Mention drilling in the Permian Basin and unconventional reservoirs immediately come to mind. But Ring Energy focused on conventional assets to set itself apart from the crowded market.

The mid-sized operator is applying shale boom technologies to legacy assets in conventional reservoirs that others viewed as uneconomic, Paul D. McKinney, chairman and CEO of Ring, told Hart Energy.

“What we’re finding is, nobody’s really competing with us for that,” McKinney said.

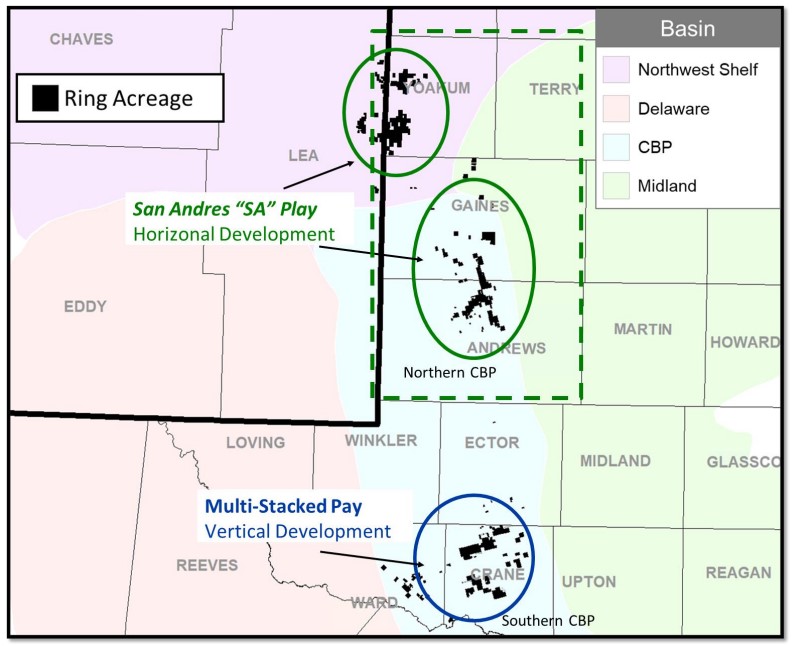

Ring operates in the Permian Basin’s Northwest Shelf and Central Basin Platform. McKinney said the company primarily pursued drilling horizontal oil wells in the San Andres formation across Yoakum and Gaines counties, Texas—a region where operators have to fill in the gaps between mature oil fields developed from the 1940s onward.

But to compete in the prolific Permian Basin, Ring needed greater scale. And in order to grow, the company needed to buy its way into a larger position.

M&A continues to be a key part of Ring’s growth strategy, but not all deals can move the needle for the company.

Not only did Ring aim to grow its size and scale in the basin with a deal, the company also needed to strengthen its balance sheet, accelerate its ability to pay down debt and lower its breakeven costs.

Ring found what it was searching for with the acquisition of Stronghold Energy II last year, McKinney said.

Come together

Stronghold Energy II, majority-owned by private equity firm Warburg Pincus, was founded by Steve and Caleb Weatherl.

The father and son duo brought complementary skills to the table. Steve, who served as Stronghold’s CEO, is a geologist who helped pioneer some of the first economically successful horizontal Wolfcamp wells in the Midland Basin.

Caleb, president and CFO, graduated from Harvard Business School and brought his financial background to the Permian operator.

Acknowledging the high-quality rock offered in the Midland and Delaware basins, Stronghold wasn’t attracted to the high prices companies were paying for acreage there. Instead, Stronghold focused its efforts on the Permian’s Central Basin Platform.

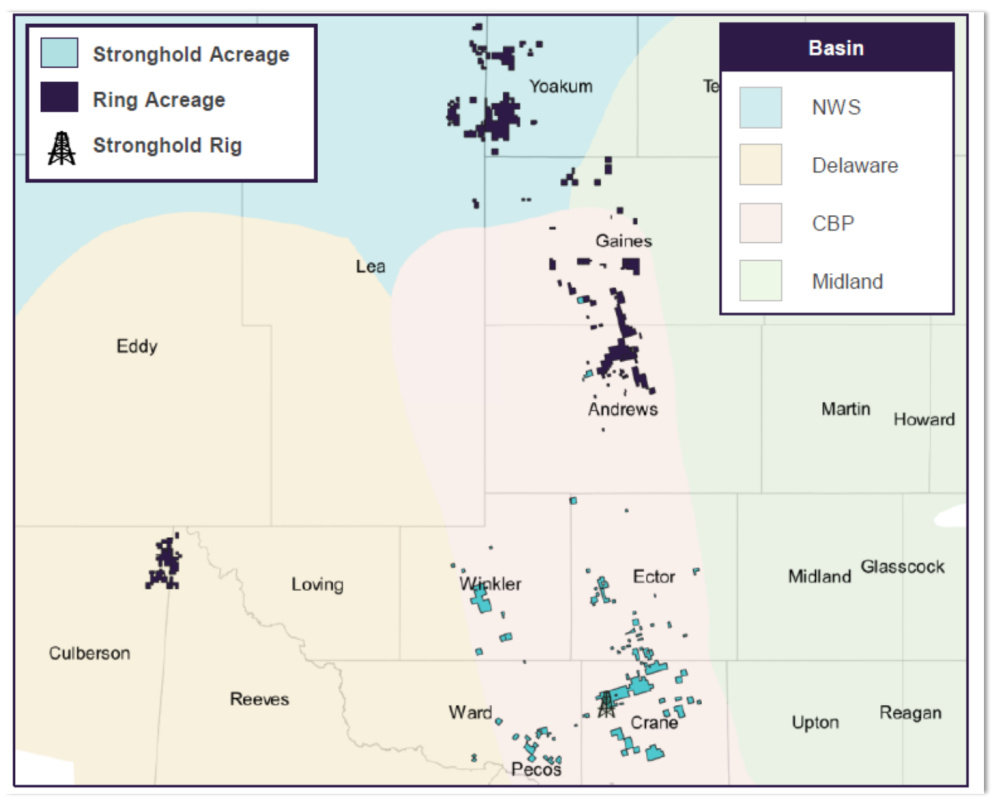

Since launching in 2017, the company grew its position to approximately 37,000 net acres in the Central Basin Platform—primarily in and around Crane County, Texas.

Stronghold’s assets had production of about 9,100 boe/d (54% oil, 75% liquids).

In July 2022, Ring announced plans to acquire Stronghold’s Permian position in a cash-and-stock deal valued at up to $465 million.

Scooping up Stronghold checked a lot of boxes for Ring. Adding the private E&P’s position in the Central Basin Platform to its portfolio effectively doubled the company’s overall production, from around 9,300 boe/d in second-quarter 2022 to a record 18,292 boe/d in first-quarter 2023, according to investor disclosures.

Accretive free cash flow generation from Stronghold assets also helped lower Ring’s leverage ratio from 3.5x at the end of 2021 to 1.65x by first-quarter 2023.

“The assets that came along with Stronghold—many of them were very similar in economics, but some of them were actually superior,” McKinney said.

“One particular area is the most economic set of opportunities that our company has,” he said.

Ultimately, the deal gave Ring better optionality to invest its money in multiple geologies with different rates of return.

“We can make a change in that investment strategy depending on what happens in the marketplace on a dime’s notice,” he said.

Although the company has the inventory to ramp up production further, Ring plans to keep oil and gas output relatively flat this year amid significant volatility in commodity prices.

Instead of pouring money into drilling, Ring plans to prioritize continuing to lower its leverage ratio and gearing up for its next deal.

“We believe now is the time to grow the company through acquisitions,” McKinney said.

Roadmap for the future

E&Ps from small independents to publicly traded supermajors are jockeying for inventory runway in the Permian, the top oil-producing basin in the U.S. Lower 48.

Public players including Callon Petroleum, Ovintiv, Matador Resources and Diamondback Energy have pumped billions of dollars into Permian Basin M&A in the past year to expand their positions and inventory.

Operators aren’t in a massive hurry to drill up their undeveloped inventory to grow production. With more than a decade of rapid expansion in the books, E&Ps now have a line of sight toward peak Permian production and eventual decline.

“[By] the end of the decade… plus or minus a couple of years, you might see the Permian peak and start plateauing,” Danny Wesson, executive vice president and COO at Diamondback, said during Hart Energy’s SUPER DUG conference in May.

“The longer it takes us to get there, the longer it will plateau and run flat. But the faster we get there, it will decline faster,” he said.

Acquiring Stronghold boosted Ring’s Permian inventory by another over 200 undeveloped drilling locations set aside for the future.

But despite the runway extension from the Stronghold deal, Ring is still searching for more longevity in the Permian.

“We’ve got good running room for the short- and medium-term,” McKinney said. “Long-term, that’s why we’re so focused on acquisitions—to ensure that five years and out we want to have a bigger inventory of undeveloped locations.”

When it comes to its M&A strategy, Ring is prioritizing adding opportunities with significant undeveloped upside, McKinney said.

The company would consider another deal that was heavy on production, but only at an attractive multiple, he said.

Ring aims to capture synergies with its existing operations in the Northwest Shelf and the Central Basin Platform. But, the company is open to deals outside of the Permian if those assets can compete economically with Ring’s existing portfolio.

“We like the Permian Basin. We think our shareholders prefer a Permian Basin focus,” McKinney said. “But I’m not necessarily promising that I’ll stay in the Permian—I will consider things outside of the basin as long as they have some really attractive aspects that provide a lot of value to my shareholders.”

McKinney said the company will consider deals in nearly any of the predominant oil plays where Ring can enter a Tier 1 acreage position at competitive costs.

That includes the Eagle Ford Shale, the Denver-Julesburg Basin, East Texas and portions of the Powder River Basin, he said.

In the meantime, Ring is focusing most of its spending this year on debt reduction.

“If I could significantly improve my balance sheet, I could be lured to go someplace else,” McKinney said.

And after selling Stronghold last year, the Weatherls are also back in the Permian searching for deals.

Their new E&P company, Midland-based Garrison Energy Holdings, secured a $500 million line of equity financing from an undisclosed institutional investor to pursue Permian acquisition opportunities.

Caleb Weatherl told Hart Energy that Garrison Energy is still open to deals in the Central Basin Platform, but the company is evaluating potential deals across the Permian, including the Delaware and the Northwest Shelf.

Garrison is fairly agnostic when it comes to the kinds of assets it wants to develop. The company is open to buying horizontal locations, but Garrison is also eyeing opportunities to acquire vertical locations or recompletion wells.

Similar to Stronghold’s strategy, the Garrison team is evaluating opportunities to develop a position outside of expensive core-of-the-core Permian plays.

“We’re certainly not afraid to take some technical risk, go into an area that is maybe not quite as proven as the core-of-the-core and apply our geology and engineering expertise to help de-risk an area,” Weatherl said.

Recommended Reading

Chevron, Brightmark JV Opens RNG Facility in Arizona

2024-04-10 - Eloy RNG produces RNG using anaerobic digesters at the Caballero Dairy in Arizona, Brightmark said April 10.

Collaboration, not ‘Mythical’ Renewables will Solve Climate Crisis

2024-03-25 - Tinker Energy Associates CEO Scott Tinker is optimistic that a combination of passion, expertise and funding can solve the world’s existential crisis—if the right questions are asked.

Energy Transition in Motion (Week of April 12, 2024)

2024-04-12 - Here is a look at some of this week’s renewable energy news, including a renewable energy milestone for the U.S.

Summit Carbon Solutions, POET Partner on CCS Project

2024-02-07 - The partnership will incorporate POET’s 12 facilities in Iowa and five facilities in South Dakota into Summit’s carbon capture and storage project.

Enough! Consumers Say They’re Overserved on Energy Transition, EY Finds

2024-02-11 - Two thirds of energy consumers are unwilling to spend more time and money to be sustainable, Ernst & Young reported.