The Prosperity FPSO during its arrival to Guyana’s Stabroek Block offshore Guyana in early April 2023. (Source: SBM Offshore)

Guyana, the world’s newest member to the oil producing and exporting club, is on track to achieve five consecutive years of double-digit GDP, according to recent estimates through 2024 from the International Monetary Fund (IMF).

The small South American country of around 800,000 people, which started producing oil in December 2019, is the only country in the world to have achieved such a feat thus far in this century. The country’s offshore oil production is expected to continue lifting the country’s economic fortunes this year and next.

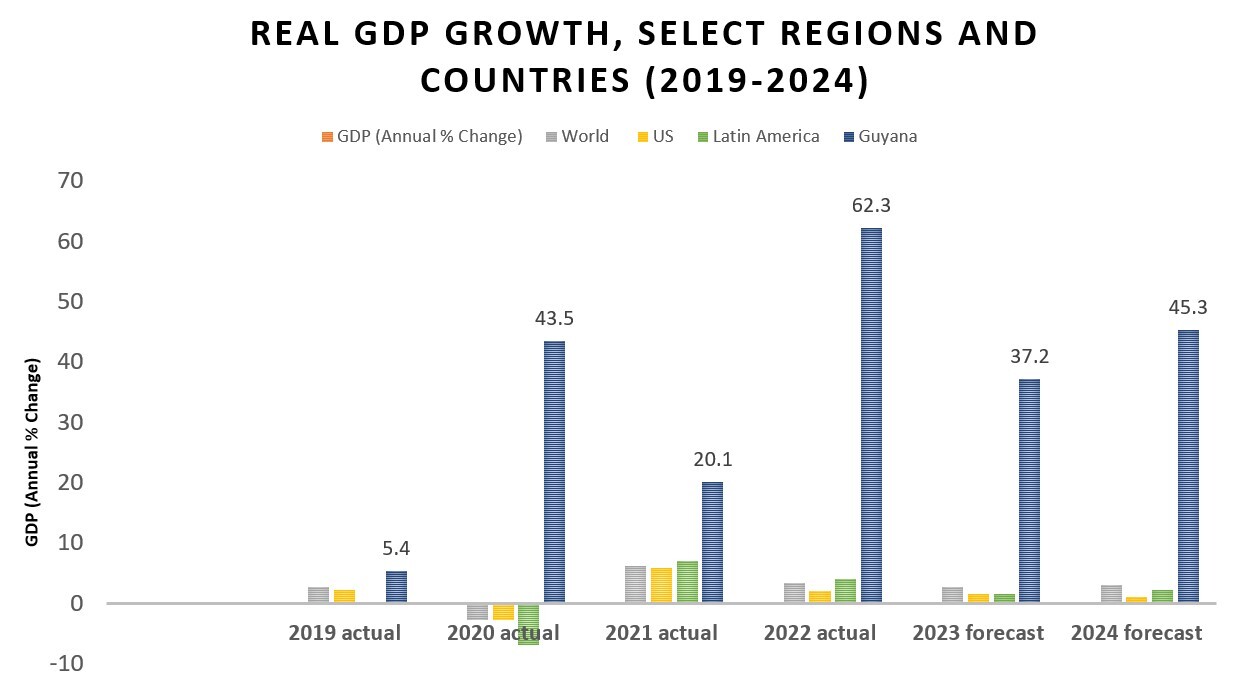

Guyana’s real GDP growth is expected to reach 37.2% in 2023 and 45.3% in 2024, the IMF said in an April 19 report, “World Economic Outlook: A Rocky Recovery.” That continues a trend of dynamic economic expansion despite economic fallout globally in the past few years.

Guyana’s GDP grew 43.5% in 2020 during the onset of the COVID-19 pandemic; 20.1% in 2021 as the pandemic still lingered on; and 62.3% in 2022 amid Russia’s invasion of Ukraine and rising energy and inflation costs worldwide.

While Guyana looks to more years of double-digit growth, the rest of the world is looking at growth of 2.8% in 2023 and 3% in 2024. Within the Latin America region, growth is expected to come in lower at 1.6% in 2023 and 2.2% in 2024, according to IMF estimates.

The IMF’s baseline forecast assumes recent financial sector stresses are contained, before rising slowly and settling at 3% growth through 2028––the lowest medium-term forecast in decades, the IMF said.

The economic forecasts consider inflation of 7% in 2023 and 4.9% in 2024. Globally, inflation averaged 8.7% in 2022.

“Tentative signs in early 2023 that the world economy could achieve a soft landing — with inflation coming down and growth steady — have receded amid stubbornly high inflation and recent financial sector turmoil,” the IMF said before offering comments on risks.

“Risks to the outlook are heavily skewed to the downside, with the chances of a hard landing having risen sharply. Financial sector stress could amplify and contagion could take hold, weakening the real economy through a sharp deterioration in financing conditions and compelling central banks to reconsider their policy paths,” the IMF said.

Guyana’s oil production growth anchors economic growth

Guyana’s impressive economic growth is all tied to the growth of its nascent oil sector, which is being lifted by rising production coming from its prolific Stabroek Block offshore.

The block, operated by an Exxon Mobil-led consortium including Hess Corp. and CNOOC, holds gross discovered recoverable resources of around 11 Bboe. Estimates from energy pundits is that the block easily holds double the resources.

RELATED

Guyana Looks to Monetize Associated Gas

Production from the first two offshore developments, Liza 1 (using the Liza Destiny FPSO) and Liza 2 (Liza Unity), is averaging over 360,000 bbl/d, Exxon Mobil Guyana Country Manager Alistair Routledge said in Houston in March during CERAWeek by S&P Global.

The Prosperity FPSO reached the Stabroek Block on April 11 after travelling just over 11,000 nautical miles from Singapore in just under 50 days, according to SBM Offshore.

By the end of 2027, six projects are expected to be online with a capacity of more than 1.2 MMbbl/d, Exxon executives said on the company’s last quarterly webcast.

Recommended Reading

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

Subsea7 Awarded Sizable Contract in GoM

2024-04-12 - Subsea7 will install a flowline for Talos’ Sunspear development in the Gulf of Mexico.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.