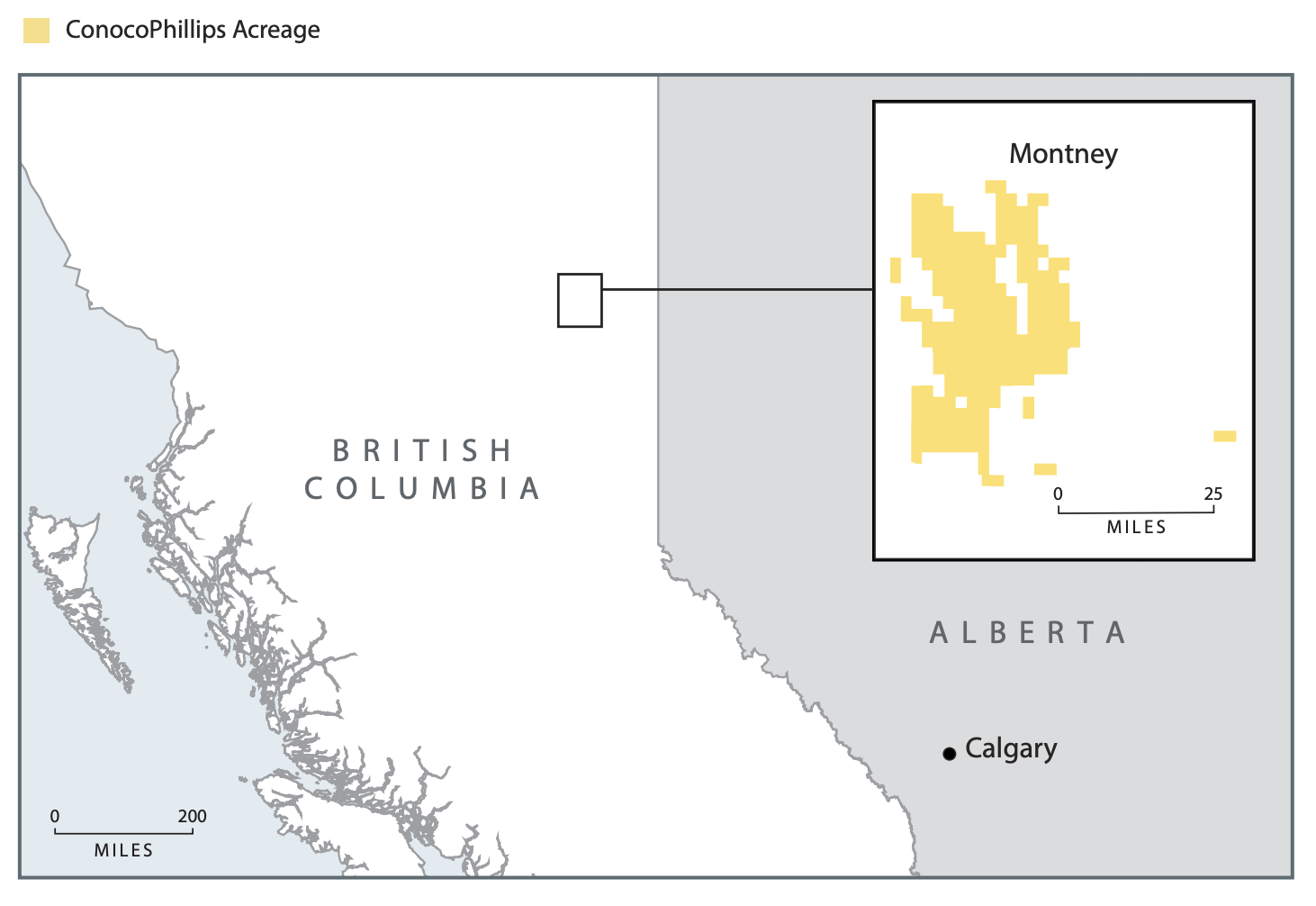

The acquisition is expected to increase ConocoPhillips’ Montney acreage position to 295,000 net acres with 100% working interest. (Source: Shutterstock.com; image of ConocoPhillips headquarters by JHVEPhoto / Shutterstock.com)

ConocoPhillips Co. on July 22 tacked on additional acreage to its position in Canada’s Montney Shale, giving the Houston-based independent “significant running room at a very attractive all-in cost,” COO Matt Fox said.

In a company release, ConocoPhillips said it agreed to pay Kelt Exploration Ltd. roughly $375 million in cash for 140,000 net acres located in the liquids-rich Inga-Fireweed asset Montney zone. ConocoPhillips will also assume about $30 million in financing obligations for associated partially owned infrastructure.

Production associated with the acquired asset, which will add over 1,000 well locations, is approximately 15,000 boe/d. ConocoPhillips estimates the acquisition adds over 1 billion boe of resource with an all-in cost of supply of mid-$30s (WTI basis), the company release said.

According to Fox, ConocoPhillips has tracked and analyzed the acreage, which is directly adjacent to ConocoPhillip’s existing Montney position, for a long time.

“[The acquired acreage] represents a high-value extension of our existing Montney position, and we’re pleased to capture this opportunity at an attractive cost of supply that meets our criteria for resource additions,” Fox said in a statement.

The acquisition is set to increase ConocoPhillips’ Montney position to 295,000 net acres with 100% working interest, nearly doubling its total acreage in the play while also giving the company full control, according to analysts with Tudor, Pickering, Holt & Co. (TPH).

The analysts estimate the transaction has an implied acreage value of about $1,250 to $1,600 per acre, assuming a 3-4x cash flow multiple at about $42/bbl WTI next year.

“Overall, the transaction is consistent with the company’s messaging regarding selective A&D for low cost-of-supply resource, with the strength of the balance sheet keeping the company positioned for future opportunities,” the TPH analysts wrote in a July 23 research note.

Separately, ConocoPhillips on July 22 announced that it initiated production from its first mutliwell pad on its Montney position in first-quarter 2020.

In his statement, Fox said ConocoPhillips is still in the process of bringing initial wells online, but noted early results are encouraging.

“We have confirmed the liquids-rich nature of the play and also confirmed that transferring the drilling and completion techniques we’re employing in the U.S. Big 3 can add significant rate and recovery potential to the play,” he said. “We view the Montney as a very attractive long-term asset and today’s announcement gives us significant running room at a very attractive all-in cost.”

The acquisition is subject to regulatory approval and is expected to close third-quarter 2020. The effective date for the transaction is July 1.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.