(Source: Shutterstock)

Activity in the oil and gas sector continues to lag, and executives are pessimistic about the direction of the industry in the months ahead, according to the Federal Reserve Bank of Dallas’ latest energy survey.

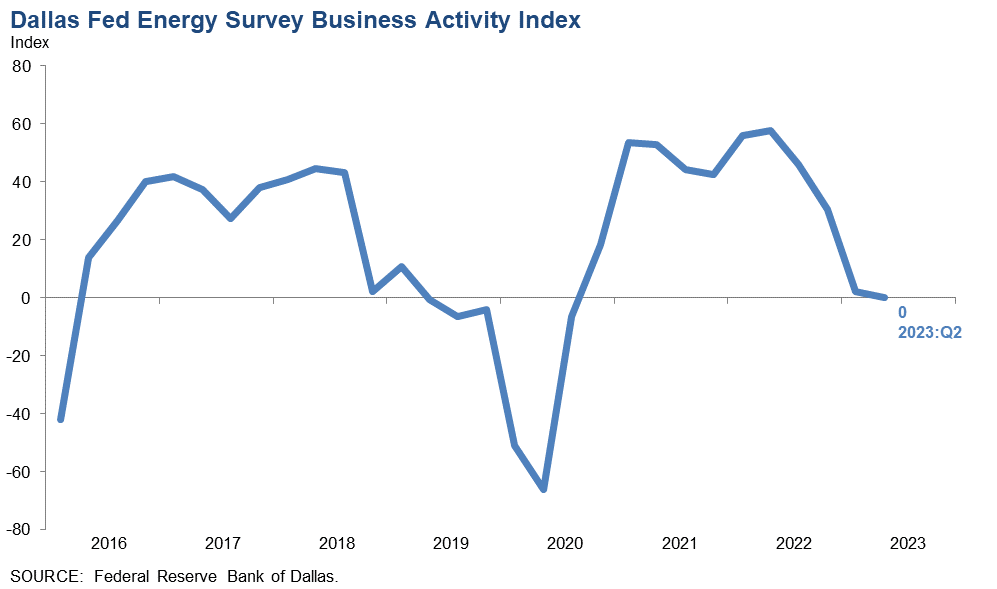

The business activity index—a broad measurement of conditions facing 152 E&Ps and service companies in Texas, northern Louisiana and southern New Mexico—fell to 0 in the second quarter, the Dallas Fed reported June 22.

That’s down slightly from 2.1 in the first quarter and 30.3 in the fourth quarter of 2022.

Crude oil production continues to grow, but at a slower pace compared to the first quarter, according to executives at 101 E&P companies.

Respondents anticipate WTI crude prices rising to $77/bbl by the end of the year—WTI spot prices averaged around $70/bbl during the survey collection period.

The natural gas production index fell from 7.4 to 2.1 quarter-over-quarter as commodity prices still face headwinds.

Survey respondents see Henry Hub natural gas prices growing to $2.97/MMBtu by year-end, up from an average of $2.03/MMBtu during the collection period.

The Energy Information Administration expects Henry Hub natural gas prices to average $2.66/MMBtu in 2023, down more than 58% from an average of $6.42/MMBtu last year, according to the agency’s latest estimates.

Energy companies are still uncertain about the future of the industry: The company outlook index remained negative at -9.1. But that’s not as negative as the first-quarter index of -14.1, said Kunal Patel, a senior business economist at the Dallas Fed during a June 22 briefing with media.

“Looking into the second half of the year, I think the comments suggest larger firms sticking with their plans. There’s only six more months to go,” Patel said. “Some of the smaller firms, this is where the lower prices can weigh on their activity a bit.”

RELATED: EIA: Lower 48 Oil, Gas Production Growth to Slow in July

Size still matters

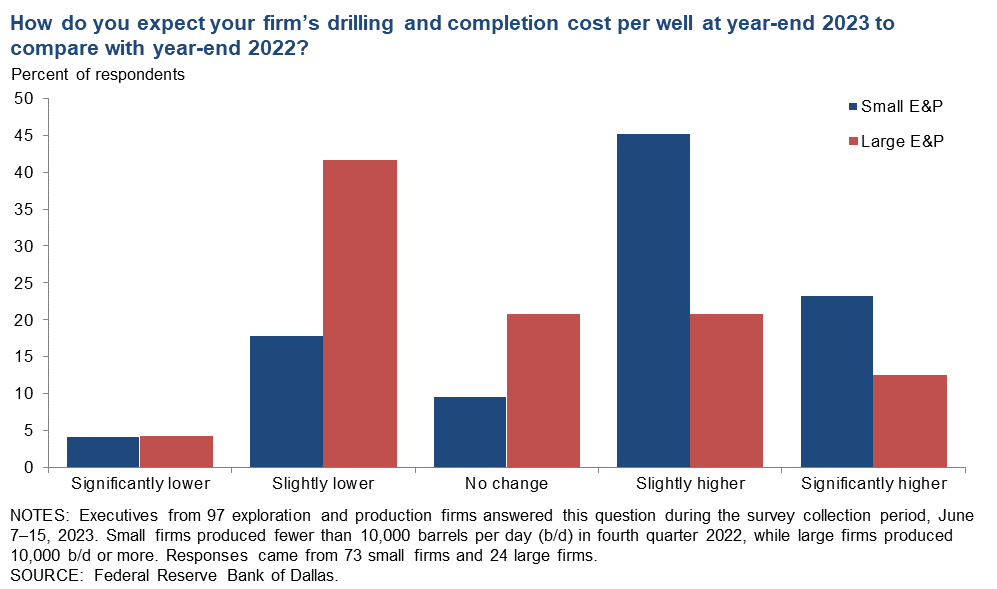

Oil and gas operators reported rising costs for a 10th consecutive quarter. But survey results suggest that size does matter when it comes to a company’s outlook on drilling and completion costs per well.

Around 45% of smaller E&Ps—companies producing less than 10,000 bbl/d—anticipate drilling and completion costs to end 2023 slightly higher than costs at the end of 2022.

Meanwhile, respondents at 42% of larger E&Ps said they expect their drilling and completion costs to be slightly down at year-end 2023 compared to a year prior.

Small E&Ps outweigh larger firms in number, but larger E&Ps account for more than 80% of total U.S. crude oil production.

“I think a lot of it is tied to economies of scale,” Patel said. “If you have multiple rigs, if you have multiple suppliers, you’re a larger firm—especially with activity being flat—you have the ability to potentially negotiate and lower your costs.”

Oilfield service companies felt the crunch last quarter as equipment utilization rates fell, input costs rose and operating margins fell.

The equipment utilization index fell into negative territory, from 3.9 in the first quarter to -7.9 in the second quarter. The operating margin index declined from 1.9 to -21.6 quarter-over-quarter.

Comments by service company executives give some visibility into some of the deteriorating conditions:

- “Small-operator activity is decreasing. This is most likely due to the fall in natural gas prices, volatility in oil prices and continued high casing and service costs.”

- “Labor availability is a big issue in blue-collar areas. It is hard to find employees, and wage rate requirements continue to increase.”

- “While [our] financial performance year-over-year has improved, we expect our business will move sideways to slightly down over the balance of 2023, driven primarily by lower natural-gas-directed drilling (due to lower natural gas prices).”

RELATED: Exclusive Q&A: Patterson-UTI, NexTier CEOs Talk Merger, Shale Dominance

Cost of capital

Like those in other sectors, energy companies are facing an increasing cost of capital as interest rates rise: Pioneer Natural Resources issued debt in 2020 and early 2021 at less than 1%. In March 2023, the Permian Basin giant chose to issue new debt at 5.1%.

But by and large, E&Ps and service companies aren’t seeing tighter credit conditions impacting their businesses so far, the survey shows.

More than half of respondents said tighter credit conditions since February 2023 have had no effect on their firms.

Oil and gas executives often lament the sector’s access to capital has been closed off by boogeymen like ESG goals. Where traditional financing sources have balked on the fossil fuel industry, private equity and family office funding have increasingly stepped up to the plate.

But uncertainty on credit conditions does seem to be weighing a bit on some energy executives in the long term: 41% of respondents expect tighter credit conditions to have a slight impact on their businesses through the rest of the year.

“There are more executives who expect an impact in the future—but overall, those impacts look to be modest for most firms,” said Michael Plante, Dallas Fed senior research economist and advisor.

RELATED: Pioneer’s Incoming Chief Rich Dealy on M&A and the End of ‘Free Money’

Recommended Reading

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

Crescent Energy: Bigger Uinta Frac Now Making 60% More Boe

2024-05-10 - Crescent Energy also reported companywide growth in D&C speeds, while well costs have declined 10%.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

SilverBow Makes Horseshoe Lateral in Austin Chalk

2024-05-01 - SilverBow Resources’ 8,900-foot lateral was drilled in Live Oak County at the intersection of South Texas’ oil and condensate phases. It's a first in the Chalk.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.