As investments pour in for companies working to advance battery, geothermal and solar projects, governments are coming together to advance hydrogen.

This week saw the governments of Canada and Germany partner to establish a bilateral hydrogen alliance with German energy firms Uniper and E.ON crafting deals to buy green ammonia from Canada’s EverWind.

Amazon also fulfilled some hydrogen needs, sealing a deal with Plug Power; while Shell partnered with electrolyzer provider Ohmium to explore green hydrogen applications, markets and project opportunities.

Here’s a look at some of this week’s renewable energy news.

Batteries

Exagen Lands Funding from Octopus Energy

Renewable technology company Exagen has secured a multimillion-dollar investment from a new fund to help the company build utility-scale solar and battery storage facilities, the U.K.-based company said Aug. 24.

The investment was made by Octopus Energy Development Partnership, which is managed by Octopus Energy Generation. With the financial boost, Exagen plans to open a second office and acquire three co-located solar and battery storage projects with an aggregate capacity of about 400 MW in the U.K.

Exagen said it has already secured land and grid connection for a 500 MW/1 GWh standalone mega-battery in the Midlands in the U.K. The site, expected to be one of the U.K.’s largest battery storage sites, is scheduled to start operations in 2027, according to a news release. The standalone battery would be capable of exporting the equivalent electricity usage of 235,000 homes, Exagen said.

“Making the first investment from this new renewable development fund is a major milestone for us and we’ve got some more coming up,” Alex Brierley, co-head of Octopus Energy Generation’s fund management team, said in the release. “Working with Exagen, there’s a massive opportunity to scale solar and battery storage projects—and these will play an absolutely integral role in the flexible renewable energy system of the future.”

Geothermal

Fervo Secures Funding from DVC, Liberty Energy, Others

Geothermal power player Fervo Energy has raised $138 million in new funding led by DCVC to build and operate carbon-free power plants, according to a news release.

The funds will be used to complete power plants in Nevada and Utah and evaluate new projects in California, Colorado, Idaho, Oregon, New Mexico and internationally.

In addition to DCVC, new investors included CPP Investments, Liberty Energy, Macquarie, Grantham Foundation for the Protection of the Environment, Impact Science Ventures and Prelude Ventures.

Fervo recently signed a 40-MW power purchase agreement with East Bay Community Energy. Last year, the company reached an agreement to power Google’s data centers using geothermal energy.

Hydrogen

Shell, Ohmium Partner in Pursuit of Green Hydrogen Solutions

Shell India has teamed up with Ohmium International, which designs and manufactures electrolyzers, to explore green hydrogen applications, markets and project opportunities in India and other parts of the world, Ohmium said Aug. 24.

The companies plan to form joint working groups to assess opportunities.

“We plan to develop integrated hydrogen hubs to serve the industry and heavy-duty transport to be a leading player in this space,” Nitin Prasad, chairman of Shell Group of companies in India, said in a news release. “This MoU with Ohmium is a step in our journey.”

Shell is aiming for net-zero emissions by 2050.

A green hydrogen company, Uhmium designs, manufactures and deploys PEM electrolyzers.

Amazon Turns To Plug Power For Green Hydrogen

Amazon has tapped Plug Power to supply liquid green hydrogen starting in 2025 as the multinational e-commerce and tech company decarbonizes its operations.

The deal announced Aug. 25 calls for Plug to supply 10,950 tons per year of liquid green hydrogen to fuel Amazon’s operations. Hydrogen deliveries are set to start Jan. 1, 2025.

“Amazon is proud to be an early adopter of green hydrogen given its potential to decarbonize hard-to-abate sectors like long-haul trucking, steel manufacturing, aviation, and ocean shipping,” said Kara Hurst, vice president of worldwide sustainability at Amazon. “We are relentless in our pursuit to meet our Climate Pledge commitment to be net-zero carbon across our operations by 2040, and believe that scaling the supply and demand for green hydrogen, such as through this agreement with Plug Power, will play a key role in helping us achieve our goals.”

Plug said the deal will help move the company closer to its 2025 $3 billion revenue goal. The company said it granted Amazon a warrant to acquire up to 16 million shares of Plug’s common stock. “Amazon would vest the warrant in full if it spends $2.1 billion over the seven-year term of the warrant across Plug products, including, but not limited to, electrolyzers, fuel cell solutions, and green hydrogen,” according to the news release.

The hydrogen agreement builds on the relationship between the two companies. Plug has been instrumental in helping Amazon replace batteries in forklifts with more than 15,000 fuel cells at 70 distribution centers since 2016. Plug aims grow its green hydrogen production from 70 tons per day by year-end 2022 to 1,000 tons per day by 2028.

Uniper, E.ON to Import Green Ammonia from Canada

German energy firms Uniper and E.ON plan to work on deals with Canada’s EverWind to buy a total of 1 million tonnes of green ammonia a year from the middle of the decade, in a bid to further diversify away from Russian energy.

Both firms signed respective initial agreements (MOU) during a trip to Canada by German Chancellor Olaf Scholz and Economy Minister Robert Habeck, accompanied by the CEOs of Volkswagen, Uniper and Siemens Energy.

“This is an important step not only to strengthen our bilateral economic relations, but also for a future-oriented and sustainable energy supply," Scholz said in a statement.

The MOUs come ahead of the planned signing of a joint declaration between Canada and Germany to establish a bilateral hydrogen alliance later Aug. 23.

The ammonia will come from EverWind’s planned Point Tupper facility, which is expected to start commercial operation in early 2025. Green ammonia, produced via renewable energy, can be either used in its gas form or be turned into green hydrogen to power the local economy.

Uniper said once agreed, the deliveries” will facilitate decarbonization across Germany and other European countries while reducing Germany’s dependence on fossil fuel-based products from Russia.”

World Energy Pursues $12B Hydrogen Project

Boston-based World Energy, a provider of net-zero solutions, will invest $12 billion in Canada’s Newfoundland and Labrador to produce hydrogen using Atlantic Canada’s wind resources, the company said Aug. 24.

As part of the project, called Nujio’qonik, the company said its subsidiary World Energy GH2 will supply 250,000 metric tons of green hydrogen per year to global markets. The project aims to begin Canadian hydrogen exports in 2024. The project was announced with Canadian Prime Minister Justin Trudeau and German Chancellor Olaf Scholz on hand.

“Atlantic Canada is positioned to be a global leader in the production of green hydrogen but there is no time to waste. World Energy GH2 is thrilled to deliver tangible support to our friends in Europe who urgently need reliable sources of clean energy,” John Risley, director of World Energy GH2, said in a news release.

Permit applications for the project have been submitted or are in progress, the company said on its website.

Broker Marsh Launches World First Insurance for Hydrogen Projects

Broker Marsh, a unit of Marsh & McLennan, said on Aug. 22 it was launching the world’s first dedicated insurance for hydrogen energy projects, as the nascent industry looks to scale up quickly in the fight against climate change.

As the world targets net-zero emissions by mid-century in an effort to cap global warming, hydrogen, particularly green hydrogen made from renewable energy sources, is seen as a crucial means of getting there.

Projects involving the highly flammable gas have often found it harder to find cover, partly because of the complexity and risks involved in production, transportation and storage, and as new and emerging technologies are generally considered riskier.

Developed with insurers American International Group and Liberty Specialty Markets, Marsh said the new facility would provide up to $300 million of cover per risk for the construction and start-up phases of hydrogen projects globally.

The facility would be available to multinational organizations as well as smaller firms and cover both new and existing blue and green hydrogen projects, the world’s largest insurance broker said.

Solar

China Warns Against Monopolies, Hoarding in Photovoltaic Industry

China’s industry ministry issued a notice on Aug. 24 to promote and optimize the development of the country’s photovoltaic industry, warning against market monopolies and encouraging development of power and storage projects.

Due to supply and demand mismatches, severe price fluctuations, and hoarding in the supply chain of the photovoltaic industry, there is an “urgent need to deepen industry management,” the ministry said.

“Local market supervision departments should strengthen supervision and management... (and) severely crack down on illegal activities in the photovoltaic industry,” said the industry ministry, citing price bidding, monopoly practices and the production and sale of fake products as such activities.

The ministry also cautioned against hoarding and reselling materials and resources within the industry, and encouraged relevant enterprises to develop reserves of polysilicon, batteries and other materials to promote peak shaving and the stability of the industrial supply chain.

“Hoarding is strictly prohibited,” it said.

Bolt, Orion-E Partner to Build Solar Plants in Brazil

Energy infrastructure company Orion-E has reached an agreement with energy trader Bolt to build solar photovoltaic plants in Brazil with a combined capacity of 500 MW, a company executive said Aug. 23.

The solar venture is expected to cost around 3.2 billion reais (US$627.49 million) in investments and will be located in several Brazilian states, including Minas Gerais, Hugo Albuquerque, Orion-E’s chief communications officer, told Reuters in an interview.

Orion-E, a relatively new player and owned by private-equity backed Domus Holdings, already has a portfolio of 1.2 GW wind and solar projects of different sizes either completed or under development, Albuquerque said.

The projects will involve small-scale production and are expected to be ready operationally within the next 24 months.

Under the agreement, Orion-E will develop the projects, while Bolt will sell the energy to consumers.

Wind

Norway Preps For Offshore Wind with Surveys

The Norwegian Petroleum Directorate (NPD) is gearing up for potential offshore wind developments by conducting subsurface surveys in the Sørlige Nordsjø II and Utsira Nord areas, it said in a news release Aug. 25

Data will be collected and processed by Fugro Norway. Mobilization of the Fugro Venturer took place Aug. 25 as crews prepared to conduct pilot surveys in the eastern part of Nordsjø II.

The project includes collection of basic seismic, bathymetry and water column data. Data collection is scheduled to wrap up in early October with data processed by year-end, the NPD said.

“This is an important step toward developing offshore wind on the Norwegian shelf,” said Arne Jacobsen, assistant director for technology, analyses and coexistence for the NPD. “The NPD has extensive experience and considerable expertise in operating seismic surveys from oil and gas activities. A sound factual basis is crucial in order to manage the resources in the best possible way.”

The data will help devise development plans for companies awarded licenses.

TotalEnergies, SSE Generate Power at Seagreen

SSE Renewables and partner TotalEnergies have achieved first power generation from the Seagreen wind farm in the U.K. North Sea, the developers said Aug. 23, after the first of 144 Vestas turbine was connected to the grid.

The 1,075-MW wind farm is expected to begin full operations in first-half 2023. SSE said the wind farm will become the largest offshore Scotland and the world’s deepest fixed bottom wind farm with a foundation that will be installed 59 meters below sea level in December.

The site is expected to produce enough electricity to power the equivalent of 1.6 million households. That is about 5 terawatt hours of renewable electricity per year.

“This marks a new step in the development of TotalEnergies’ offshore activities capacity,” Vincent Stoquart, senior vice president of renewables for TotalEnergies, said in a release. “This milestone will contribute directly to our objective of reaching 35 GW of renewable electricity capacity worldwide by 2025.”

TotalEnergies has a 51% stake in the project.

Wind Development for Gulf of Maine?

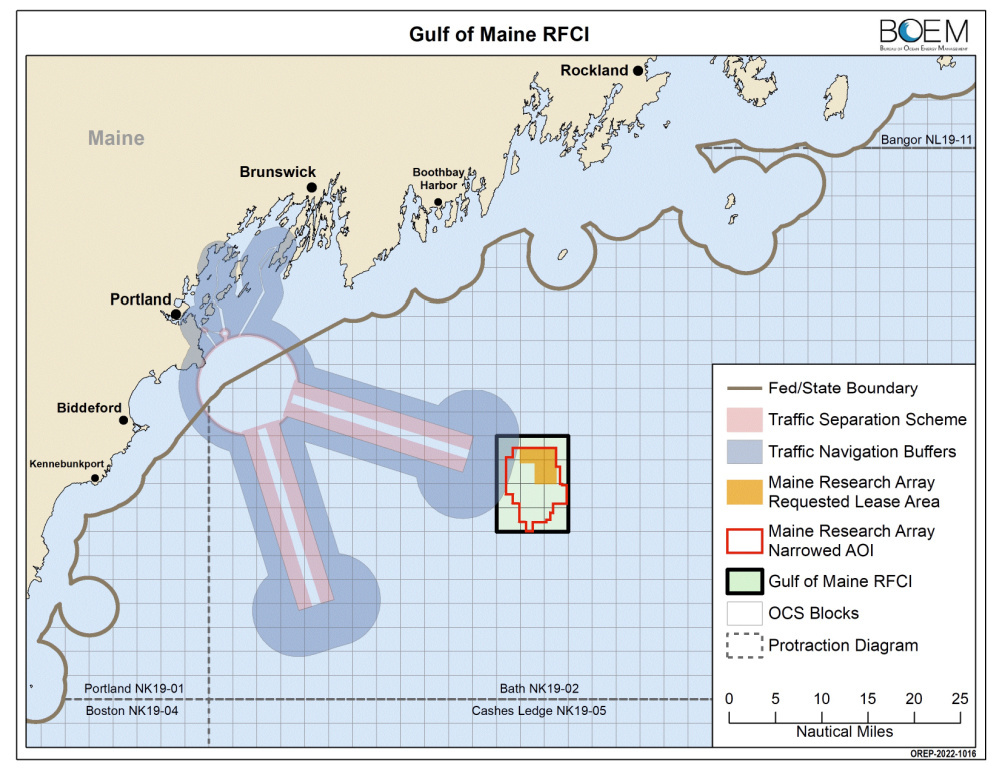

The U.S. Bureau of Ocean Energy Management (BOEM) wants to know if there is interest in development of commercial wind energy in the Gulf of Maine.

BOEM published a request for interest Aug. 19 seeking feedback for the 13.7 million-acre area. Information gathered will be used to narrow down the area up for offshore wind development consideration as BOEM moves forward with the Gulf of Maine planning and leasing process.

The 45-day public comment period runs through Oct. 3.

A request for competitive interest was also published as part of the state of Maine’s application for a research lease, providing notice of the proposed area. The state requests 9,700 acres on the Outer Continental Shelf more than 20 nautical miles off Maine. The research array, if developed, would include up to 12 floating offshore wind turbines capable of generating up to 144 MW of renewable energy, according to BOEM.

“The RFCI Area (68,320 acres) expands upon Maine’s requested research lease area to allow future siting flexibility to avoid or minimize conflicts with existing ocean users should a lease (research or commercial) be issued,” BOEM said. “Only one project, approximately the size of Maine’s research lease proposal (i.e., no more than 10,000 acres and no more than 12 floating turbines), will have the potential to move forward.”

Meridian Energy Raises Cost for Wind Farm Project amid Inflation

New Zealand’s Meridian Energy said on Aug. 24 it expected capital costs for Hawke’s Bay-based wind farm project to rise about 13% to NZ$448 million (US$278.30 million) due to higher expenses from poor weather and rising cost inflation.

The construction has been affected by excessive rains and damages from cyclones since it began in September 2021, but better weather from April has helped.

“The combined impacts of the COVID pandemic, inflationary pressures and resource constraints will impact the project's overall costs,” CEO Neal Barclay said.

However, he said the company is working to maintain the project timeline amid elevated demand for renewable energy sources.

The wind farm, which is touted as one of the biggest in New Zealand, was on schedule to produce its first power in June 2023 and full power production in June 2024.

In February 2021, Meridian had announced an investment of NZ$395 million in the project, with an original capacity of 176 MW, which remains unchanged.

Hart Energy staff and Reuters contributed to this article.

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.