surpass Colombia and the region's lone member of OPEC: Venezuela. Brazil and Mexico are currently Latin America's top oil producers.

Guyana’s rising oil production has grabbed the attention of investors in the region and others from around the world, including the Middle East, and rightly so.

Stabroek covers 6.6 million acres, or 26,800 sq km. The block holds over 11 Bboe of estimated gross discovered recoverable resources, Exxon and Hess have reiterated in their most recent press releases. Importantly, energy pundits covering Guyana speculate the ultimate recoverable resources could easily be twice that size.

Currently, three offshore developments are operating in Stabroek, and more are expected.

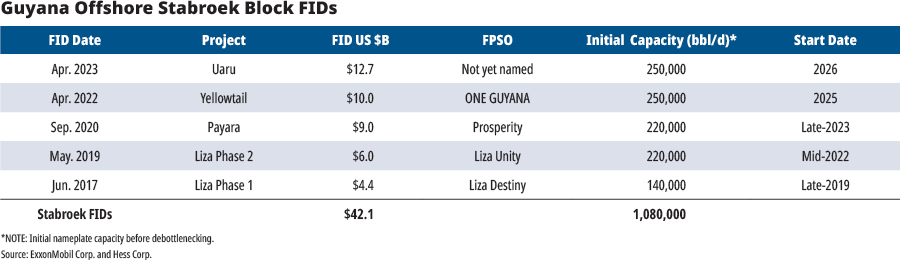

Exxon expects gross combined production from three projects will be around 620,000 bbl/d in the first half of 2024: its first offshore project, Liza Phase 1 (using the Destiny floating production storage and offloading vessel (FPSO); the second project, Liza Phase 2 (using the Unity FPSO); and the addition of the third project, Payara (using the FPSO Prosperity).

By the end of 2027, Exxon and Hess expect Stabroek will have six FPSO vessels online with a gross capacity of over 1.2 MMbbl/d. And, there is potential for up to 10 FPSOs to develop the current resources, according to the two U.S. companies.

Exxon operates Stabroek with a 45% interest. Other partners in the block include Hess (30%) and CNOOC (25%). Chevron’s deal to acquire Hess would move it into the consortium and team up the top two U.S. energy companies.

The offshore oil project is lifting Guyana’s economy, which is expected to grow 34.3% and exceed 2023’s 33% growth in 2023, as Stabroek oil production rises, Ashni Singh, the country’s finance minister said in early January. Projected growth in 2024 will represent the fifth consecutive year that the Guyanese economy has grown over 20%, and will result in Guyana growing at an annual average of 38.8% over that five-year period, Singh said.

Exxon on damage control

Despite the jousting over Hess’ interest in Stabroek, Guyana's government under President Irfaan Ali, continues to want fast-tracked development of its newfound oil resources as well as associated gas.

In Oct. 26, after the Chevron deal to acquire Hess was announced, Guyana Vice President Bharrat Jagdeo said the country welcomed having two major U.S. oil companies in its waters.

“We believe they have deep pockets, and they can fund the investment programs necessary to move us to peak production at the earliest point in time,” he said, according to Chevron’s SEC filing.

Jagdeo, who labeled Chevron as a “good partner too in Guyana,” seemingly would be happy even if Exxon were to assume Hess’ 30% interest, Reuters reported Feb. 28.

However, as Exxon has taken most credit for the success in Stabroek as skipper of the consortium, it hasn’t been immune from criticism on a number of fronts.

In early 2020, a controversial report suggested the Guyanese government of then President David Granger signed a so-called “sweetheart” deal with Exxon, which suggested his government negotiated ineptly with the U.S. energy giant.

In late 2020, Exxon attracted more attention to its leadership in Stabroek over gas flaring as it confronted gas compressor issues on its initial FPSO on the block.

Most recently, Venezuela Vice President Delcy Rodríguez accused the Guyanese president of following orders from Exxon and the U.S. Southern Command regarding claims to the disputed Essequibo territory located between Venezuela and Guyana.

Venezuela still has issues with Exxon, even after the company quit the country in the mid-2000s.

Then, the administration of Exxon Mobil differed with the government of Venezuela’s late President Hugo Chávez over a forced joint venture migration process. The process mandated that state-owned Petróleos de Venezuela (PDVSA) operate new joint ventures and hold a majority interest, which in effect relegated bigger and better financed IOCs to the backseat. Houston-based ConocoPhillips also quit Venezuela for similar reasons around the same time. Numerous other companies also left Venezuela and many continue to pursue lawsuits for compensation of wrongful asset expropriations.

As it stands, Chevron is the lone U.S. company still operating in Venezuela. And Chevron’s presence in Venezuela, coupled with its presence in Guyana, could work to the betterment of discussions between both governments, pundits in Caracas tell Hart.

Despite all the negative press Exxon has generated in Guyana, especially among some climate groups, and in Venezuela among supporters of the government, the company’s actions are in general seen as positive by Guyana’s government and many of its citizens for generating jobs and boosting the country’s economic activities.

RELATED

Chevron-Hess Deal Creates American “Dream Team” Offshore Guyana, Surprises Analysts

Venezuela’s VP Says Guyana Follows Exxon Mobil Script to Rob Resources

Recommended Reading

PureWest Bides Time, Positions for NatGas Demand in West Coast Markets

2024-06-11 - In this Hart Energy exclusive interview, PureWest's COO Kristel Franklin talks about how the private company is navigating the dismal natural gas market opposite public players.

TotalEnergies Joins Ruwais LNG Project in UAE

2024-07-11 - French energy giant TotalEneriges joined the two-train 9.6 million tonnes per annum Ruwais LNG project in the United Arab Emirates with a 10% interest. The LNG project is expected to start sending out cargos in the second half of 2028.

Aethon to Acquire Tellurian Haynesville Shale Assets for $260MM

2024-05-29 - Aethon Energy is acquiring Tellurian Inc.'s Haynesville Shale assets in a $260 million deal, allowing Aethon to continue growing as the basin's top private producer and for financially struggling Tellurian to prioritize its flagship Driftwood LNG project.

Wars Complicate Energy Transition Despite US LNG Security Blanket

2024-06-10 - Analysts with Norway’s Equinor argue that increased levels of geopolitical conflict and outright wars “have made the energy transition more fragmented,” despite U.S. LNG creating an energy security blanket for Europe and elsewhere.

BP Energy Outlook: Oil Demand Diminishes, NatGas, LNG a Wildcard

2024-07-16 - BP’s energy outlook presents a view at current trends for energy use through 2025 and a net zero case, which would require a history-defying shift from adding fuel sources to substituting them.