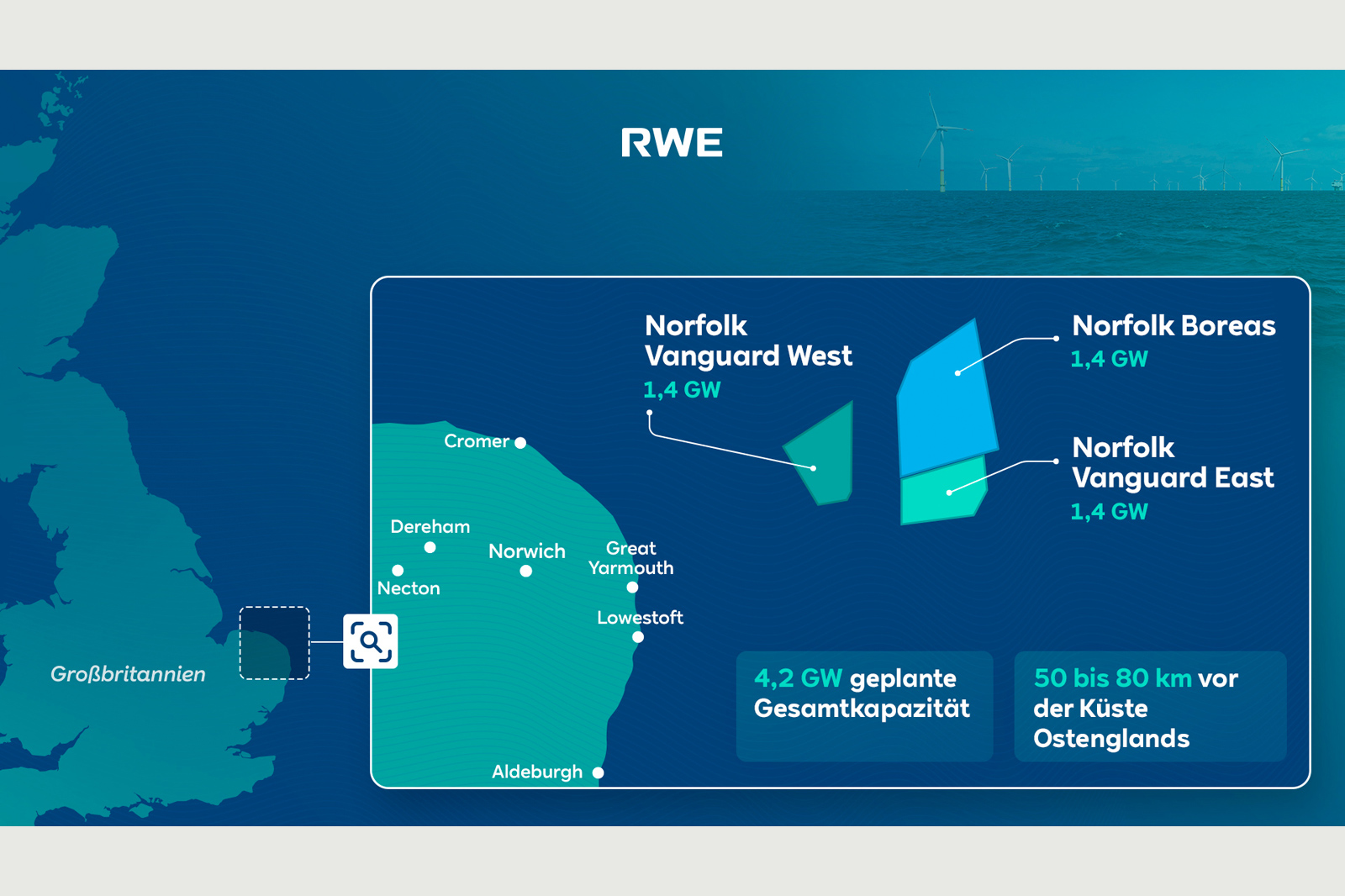

Offshore wind developer RWE is growing its portfolio with the acquisition of Vattenfall’s three Norfolk Offshore Wind Zone projects offshore the U.K. for about $1.2 billion, the Germany-based company said Dec. 21.

The 4.2-gigawatt (GW) wind zone is comprised of the Norfolk Vanguard West, Norfolk Vanguard East and the halted Norfolk Boreas, which RWE plans to resurrect. The transaction is expected to close in fourth-quarter 2024 subject to approval by The Crown Estate.

“After 13 years of development, the three development projects have already secured seabed rights, grid connections, Development Consent Orders and all other key permits,” RWE said in a news release. The company said it looks to secure a Contract for Difference in an upcoming auction round for Norfolk Vanguard West and Norfolk Vanguard East.

The planned acquisition followed RWE’s decision to grow its clean energy portfolio to more than 65 GW by 2030, investing about $60 billion from 2024 to 2030. RWE considers the U.K. one of its core markets. The company currently operates 10 offshore wind farms in the U.K. and has nine—including the Norfolk three—in development. RWE said it expects all three Norfolk wind projects to be commissioned in this decade.

“The timely and efficient deployment of offshore wind is essential to ensure the UK’s domestic energy security, as well as achieving our net zero targets,” said Tom Glover, RWE’s U.K. country chair.

The company also said this week it was awarded an onshore wind project and one solar project, with a combined capacity of 15 megawatts (MW), during France’s technology-neutral tender for hydro, wind and photovoltaic (PV) projects.

Here’s a look at other renewable energy news this week:

RELATED

Solar PV Maker Waaree Plans $1B Facility in Houston Area

Nabors’ Vast New Energy Source

Shell to Sell Wind, Solar Interests to InfraRed Capital Partners

Energy storage

AGL Energy Reaches Final Investment Decision on Liddell Project

Australia’s top power producer AGL Energy said on Dec. 19 it reached a final investment decision (FID) on a 500-MW grid scale battery at the Liddell project in New South Wales.

The total construction cost of the battery project is expected to be about A$750 million (US$502.95 million).

The project will be supported by a A$35 million grant from the Australian Renewable Energy Agency and a long-term energy service agreement arranged by AEMO Services on behalf of the government of New South Wales.

Construction work for the battery project is expected to begin in early 2024 with the start of operations targeted for mid-2026.

AGL shut down the Liddell power station in April after more than half a century of operations as it looked to convert the site into a renewable energy hub.

RELATED

Japan’s Nidec to Invest in Gore Street Energy Storage Fund

Hydrogen

ACWA, Egypt Ink $4B Hydrogen Deal

Saudi Arabia-based ACWA Power said Dec. 20 it signed a deal with Egypt to develop a green hydrogen project in Egypt as part of a $4 billion investment.

The framework agreement, which followed a memorandum of understanding signed in 2022, lays out plans to develop a green ammonia project with a capacity of 600,000 tonnes per year (tpy), ACWA said in a news release. Hydrogen for the project will be produced using wind and solar energy. The plans include work on a larger green hydrogen project in Egypt with a potential capacity of up to 2 MMtpy, the company said.

“Egypt is well-positioned to become one of the world’s top producers of green hydrogen,” ACWA Power CEO Marco Arcelli said in the release.

Partners include the Sovereign Fund of Egypt, Suez Canal Economic Zone, Egyptian Electricity Transmission Co. and the New and Renewable Energy Authority.

The agreement marked another addition to ACWA’s green hydrogen portfolio. The power and water desalination company is also developing the 1.2 MMtpy NEOM green hydrogen project with partners Air Products and NEOM in Saudi Arabia, the Garuda Hidrogen Hijau project in Indonesia and a green hydrogen project in Uzbekistan.

H2U Technologies, De Nora Form R&D Partnership

California-based H2U Technologies, a proton exchange member electrolyzer developer, partnered with membrane supplier De Nora to research and develop electrocatalysts for electrolytic hydrogen production, according to a Dec. 18 news release.

The companies, which signed an R&D agreement, aim to find lower-cost and durable catalysts for water electrolysis, which is the process in which electricity is used to split water into hydrogen and oxygen.

“A key objective in the market for water electrolyzers is to reduce the content of iridium catalysts: H2U is at the forefront of techniques for discovering iridium-free materials,” De Nora CTO Christian Urgeghem, said in the release. “De Nora itself has always been committed to implementing strategies to reduce the use of noble metals in favor of environmental and supply chain sustainability.”

De Nora and H2U previously collaborated using H2U’s Catalyst Discovery Engine to develop a pioneering electrocatalysts for use in water electrolysis-based hydrogen production, according to the release.

RNG

EverGen Completes Fraser Valley RNG Expansion Project

Vancouver-based EverGen Infrastructure Corp. delivered its first gas at its Fraser Valley Biogas expansion, the company said Dec. 21, boosting production of renewable natural gas (RNG).

The facility, which is the first RNG facility in British Columbia, digests manure and off-farm organics. Production is expected to double, ramping up to 160,000 gigajoules (about 152 MMcf) of RNG annually.

EverGen acquired Fraser Valley Biogas in 2021.

“The seamless integration of our facility’s original design, under EverGen’s management and operations team, showcases our capacity and capability to execute these RNG projects,” said Jamie Betts, COO of EverGen. “This is a model that can be replicated across the platform as we continue to prioritize core project delivery.”

RELATED

Clean Energy Financing Up to $400MM with Stonepeak for RNG Production

Solar

Adapture Renewables, Meta Sign Solar Deals

Utility-scale solar developer Adapture Renewables said Dec. 18 that it reached deals with Facebook parent company Meta to procure 330 MW of solar energy for projects being developed in Illinois and Arkansas.

The environmental attribute purchase agreements were signed for energy from three projects with a combined net economic impact of more than $400 million, Adapture said in a news release. Each project is located in areas where former coal facilities were located.

“These solar projects represent an important milestone in continuing our commitment to sustainable operations,” said Urvi Parekh, head of renewable energy for Meta. “Our partnership with Adapture Renewables underscores our dedication to utilizing renewable energy to support our facilities and fostering a cleaner, greener future for all.”

CPV Maple Hill Solar Begins Operations in Pennsylvania

Competitive Power Ventures’ (CPV) affiliate CPV Renewable Power brought the 100-MW Maple Hill Solar farm online in Pennsylvania, the company said Dec. 18.

Located in Portage Township on a former coal mine site, the solar farm—constructed by Gemma Power Systems—features bi-facial solar panels and single-axis tracking. It is expected to generate about 185,000 megawatt-hours of clean electricity annually, avoiding nearly 100,000 tons of CO2 emissions—equivalent to removing about 20,000 cars from the road—each year, CPV said in the release.

“Completion of the CPV Maple Hill Solar project is a tremendous milestone for our company as we continue our efforts to help lead the energy transition by bringing new low or zero carbon resources online,” said Sean Finnerty, executive vice president of renewable power for CPV.

Maple Hill is one of three utility-scale solar projects constructed in 2023 for CPV. It joins the company’s five operating wind projects with a combined capacity of 762 MW.

RELATED

Nabors Closes Combination with Solar-thermal Company Vast Renewables

Wind

Ørsted Reaches FID on 2.9-GW Wind Farm in North Sea

Renewable energy developer Ørsted said Dec. 20 it has taken a FID on the 2.9-GW Hornsea 3 wind farm, which will be capable of producing enough electricity to power more than 3.3 million U.K. homes.

When complete, Hornsea 3 will become the world’s largest offshore wind farm. Commissioning is expected around year-end 2027, Ørsted said.

Located in the North Sea, Hornsea 3 is part of a more than 5-GW wind farm trio that includes the 1.2-GW Hornsea 1 and 1.3-GW Hornsea 2—both of which are operating. The offshore wind farm cluster could also include the up to 2.6-GW Hornsea 4, which would lift the cluster’s capacity to about 8 GW.

“By applying our world-leading capabilities within offshore wind innovation, engineering, operations, procurement and financing, we’ve been able to mature the world’s largest offshore wind project and take final investment decision,” said Ørsted CEO Mads Nipper. “Offshore wind is an extremely competitive global market, so we also welcome the attractive policy regime in the U.K. which has helped secure this investment.”

The FID comes as the U.K. continues to push toward a goal of deploying up to 50 GW of offshore wind capacity by 2030. However, the offshore wind sector faced challenges, including rising costs that have prompted some developers to cancel projects.

Ørsted called Hornsea 3’s risk-reward profile “robust,” given the “well-established supply chain and synergies” with Hornsea 1 and Hornsea 2.

“Most of the capital expenditure for Hornsea 3 was contracted ahead of recent inflationary pressures, securing competitive prices from the supply chain and allowing time to work collaboratively on value creation opportunities,” Ørsted said in a press release.

All major contracts for the project have been secured, including a deal with Siemens Gamesa for SG 14-236 DD offshore wind turbines. “The larger wind turbines and the synergies with Hornsea 1 and 2 lead to lower operating costs than we have seen before in our portfolio,” the company said.

CrossWind Completes 759-MW Wind Farm off Dutch Coast

The Shell-led CrossWind consortium said on Dec. 20 it completed on schedule a 759-MW offshore wind farm at the Hollandse Kust Noord site, a milestone in a sector where similar projects elsewhere face delays due to rising costs.

Completion of the park brings the Dutch installed base of wind power in the North Sea to 4.5 GW, in line with a plan drafted a decade ago and enough to supply about 15% of national electricity needs.

The offshore wind sector has faced cost increases due to inflation, slowing projects in the U.S. and Britain. But outgoing Dutch Energy Minister Rob Jetten said construction costs in the Netherlands have declined with growing expertise and standardization and “we have started to work more and more efficiently.”

Under the Dutch system, private companies, such as Swedish-owned Vattenfall, bid for concessions to build wind farms, while the state ensures proper grid connections. The CrossWind consortium, which includes Mitsubishi-owned energy company Eneco NV, is not receiving any subsidy.

However, Jetten warned parliament in October that costs to finance grid construction at state-owned grid company TenneT would be higher than expected due to rising interest rates.

The Dutch government has planned to continue building quickly in the North Sea, adding additional larger farms at 2 GW each to reach 21 GW in total installed capacity by 2030-2031.

It is not clear whether the country’s next government will continue those plans.

TotalEnergies to Sell Seagreen Wind Farm Stake to Thailand’s PTTEP

France’s TotalEnergies said on Dec. 21 it would sell a 25.5% stake in the Seagreen wind farm offshore Scotland to Thailand’s PTT Exploration and Production (PTTEP) for 522 million pounds (US$661.4 million).

“This transaction is a new milestone in the implementation of our transition strategy and will contribute to reaching our 12% profitability target in Integrated Power business,” said Patrick Pouyanne, chairman and CEO of TotalEnergies.

TotalEnergies and Thai oil and gas giant PTTEP will each hold 25.5% of Seagreen, with SSE Renewables owning 49%.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.