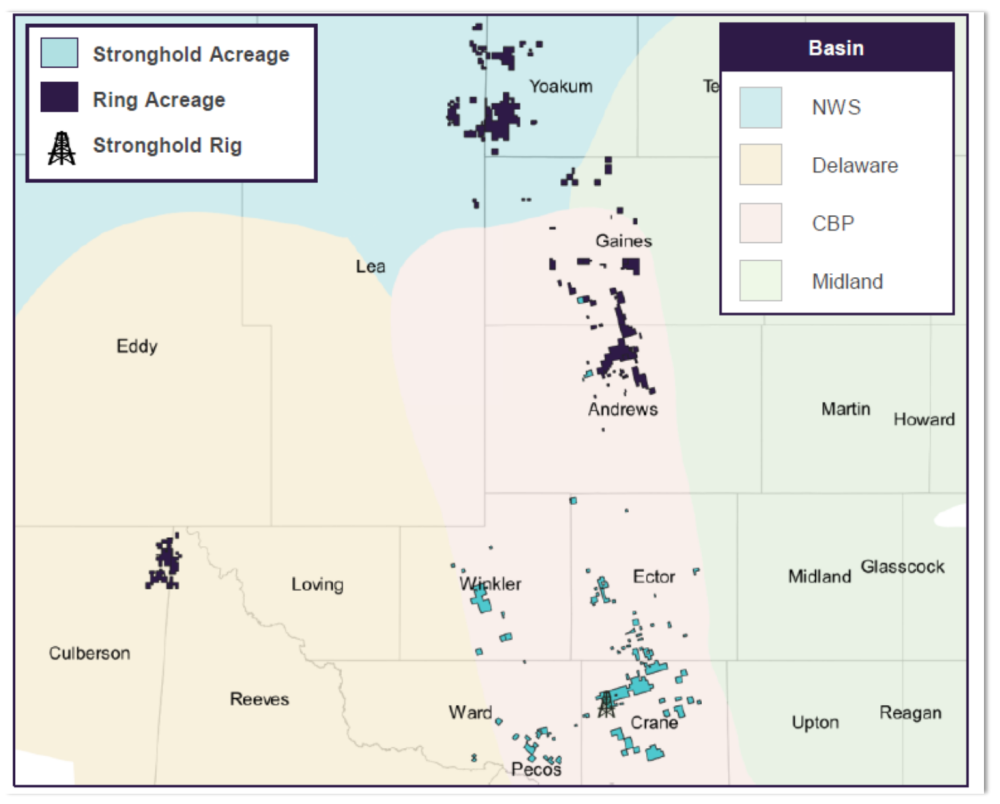

Majority owned by Warburg Pincus, Stronghold’s operations are focused on the development of approximately 37,000 net acres located primarily in Crane County, Texas in the Permian Basin’s Central Basin Platform. (Source: Stronghold Energy II Operating / Oil and Gas Investor)

Ring Energy Inc. agreed on July 5 to acquire Stronghold Energy, a privately held E&P with a position in the Permian Basin’s Central Basin Platform, in an agreement worth up to $465 million.

“We are excited to announce the agreement to acquire Stronghold’s conventional asset base, which we expect will further diversify our commodity mix and provide increased optionality on multiple fronts upon closing,” Paul D. McKinney, chairman and CEO of Ring Energy, commented in a company release.

Majority owned by Warburg Pincus LLC, Stronghold’s operations are focused on the development of approximately 37,000 net acres located primarily in Crane County, Texas. According to McKinney, the assets truly complement Ring’s existing footprint of conventional-focused Central Basin Platform and Northwest Shelf asset positions in the Permian Basin.

“On closing, we expect to nearly double our production, reserves and forecasted free cash flow with assets that we know well,” he added. “We also expect to capture meaningful synergies from this acquisition.”

The transaction includes the assets of privately-held Stronghold Energy II Operating LLC and Stronghold Energy II Royalties LP consisting of 31,000 leasehold and 6,000 mineral acres. Stronghold’s asset base is approximately 99% operated, 99% working interest and 99% HBP. The assets also have strong current net production of about 9,100 boe/d (54% oil, 75% liquids).

As part of the transaction, Ring will pay $200 million in cash at closing and $230 million in Ring equity based on a 20-day volume weighted average price, all of which will be issued to the owners of Stronghold. Consideration for the transaction also includes $15 million deferred cash payment due six months after closing and $20 million of existing Stronghold hedge liability.

Following the closing of the transaction, Stronghold’s owners will own approximately 34% of Ring and become its largest stockholder.

Stronghold II Operating LLC was founded in 2017 by father and son duo Steve and Caleb Weatherl. The company was capitalized shortly after with a $150 million commitment led by Warburg Pincus.

In 2019, Stronghold acquired Devon Energy Corp.’s Central Basin Platform assets for $191 million.

For more on the father son duo, Steve and Caleb Weatherl, read New Privates: Oil and Gas Startups Stand Out in the January 2022 issue of Oil and Gas Investor.

On July 5, Ring said it expects the Stronghold acquisition to increase inventory by approximately 500 new vertical drilling and recompletion locations with short-cycle times and high rates of return. The company also projects an asset level adjusted EBITDA of roughly $36 million to $38 million for the fourth quarter with low breakeven drilling economics o about $20 to $25 per barrel of oil.

“We intend to leverage our extensive expertise in applying the newest unconventional and conventional technologies to optimally develop Stronghold’s deep inventory of investment opportunities,” McKinney said.

Ring Energy will fund cash portion of the consideration for the Stronghold acquisition primarily from borrowings under a fully committed revolving credit facility to be underwritten by Truist Securities, Citizens Bank NA, KeyBanc Capital Markets and Mizuho Securities. The borrowing base of Ring’s $1 billion credit facility will be increased to $600.0 million from $350.0 million upon closing of the transaction.

The equity component of the consideration will be approximately 21.3 million shares of Ring’s common stock and 153,176 shares of new Series A convertible preferred stock. The preferred stock will be automatically converted to common stock upon stockholder approval of the conversion into roughly 42.5 million shares of stock at the equivalent price of $3.60 per common share.

The effective date of the transaction is June 1, and closing is anticipated in the third quarter.

Raymond James and Truist Securities are financial advisers to Ring, and Piper Sandler & Co. is financial adviser to Stronghold for the transaction. Mizuho Securities provided a fairness opinion to Ring’s board. Jones & Keller, P.C. provided legal counsel to Ring and Kirkland & Ellis LLP provided legal counsel to Stronghold.

Recommended Reading

Energy Transfer Asks FERC to Weigh in on Williams Gas Project

2024-04-08 - Energy Transfer's filing continues the dispute over Williams’ development of the Louisiana Energy Gateway.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Ozark Gas Transmission’s Pipeline Supply Access Project in Service

2024-04-18 - Black Bear Transmission’s subsidiary Ozark Gas Transmission placed its supply access project in service on April 8, providing increased gas supply reliability for Ozark shippers.

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.