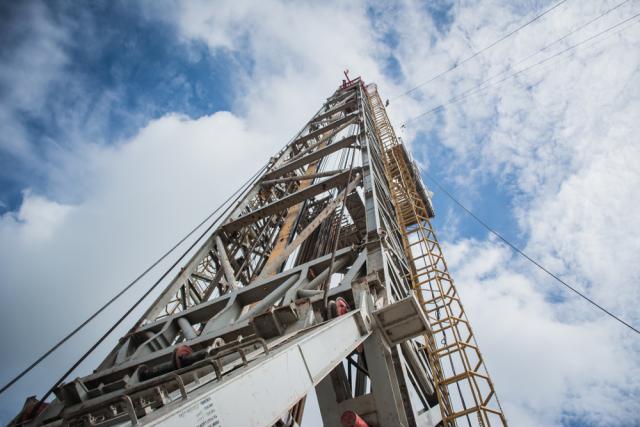

Several companies operating in U.S. shale plays have said they plan to run fewer rigs in 2019 partly due to forecasts for lower oil and gas prices. (Source: Pattadon Ajarasingh/Shutterstock.com)

Apache Corp. is targeting rich gas and NGL at its Alpine High development in the Permian’s Delaware Basin as the company cuts overall spending and works to grow production this year with fewer rigs in the U.S.

The Houston-based company said it plans to focus on multiwell pad development at Alpine High, drilling 85 wells mainly in the Northern Flank of the field, this year compared to 55 in the Midland Basin and 42 in other parts of the Delaware. But Apache will do so with fewer rigs as it maintains fiscal discipline amid market uncertainty.

Several companies operating in U.S. shale plays have said they plan to run fewer rigs in 2019 partly due to forecasts for lower oil and gas prices.

Apache aims to produce between 85,000 and 90,000 barrels of oil equivalent per day at Alpine this year, running five rigs compared to an average of seven last year with one frac crew, down from two. Similar steps are being taken in other parts of the Permian Basin, where Apache said its rig count will fall from 16-17 to 12-13 this year.

The company cut its 2019 capital spending to about $2.4 billion, a nearly 30% drop.

“Maintaining critical mass and proper rig to frac crew ratios in these two key areas will enable us to deliver a very efficient capital program given the reduced budget,” CEO John Christmann said on an earnings call Feb. 28. “Apache’s U.S. oil production comes primarily from the Permian, including the Midland Basin, the Delaware Basin and Alpine High. This year, we will continue to develop all three, but at an appropriately reduced pace.”

Since the Alpine High discovery was announced by Apache in 2016, more than 5,000 drilling locations have since been identified and the company continues to learn more about the field, incorporating lessons learned on completion and spacing, for example, from other parts of the basin.

“With 600 million cubic feet per day of in-place cryogenic processing capacity scheduled to come online in the second half of the year we should realize a significant uplift in cash margins and cash flow generation,” Christmann told analysts on the call. “We are de-emphasizing dry gas drilling for it will no longer be needed for blending purposes to meet pipeline specs following cryo processing installation.”

The move is expected to lower volume growth at the field but boost the percentage of NGL to 40%, up from previous guidance of 30%.

Apache’s overall production is expected to increase by up to 10% as the company runs two programs in the U.S.—one focused on Alpine High’s rich gas and an oil-focused one predominately in the Midland and other parts of the Delaware Basin, Christmann said.

This comes as the company continues learning more about the field.

“Highlights during the quarter include six wells at the Mont Blanc pad in the Northern Flank, which targeted two zones in the Woodford Formation and averaged a 30-day IP of 16.1 million cubic feet equivalent per day of rich gas,” said Tim Sullivan, executive vice president of operations support for Apache. “This pad advances our learnings from the previously disclosed Blackfoot pad and demonstrates improvements in capital and production efficiency, utilizing improved configurations and larger fracs from fewer wells.”

The Mont Blanc wells are indicative of the planned 2019 drilling program for the field, he said, adding “we are looking forward to processing the rich gas through our new cryogenic facilities coming online in the second half of the year.”

Christmann later pointed out the importance of integrating learnings, recognizing different geology of each play and thinking about full-scale development by looking at well performance over three months to a year instead of focusing on 30-day IPs.

“I think what you’ll see is us probably going a little wider,” Christmann said referring to Alpine High spacing in the Woodford. “You’re going to see multiple landing zones in the Woodford and larger fracs. … That’s part of the learning process that we’ve gone through in the Midland Basin. … That’s why you’re starting to see those same results come through as we continue to very scientifically evaluate every well and our patterns,” aiming to improve productivity and capital efficiency.

Despite an unplanned field-wide shutdown related to BTU spec issues and a delay in some new facility startups, Alpine High production still reached its anticipated 2018 exit rate, the executives said.

The update was delivered after Apache reported a quarterly loss of $381 million, attributable to asset write-downs. But the company saw higher revenues, which climbed to $1.77 billion compared to $1.59 billion a year earlier. Higher output led by the Permian Basin, which rose 18%, exceeded analysts’ expectations and helped push Apache’s overall production up 10% to 482,298 barrels of oil equivalent per day for the quarter.

“Looking forward through 2021, we expect to spend between $2.5 to $2.8 billion per year, assuming $50 to $55 WTI. This investment level will deliver continued, attractive growth while enabling Apache to achieve cash-flow neutrality,” Christmann said in a statement. “We intend to return to investors at least 50% of cash flow in excess of plan, inclusive of asset sale proceeds, before increasing planned activity levels.”

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.