The $234 billion total includes asset acquisitions and corporate M&A, which accounted for 82% of total announced dealmaking last year. (Source: Shutterstock)

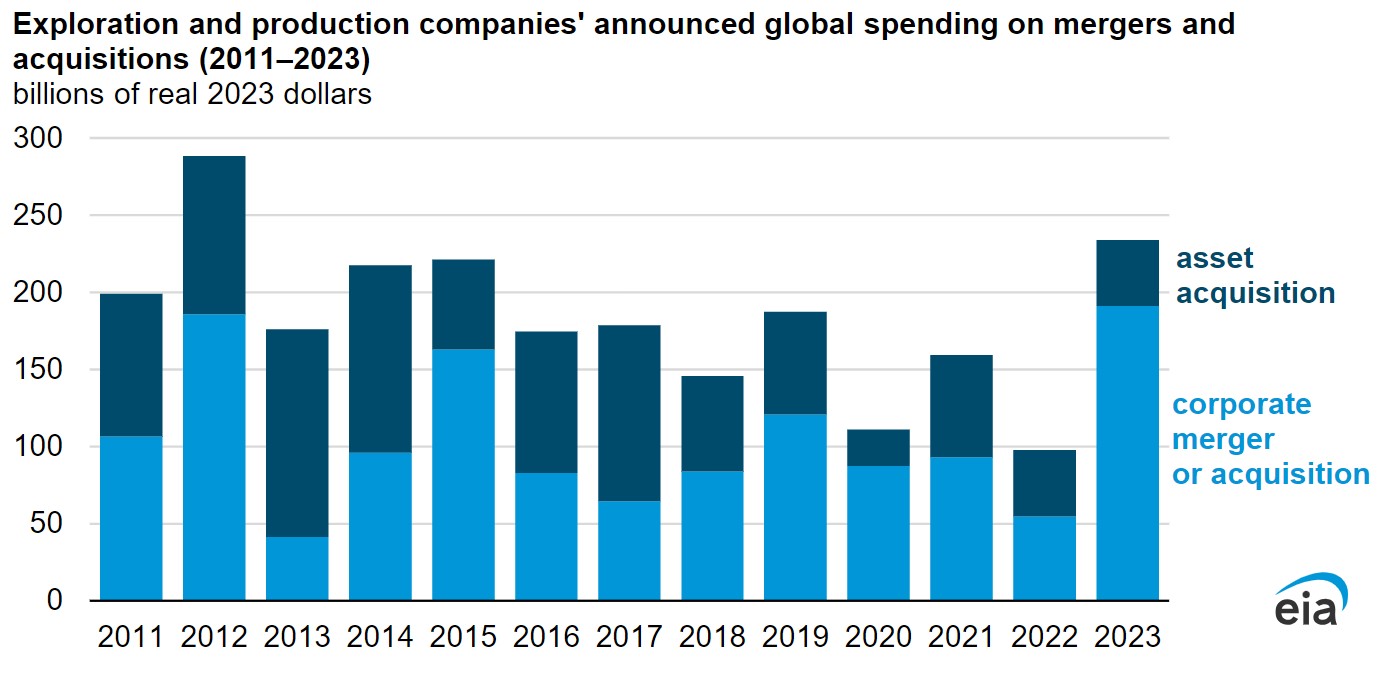

Oil and gas producers spent $234 billion on mergers and acquisitions in 2023, the most in over a decade, federal officials say.

The spike in dealmaking was the most in real 2023 dollars since 2012, according to figures published by the U.S. Energy Information Administration (EIA).

Transactions fell off drastically from 2020 through 2022 due to significant oil market volatility and supply-demand imbalances caused by the COVID-19 pandemic.

The $234 billion total includes asset acquisitions and corporate M&A, which accounted for 82% of total announced dealmaking last year.

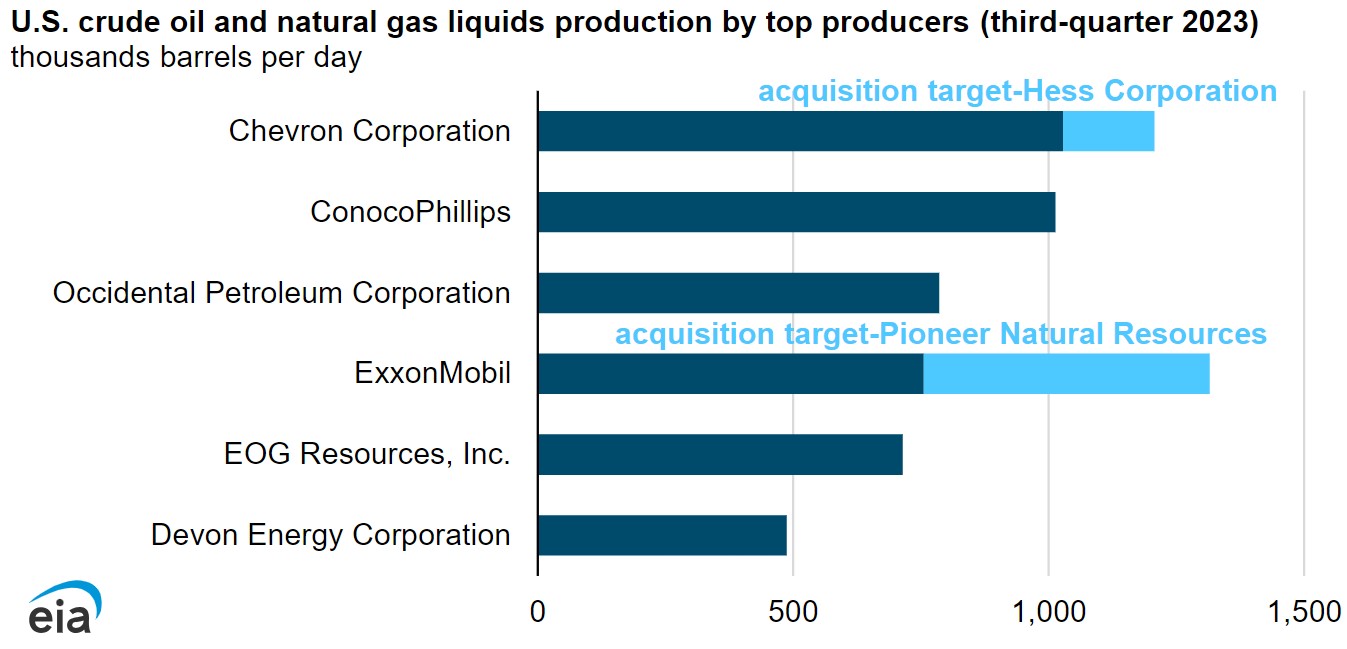

That was largely due to two massive transactions, the EIA said: Exxon Mobil’s $64.5 billion acquisition of Permian Basin juggernaut Pioneer Natural Resources and Chevron’s $60 billion acquisition of Hess Corp.

“These deals are the largest by value in real terms since Occidental Petroleum Corporation acquired Anadarko Petroleum Corporation for a total acquisition cost of $55 billion in 2019,” the EIA wrote in a May 19 report.

Both transactions will yield even larger energy companies owning more producing assets. Chevron is the nation’s top producer of crude oil and NGL. The company averaged just over 1 MMbbl/d in third-quarter 2023, accounting for 5% of domestic production.

If Chevron completes its acquisition of Hess, “it could increase Chevron’s share of U.S. production to 6%,” or just over 1.2 MMbbl/d, based on third-quarter data, the EIA said.

Closing the deal isn’t a guarantee for Chevron, the EIA notes. Chevron’s primary goal by picking up Hess is to buy into the prolific Stabroek Block offshore Guyana. Exxon owns a 45% stake in the Stabroek joint venture, while Hess owns 30%; the China National Offshore Oil Corp. (CNOOC) owns the remaining 25% interest.

But Exxon has filed an arbitration claim to block Chevron’s acquisition of Hess’ stake offshore Guyana, claiming a right to first refusal of a sale.

“The outcome of the claim could affect whether the acquisition is completed or not,” the EIA wrote.

Exxon Mobil is the fourth-largest producer of crude and NGL in the U.S., but the Texas-based supermajor could jump to the nation’s largest producer by acquiring Pioneer Natural Resources.

Following the acquisition, Exxon’s production could increase to nearly 7% of total U.S. output—from about 750,000 bbl/d to 1.3 MMbbl/d.

The tie-up of Pioneer and Exxon would bring together two of the largest producers in the Permian Basin, the nation’s top oil-producing region and a main driver of future U.S. oil output growth.

“ExxonMobil expects that combining its 570,000 net acres in the Delaware and Midland Basins—both sub-basins of the Permian Basin—with Pioneer’s more than 850,000 net acres in the Midland Basin will result in an estimated 16 billion barrels of oil equivalent (BOE) worth of reserves in the Permian Basin,” the EIA wrote.

But Exxon’s Pioneer acquisition also isn’t guaranteed to close. Those companies, as well as Chevron and Hess Corp., have received requests from the Federal Trade Commission for additional information about both deals.

Several other upstream companies have announced notable mergers recently. Diamondback Energy’s $26 billion acquisition of Endeavor Energy Resources would be the largest buyout of a private upstream company when it closes.

Occidental Petroleum is acquiring private E&P CrownRock LP for $12 billion to add scale and inventory runway in the Midland Basin.

Gas producers Chesapeake Energy and Southwestern Energy are combining in a $11.5 billion merger.

Experts say the wave of consolidation shows no sign of cresting or slowing anytime soon.

“[Consolidation] is a natural progression of maturity that goes through these basins,” ConocoPhillips CEO Ryan Lance said March 19 at the CERAWeek by S&P Global conference. “And we’re not done—it’s going to continue.”

Recommended Reading

Exxon’s Payara Hits 220,000 bbl/d Ceiling in Just Three Months

2024-02-05 - ExxonMobil Corp.’s third development offshore Guyana in the Stabroek Block — the Payara project— reached its nameplate production capacity of 220,000 bbl/d in January 2024, less than three months after commencing production and ahead of schedule.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

McKinsey: US Output Hinges on E&P Capital Discipline, Permian Well Trends

2024-02-07 - U.S. oil production reached record levels to close out 2023. But the future of U.S. output hinges on E&P capital discipline and well-productivity trends in the Permian Basin, according to McKinsey & Co.

EIA: Oil Prices Could Move Up as Global Tensions Threaten Crude Supply

2024-02-07 - Geopolitical tensions in the Middle East and ongoing risks that threaten global supply have experts questioning where oil prices will move next.