Altus is anchored by substantially all of Apache’s gathering, processing and transportation assets at Alpine High, which Apache discovered in the Delaware Basin in 2016. (Source: Hart Energy)

Altus Midstream Co. acquired a stake in the Permian Highway Pipeline on May 29, joining a project aimed at easing takeaway constraints that recently sent natural gas prices in the prolific basin below zero.

Houston-based Altus said it exercised and closed its option to acquire a 26.7% equity interest in the Permian Highway Pipeline for about $161 million. The transaction was a part of the company’s formation last year by Apache Corp. and midstream investor Kayne Anderson Acquisition Corp.

Altus was structured as a C-corp anchored by substantially all of Apache’s gathering, processing and transportation assets at Alpine High, an unconventional resource play in the Delaware Basin which Apache discovered in 2016. At the time of the formation, Apache owned 71.1% of Altus with the ability to increase its ownership to about 74% subject to performance earn-outs.

RELATED:

Apache, Kayne Anderson Form Partnership, New Midstream Company

Apache Pushes Forward At Permian Basin’s Alpine High

In addition, Apache also agreed to give up some of its midstream assets, which included the option to purchase equity ownership in the planned Permian Highway Pipeline as well as the Shin Oak and Salt Creek NGL pipelines.

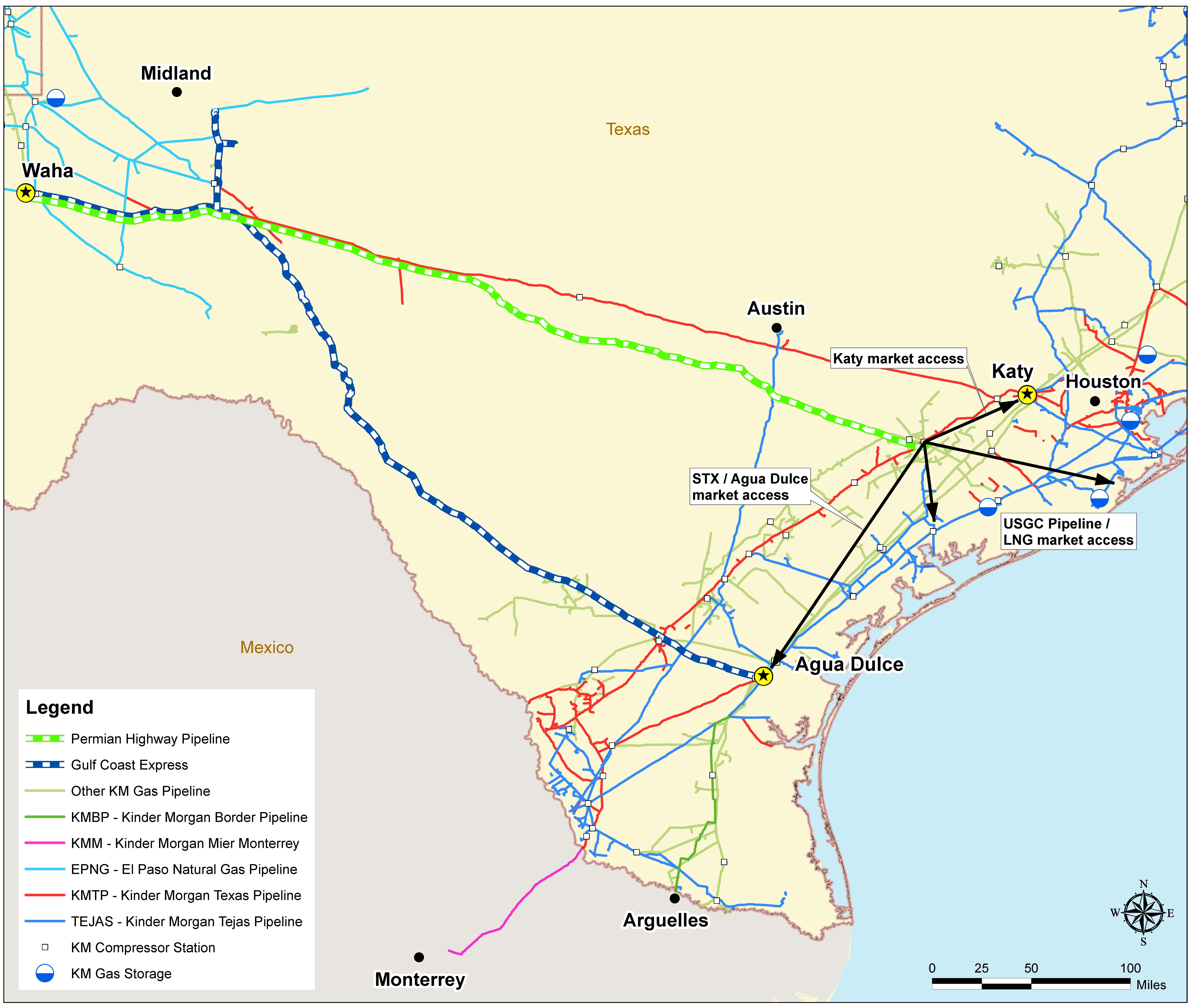

The Permian Highway Pipeline is an estimated $2.1 billion long-haul pipeline that is expected to have roughly 2.1 billion cubic feet per day of natural gas transportation capacity from the Waha area in northern Pecos County, Texas, to the Katy, Texas area, with connections to Texas Gulf Coast and other markets.

As a result of the transaction on May 29, the Permian Highway Pipeline is now roughly 26.7% owned by each of Altus Midstream Processing, Kinder Morgan Inc. and EagleClaw Midstream Ventures. The remaining 20% is owned by an anchor shipper affiliate.

The price of the transaction included Altus’ proportional share of capital spent by its JV partners prior to the option exercise and a financing charge associated with the cost of this capital spent prior to Altus’ option exercise.

Clay Bretches, Altus Midstream’s CEO and president, said a recent preferred equity financing and revolver amendment facilitate gave the company the ability to move forward with the early exercise of the Permian Highway Pipeline.

“Exercising the [Permian Highway Pipeline] option in advance of the September deadline minimizes this financing charge, which reduces our capital requirements by approximately $8 million relative to what was included in our 2019 guidance,” Bretches said in a statement on May 29.

The final investment decision to proceed with the Permian Highway Pipeline project was made in September 2018, and the initial capacity of the pipeline is fully subscribed under long-term binding agreements. The Permian Highway Pipeline is expected to enter service in October 2020.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

US Drillers Cut Oil, Gas Rigs for Second Time in Three Weeks

2024-02-16 - Baker Hughes said U.S. oil rigs fell two to 497 this week, while gas rigs were unchanged at 121.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.