Patterson-UTI sees opportunity to expand its drilling and completion services in the Middle East and other international markets with its acquisition of Ulterra Drilling Technologies.

The Houston-based Patterson-UTI agreed to pay $370 million in cash and 34.9 million shares of the company’s PTEN common stock to acquire Ulterra, a Fort Worth, Texas-based provider of specialized polycrystalline diamond compact drill bits.

Ulterra is already a market leader in North America: The drill bit company owns a leading 30% market share in U.S. land, according to an analysis by Evercore ISI.

Despite already owning a leading position in the market, there’s still room for Ulterra to grow and enhance its business in the U.S., Patterson-UTI CEO Andy Hendricks said on a June 5 conference call with analysts.

“While they are the leading provider of drill bits already, there are a few basins where they may be able to do a little bit more,” Hendricks said. “And we’ve got some good strong customer relationships in some of those places as well with our broad customer base.”

But Patterson-UTI also sees a lot of runway for Ulterra to grow its business in markets in the Middle East, Latin America and Asia. That includes growth in both international onshore and offshore markets, Hendricks said.

“I think the international opportunity is probably where you’ll see the majority of the growth come from,” Patterson-UTI COO James Holcomb said.

Patterson-UTI expects to see more rig growth and drill bit use in onshore operations in international markets. But the company still sees upside for Ulterra in international offshore, a market the company only started to touch over the past few years, Hendricks said.

About 76% of Ulterra’s 2022 revenue was generated in North American markets, while 24% came from international customers, according to an investor presentation.

Patterson-UTI’s acquisition of Ulterra—as well as its recent deal to merge with NexTier Oilfield Solutions to create a $5.4 billion services giant—help enhance its positions in the drilling and completion market, Evercore ISI analysts said in a June 5 market note.

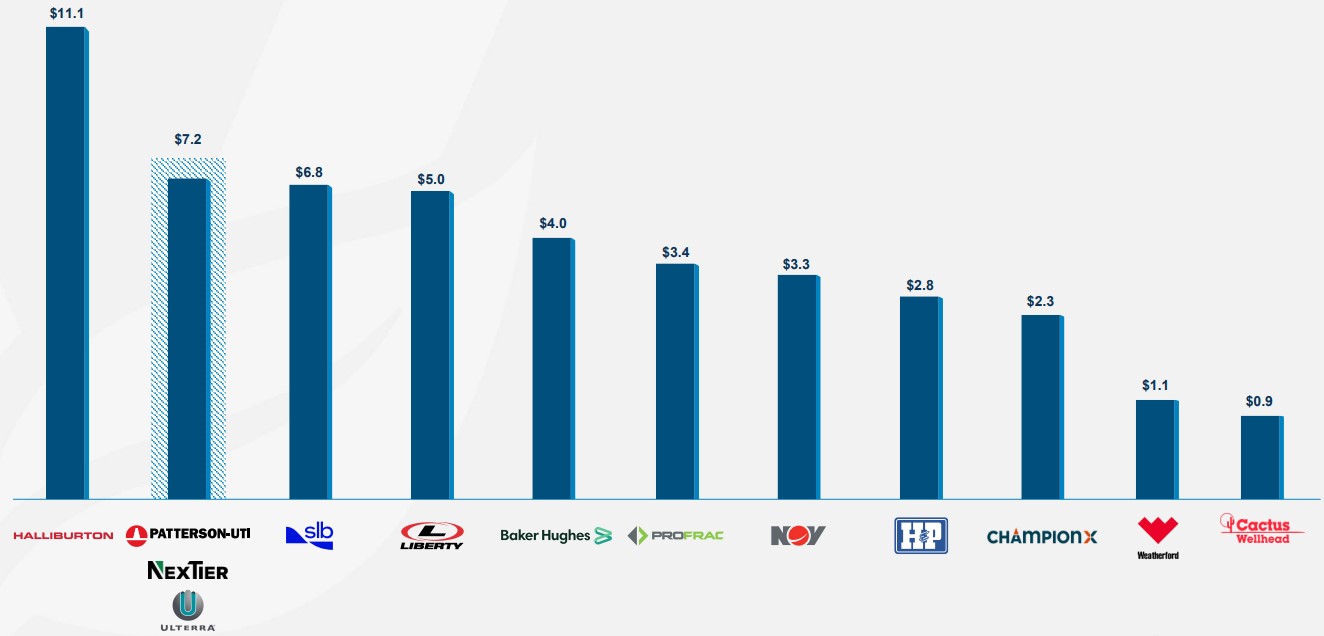

The recent string of acquisitions will move Patterson-UTI to the second-largest North American services player based on first-quarter revenues, analysts at Piper Sandler & Co. said.

Piper Sandler had expected Patterson-UTI to be focused more on the integration of NexTier than further diversifying into manufacturing with the Ulterra acquisition.

But the firm believes Patterson-UTI “isn’t done acquiring yet and could further broaden its reach to become an even more diversified company focused on drilling and completions.”

RELATED: Patterson-UTI to Acquire Global Drill Bit Company Ulterra

Funding the deal

The $370 million cash consideration of the Ulterra deal will be primarily used to repay the drill bit company’s outstanding debt. As such, Patterson-UTI is not assuming any of Ulterra’s debt with the acquisition, CFO Andrew Smith said.

Patterson-UTI plans to fund the cash portion of the deal using a combination of cash on its balance sheet and the company’s revolving line of credit. The company’s revolver capacity is expected to provide between $200 million and $225 million in net debt for the deal.

Net debt coming over from the NexTier deal is also in the range of $200 million.

“You’re looking at probably adding, between those two deals, somewhere in the neighborhood of $400 million to $450 million of debt to the balance sheet,” Smith said.

“As we close these transactions, we’ll look at our options in terms of financing that—maybe on something more of a long-term basis rather than just using the ability to do it under the revolver,” he said.

The deal is expected to close during the third quarter, pending regulatory approvals. The Ulterra business will continue under the Ulterra brand and remain headquartered in Fort Worth after closing.

RELATED: Exclusive Q&A: Patterson-UTI, NexTier CEOs Talk Merger, Shale Dominance

Recommended Reading

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

2024-04-18 - Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.

Uinta Basin's XCL Seeks FTC OK to Buy Altamont Energy

2024-03-07 - XCL Resources is seeking approval from the Federal Trade Commission to acquire fellow Utah producer Altamont Energy LLC.

CEO Darren Woods: What’s Driving Permian M&A for Exxon, Other E&Ps

2024-03-18 - Since acquiring XTO for $36 billion in 2010, Exxon Mobil has gotten better at drilling unconventional shale plays. But it needed Pioneer’s high-quality acreage to keep running in the Permian Basin, CEO Darren Woods said at CERAWeek by S&P Global.

Analysts: Why Are Investors Snapping Up Gulfport Energy Stock?

2024-02-29 - Shares for Oklahoma City-based Gulfport Energy massively outperformed market peers over the past year—and analysts think the natural gas-weighted name has even more upside.

SilverBow Saga: Investor Urges E&P to Take Kimmeridge Deal

2024-03-21 - Kimmeridge’s proposal to combine Eagle Ford players Kimmeridge Texas Gas (KTG) and SilverBow Resources is gaining support from another large investor.