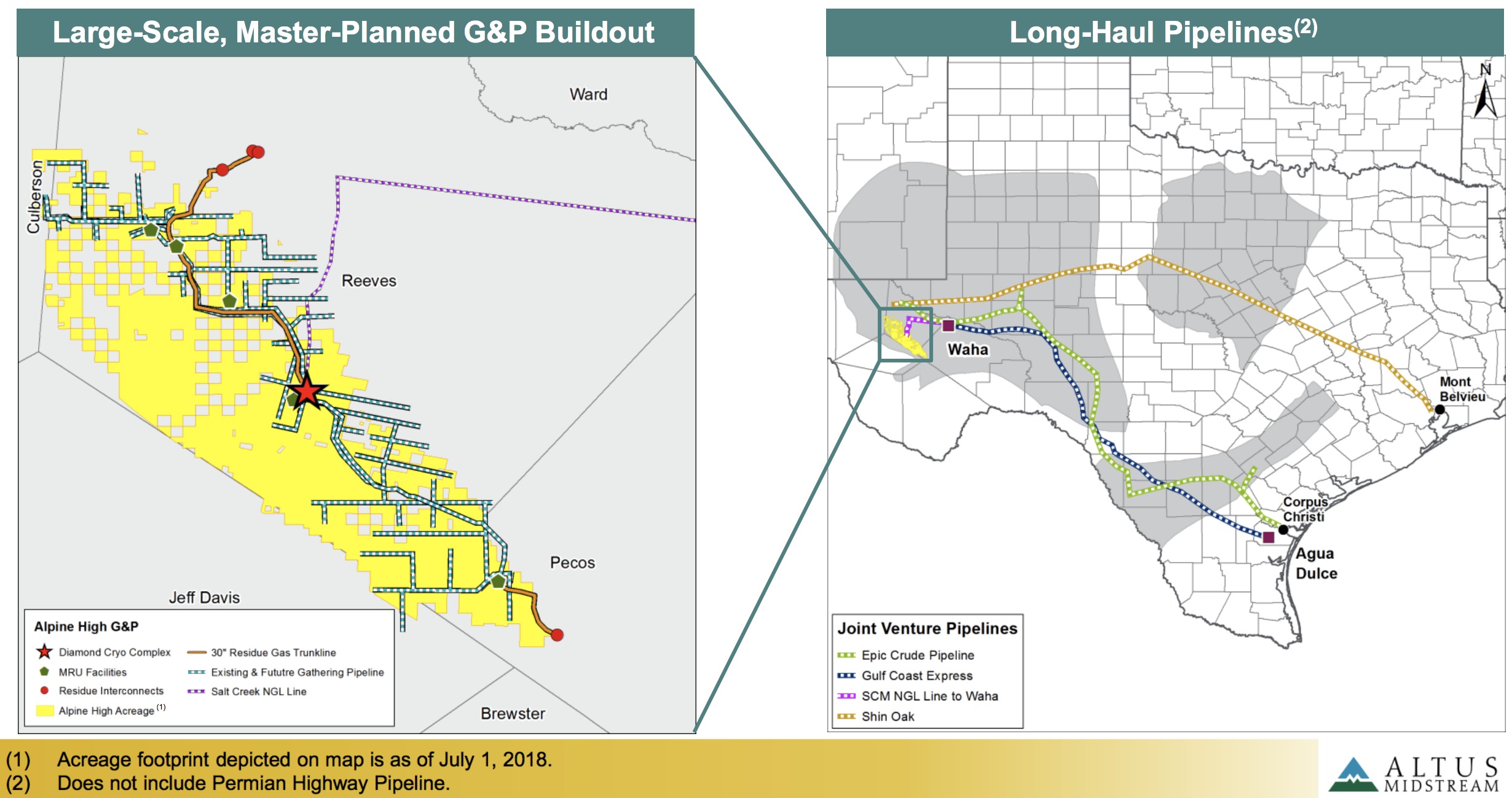

Apache Corp. will contribute midstream assets from its Alpine High acreage in the southern portion of the Delaware Basin, shown, to Altus Midstream LP, a partnership jointly owned by Apache and KAAC. (Source: Apache Corp.)

Apache Corp. (NYSE: APA) and midstream investor Kayne Anderson Acquisition Corp. (NASDAQ: KAAC) on Aug. 8 agreed to form a partnership for the launch of a new midstream company that will make them an even bigger force in the Permian Basin.

In the agreement, Apache will give up some of its oil and gas pipeline at Alpine High to join forces with Kayne Anderson to form Altus Midstream LP. Apache will own 71.1% of the new company.

“It brings us together with a world-class midstream investor,” Apache CEO and president John Christmann said during a conference call on Aug. 8. “It utilizes a C-corp structure that will bring clarity to shareholder reward and a corporate governance, and it brings access to the largest pool of future available capital.”

Altus Midstream will have a market value of $3.5 billion, and the new company expects to have in excess of $900 million in cash and no debt when the deal closes.

Kayne Anderson will contribute $952 million in the deal.

“I must say we never dreamed we would find as good a target as Alpine High or as good a partner as we have with Apache,” said Kevin McCarthy, chairman of the board of Kayne Anderson. “We are excited to be a part of creating a brand new midstream company that will be focused on Alpine High, which we truly believe is a world-class resource play.

“We are bringing together all of the talents and experience of Apache with a 64-year track record as a super-independent with Kayne Anderson, a leading investor of midstream securities.”

Altus Midstream will be structured as a C-corp anchored by substantially all of Apache’s gathering, processing and transportation assets at Alpine High, an unconventional resource play in the Delaware Basin. The company will also own options for equity participation in five gas, NGL and crude oil pipeline projects from the Permian Basin to various points along the Texas Gulf Coast.

Kayne Anderson’s $952 million cash contribution comprises $380 million in proceeds raised in its IPO and $572 million in proceeds raised in a private placement of Class A shares.

According to a press release, the new company will have no debt at closing and cash-on-hand will be used to fund ongoing midstream investments.

Gross volumes projected to approach more than 1 billion cubic feet per day of gas, producing about 100,000 barrels per day of NGL by the end of 2020.

Long-term growth opportunities for Altus Midstream are driven by Alpine High’s upstream development, investments in long-haul pipelines and third-party gathering and processing volumes.

Apache will have the ability to increase its ownership to about 74% subject to performance earn-outs.

“Apache will be given incentives to increase their ownership as long as Altus achieves specified stock price appreciation and production volume targets,” McCarthy said. “The earn out thresholds are 40% and 60% above the current price and the production threshold is about four times the current volume.”

Upon expected closing of the transaction in the fourth quarter of 2018, Kayne Anderson Acquisition will change its name to Altus Midstream.

Terrance Harris can be reached tharris@hartenergy.com

Recommended Reading

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.