Houston-based Fidelis New Energy has chosen West Virginia as the site for its planned hydrogen production facility, data center campus and greenhouse complex, representing a multibillion-dollar investment.

The company said on Aug. 16 it will produce hydrogen from natural gas and renewable energy. If the required regulatory approvals are secured, Fidelis’ Mountaineer GigaSystem facility will be built in four phases in West Virginia’s Mason County. Plans are to produce more than 500 metric tons per day of hydrogen during each phase, costing an estimated $2 billion per phase.

Operations for the first phase are scheduled to start in 2028, the company said in the release. The project will utilize its FidelisH2 technology to produce hydrogen.

“By combining several proven technologies from leading providers including our FidelisH2 partners Topsoe and Babcock & Wilcox, we are able to produce lifecycle carbon free clean hydrogen at scale, without taking new technology risk,” said Bengt Jarlsjo, co-founder, president and COO at Fidelis. “Our proprietary net-zero solutions using only proven technologies are attracting significant commercial interest from hydrogen users, data center operators, and greenhouse owners.”

About 10 million metric tons per year of CO2 will be permanently stored once all four phases are operational, the company said.

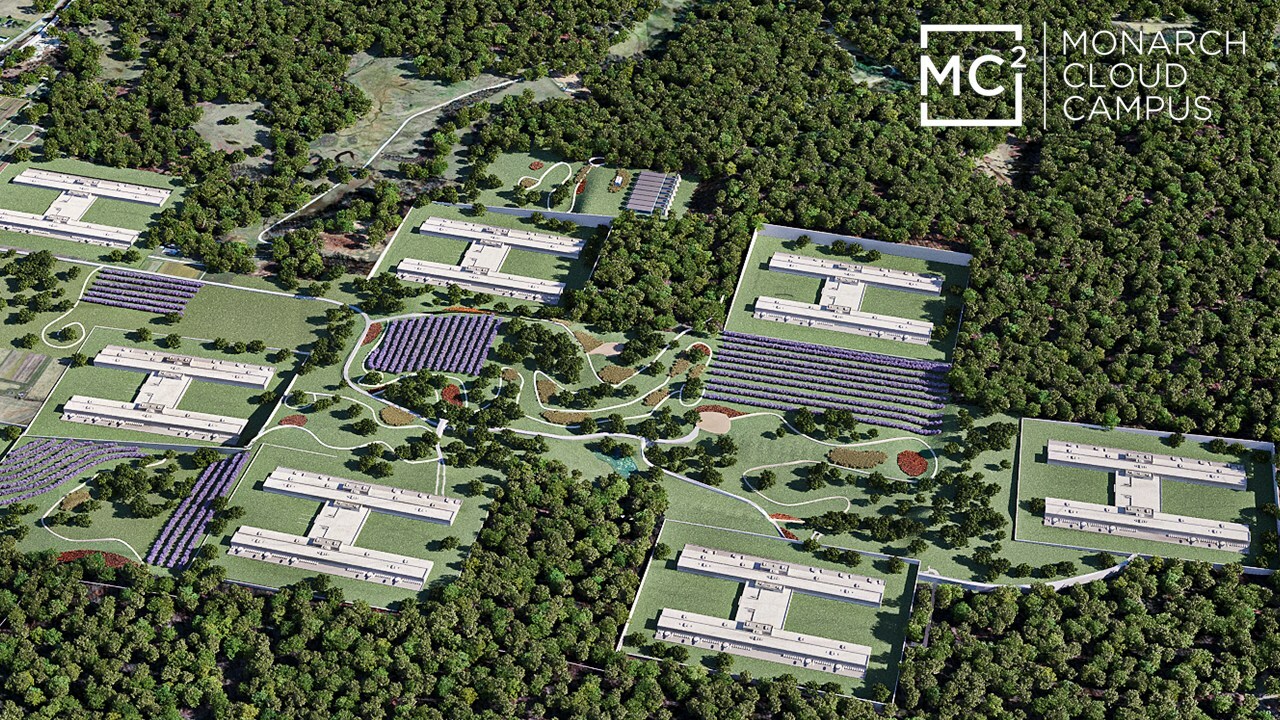

As part of Fidelis’ plan, hydrogen produced would power the company’s data center campus, called Monarch Cloud. Hydrogen could also be transported for other uses, including greenhouses, transportation and steel production, the company said.

“Fully built out, the data center capacity could reach 1,000 MW, representing over $5 billion in additional investment,” Fidelis said in the release. “Waste heat and a portion of the captured CO2 from FidelisH2 production and waste heat the hyperscale data centers would be used as inputs to co-located greenhouses to decarbonize and lower the cost of food production.”

“West Virginia has worked hard to build our reputation as an all-of-the-above energy state,” West Virginia Senate President Craig Blair said in a news release. “This investment by Fidelis will enable them to use our abundant natural gas resources to produce clean hydrogen energy, which then will be used to power manufacturing sites and more.”

West Virginia is part of the Marcellus Shale region, one of the top natural gas-producing basins in the U.S.

Here is a look at other renewable energy news this week.

RELATED:

- IRA One Year Later: Progress, But a Long Way to Go

- Offshore Wind Developer Ørsted Eyes Challenges, Remains Optimistic

Energy Storage

Ford, Partners to Build Cathode Plant in Québec

Ford Motor Co. and partners EcoProBM and Korean battery maker SK On have selected Bécancour, Québec, as the site of a CA$1.2 billion (US$884.7 million) cathode manufacturing facility they will jointly develop to provide materials for EV batteries, Ford said Aug. 17.

With a capacity to produce up to 45,000 tonnes of cathodes annually, the 280,000 sq m site is expected to begin production in the first half of 2026. Ford said the material will be used for batteries for its future EVs. Construction on the site has already begun.

The facility marks Ford’s first investment in Québec, the company said.

EcoPro CAM Canada LP will manufacture high-quality nickel cobalt manganese, using its core shell gradient technology, according to the release.

Ford and SK On plan to invest in EcoPro CAM, forming a joint venture.

“Through the cathode JV [joint venture], the three companies can have a stable supply of battery raw materials in North America,” said SK On Chief Commercial Officer Min-suk Sung. “We will continue to work with our partners to lead electrification of the global auto market.”

The JV will enable EcoPro to mass produce and supply 45,000 tonnes of cathode materials to support production of up to 225,000 EV annually, the release said.

GM Invests in Battery Materials Company Mitra Chem

GM has turned to AI-enabled, battery materials company Mitra Chem to help speed up commercialization of affordable EV batteries.

The automaker said on Aug. 16 it is leading a $60 million Series B financing round for Mitra Chem. The two will collaborate to develop advanced iron-based cathode active materials such as lithium manganese iron phosphate to power EV batteries.

“GM is accelerating larger investments in critical subdomains of battery technology, like cell chemistry, components and advanced cell production processes. Mitra Chem’s labs, methods and talent will fit well with our own R&D team’s work,” said Gil Golan, GM vice president of technology acceleration and commercialization.

The investment will go toward helping Mitra Chem scale operations and bring the novel battery materials formulation to market faster, GM said in the release. The company’s AI-powered platform and advanced R&D facility is located in California.

The startup uses simulations and machine learning models to accelerate formulation discovery, cathode synthesis optimization, cell-lifetime evaluation and process scale-up, the release said. Mitra Chem says it has an in-house cloud platform for battery cathode development, material characterization, cell prototyping,and standardized analyses and visualizations.

Recurrent Energy, APS Sign Energy Storage Agreement

Canadian Solar Inc. subsidiary Recurrent Energy has sealed a 20-year tolling agreement with Arizona Public Service Co. (APS) for 1,200 megawatt-hours (MWh) of energy storage from the Papago Storage project, according to an Aug. 16 news release.

Construction for the project, located in Maricopa County, Arizona, is scheduled to begin in third-quarter 2024 with commercial operations starting in second-quarter 2025. Developers say it will be the state’s largest standalone energy storage project in the state.

The agreement was reached following APS’s quest to find between 1 gigawatt (GW) and 1.5 GW of resources, including up to 800 MW of renewable energy. The electric company has a goal to become 100% carbon-free by 2050.

SK On to Invest $1.1B to Expand Battery Capacity at Home

South Korean battery maker SK On will invest 1.5 trillion won (US$1.12 billion) in South Korea to expand its production capacity at home, the company said Aug. 16.

SK Innovation Co. Ltd.’s battery unit SK On, which supplies Ford Motor Co. and Hyundai Motor Co., among others, said in a statement that its new battery plant will have an annual production capacity of up to 14 gigawatt-hours (GWh) by 2028.

That would take annual production capacity in South Korea to 20 GWh, capable of powering about 280,000 electric vehicles, the company said.

Hydrogen

BP Leads $12.5M Investment in Hydrogen Electrolyzer Developer Advanced Ionics

Wisconsin-based Advanced Ionics, the developer of a new type of hydrogen electrolyzer that splits water into hydrogen using less electricity, has closed $12.5 million in Series A financing led by BP Ventures, the energy giant said Aug. 15.

The capital from investors, which also include Clean Energy Ventures, Mitsubishi Heavy Industries and GVP Climate, will be used to expand Advanced Ionics’ team and help deploy the company’s Symbion water vapor electrolyzer technology.

Advanced Ionics said its technology has lower costs and requires less electricity to produce hydrogen from renewable energy. Its electrolyzer stack, which is made from steel and uses available heat for the process, requires 35 kilowatt-hours (kWh) per kilogram of produced hydrogen compared to more than 50 kWh for typical electrolyzers, the company said.

“Advanced Ionics’ technology has the potential to drive down cost and disrupt the hydrogen market,” BP Ventures Vice President Gareth Burns said in a news release. “BP has a global portfolio of hydrogen projects, and as the world transitions to a net zero future, it’s important to us to be investing in these technologies and advance the track to deploying green hydrogen. We look forward to working with Advanced Ionics on the next stage of its growth.”

The Symbion electrolyzer is already being used as part of a pilot program with Repsol Foundation. BP said it plans to explore pilot opportunities with Advanced Ionics as well.

RELATED: Bloom Energy Installs First Fuel Cells in Taiwan

Solar

Siemens to Make Solar Energy Equipment for US Market in Wisconsin

German conglomerate Siemens said on Aug. 15 it will start producing solar energy equipment in the U.S. in 2024 through a contract manufacturer in Wisconsin.

The announcement marks a move by one of the world’s largest manufacturers to capitalize on incentives in President Joe Biden’s year-old landmark climate change law to boost American-made supplies of solar energy components and compete with China.

Siemens will produce solar string inverters, devices that convert energy generated from solar panels into usable current, for the U.S. utility-scale market, the company said. The products will be made at a facility in Kenosha, Wisconsin, operated by Sanmina.

“Working with Sanmina to establish this new production line, Siemens is well positioned to address supply challenges our country is facing as we work to localize production for green and renewable infrastructure,” Brian Dula, vice president of electrification and automation at Siemens Smart Infrastructure USA, said in the statement.

The work for Siemens will create up to a dozen jobs at the factory to start, the company said in a news release. Production will scale up to a capacity of 800 MW of inverters per year.

The Inflation Reduction Act has unleashed $100 billion in investment in the domestic solar sector in the last year, including $20 billion for solar and storage manufacturing, the top U.S. solar trade group said this week.

More than 50 solar manufacturing facilities have been announced or expanded since the IRA passed, according to the Solar Energy Industries Association study. That includes about 7 GW of inverter capacity.

IRA tax credits incentivize both producers and buyers of domestically made clean-energy equipment. For example, solar projects that use American-made equipment, including inverters and other components, can qualify for a bonus tax credit worth 10% of the project’s cost.

Wind

BOEM Identifies Two Draft Wind Energy Areas Offshore Oregon

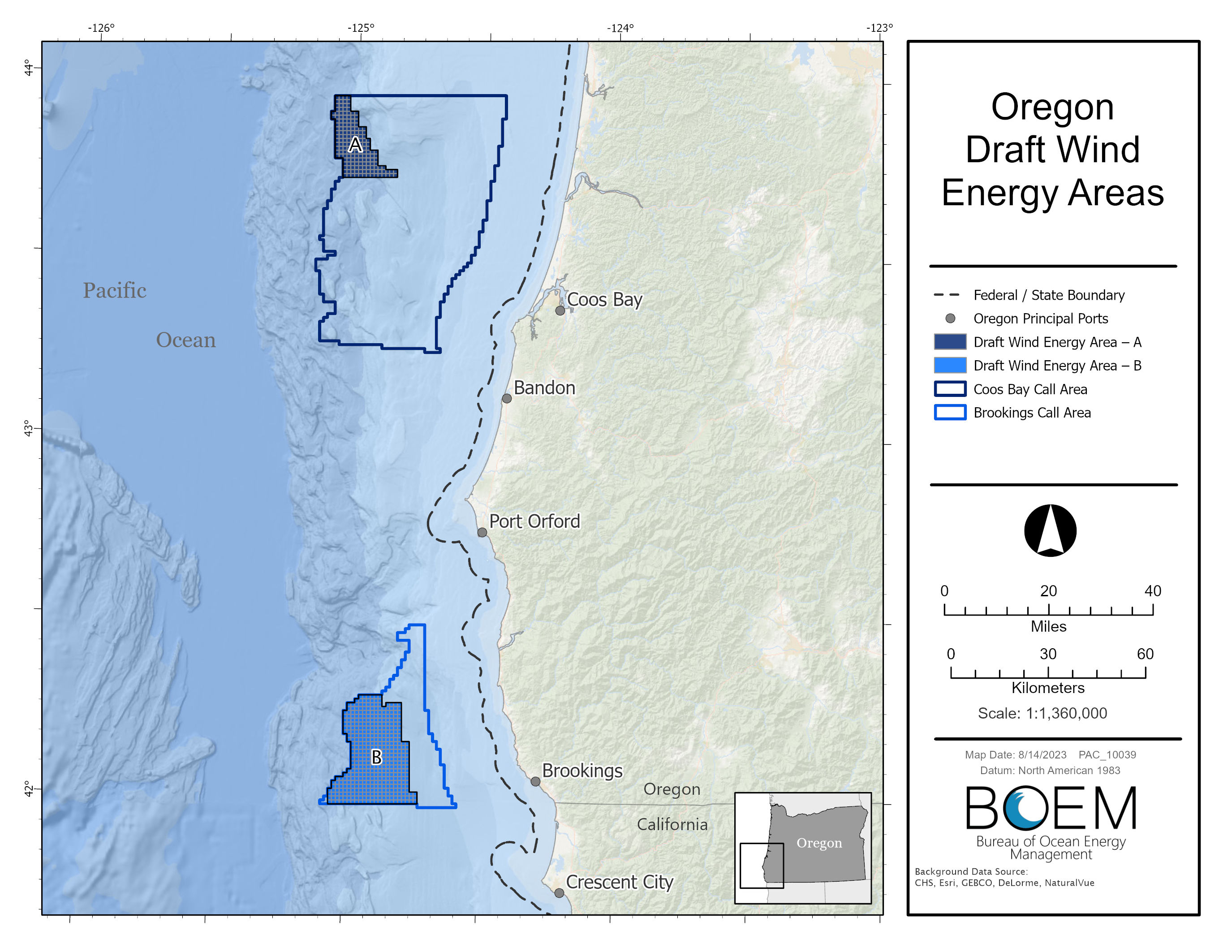

Floating wind energy could be on the horizon offshore Oregon, where the U.S. Bureau of Ocean Energy Management (BOEM) said Aug. 15 it has identified two draft wind energy areas (WEA).

Together, the WEAs—located in the Brookings and Coos Bay areas—cover more than 219,500 acres, ranging from 18 to 32 miles off Oregon’s coast, with a potential to generate up to 2.6 GW of energy, according to BOEM.

“Oregon has major opportunities for offshore wind deployment, which will create good-paying jobs and new economic activity,” BOEM said Aug. 15. “Due to the deep waters off of Oregon’s coast, these areas are also an opportunity to accelerate U.S. leadership in floating technologies.”

Aiming to reduce emissions and dependence on fossil fuels, the U.S. is targeting 30 GW of offshore wind energy capacity by 2030 and 15 GW of floating offshore wind by 2035.

The U.S. is near the beginning of its floating wind journey, having held in December 2022 its first wind auction for development rights in the Pacific Ocean. Five wind leases were awarded in California’s deepwater Morro Bay and Humboldt Bay. More is expected as the U.S. also gears up for potential lease auctions in the Gulf of Maine. The Central Atlantic is also being eyed for floating wind.

Identification of the Oregon draft WEAs kick off a 60-day public comment period. The comments gathered will be considered when designating the final areas, BOEM said.

“As BOEM works to identify potential areas for offshore wind development, we continue to prioritize a robust and transparent process, including ongoing engagement with tribal governments, agency partners, the fishing community, and other ocean users,” BOEM Director Elizabeth Klein said.

As part of the process, BOEM said it will have public meetings to outline data and information used to inform the draft WEAs and to discuss next steps as well as an intergovernmental task force meeting. The public comment period ends Oct. 16.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.